“Davidson” submits:

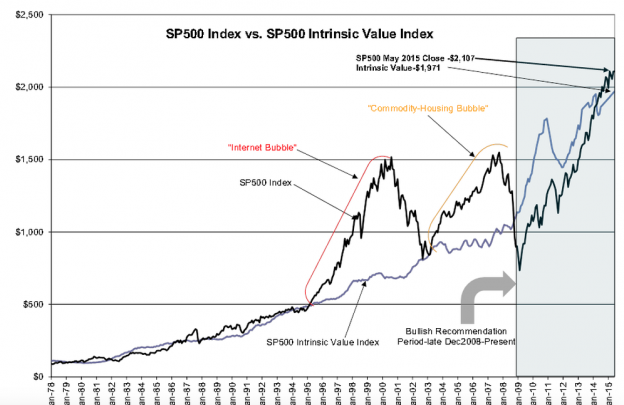

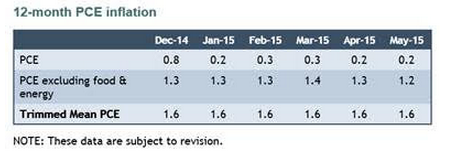

Dallas Fed reports 12mo Trimmed Mean PCE(inflation) at 1.6% which has been roughly the same for the past 18mos. Inflation is the only input to the SP500 Intrinsic Value Index which does not trend smoothly. When inflation is trending without volatility, the SP500 ($SPY) Intrinsic Value Index becomes smooth as one can see in the chart below.

The difference between the SP500 and the SP500 Intrinsic Value Index is a measure of Momentum Investor vs. Value Investor market psychology. In March 2014 the SP500 level exceeded the SP500 Intrinsic Value Index and has remained in excess since. Even with speculative pricing present in a number of stocks which are discussed on CNBC every day(perhaps they are over valued because they are discussed every day), the general market shows only a minor level of speculation when compared to that seen in 2007 and 2000 at market peaks.

Several famous investors have issued calls for a market top in the past 10dys or so. The history and current state of multiple economic indicators and excess valuation vs. the SP500 Intrinsic Value Index do not support this thinking. Published remarks by a number of respected investors have focused on the fact that we are more than 6yrs from the market lows of 2009 as if this indicated a market top. How far the market has traveled from its recession lows has nothing to do with the next major peak. History shows that markets peak some months after we see an economic peak. There is no sign of peaking in economic activity. In fact, economic activity has been accelerating. In the past 25yrs, market peaks have occurred at SP500 levels considerably in excess of the SP500 Intrinsic Value Index. There is no sign of grossly excess valuation today.

As impossible as it is to predict market prices with precision, history does permit us make some guesses. My expectation at the moment is an SP500 closer to $5,000 than remaining or even correcting from the current price.. We have always had an increase in infrastructure investment/spending later in economic cycles and I expect the same to occur in the current cycle. The world still needs expanded housing and infrastructure and all the heavy equipment, labor and material associated which goes along with putting it in place. My guess is that we remain roughly ½ way through this cycle and much more is yet ahead.