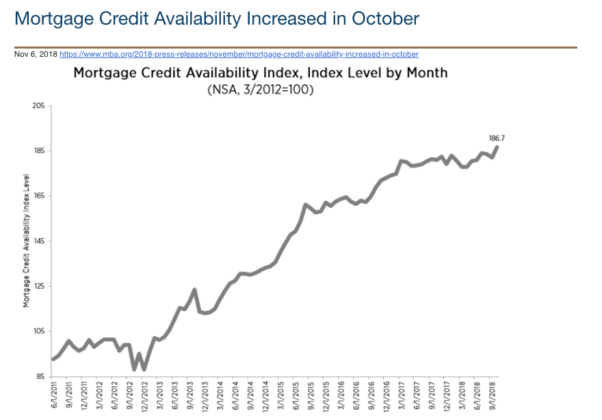

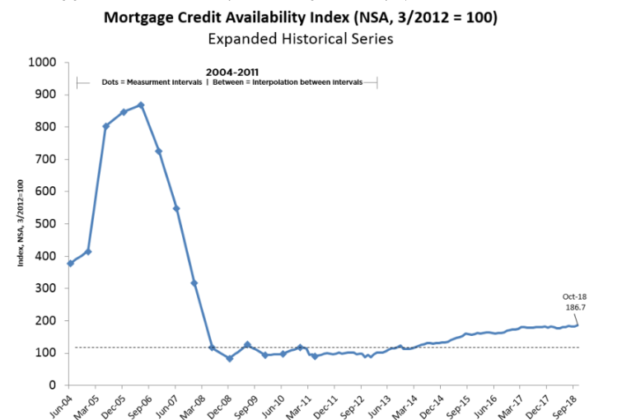

This bears really close watching. Mortgage credit, or lack thereof has been a drag on this economy. Housing starts are still nowhere near where they need to be and Dodd/Frank is the culprit. Should these regs be relaxed to even reasonable standards, we would likely see a surge in home construction which would be a major tailwind to an already strong economy.

“Davidson” submits:

MCAI higher after a pause-requires close monitoring and checking if this is connected to change in FDIC small/regional bank lending regs. The recent pause has resulted in sharp corrections to housing, rec vehicle and building product issues. But, strong employment and personal income trends suggest more demand going forward IF the FDIC relaxes Dodd Frank onerous lending standards for new homeowners which have kept single-family starts at ~1/2 the historical level prior to the Sub-Prime Crisis.

I am watching for opportunity in this space. I already hold THO, LCII and BECN which have been well operated for years and now looking to add to these positions if the current administration’s policy shift justifies such action.