“Davidson” submits:

Hindsight is the most valuable investment tool in the toolbox

Market psychology hindsight is ignored as an investment tool. Many will argue that it is routinely incorporated in MPT. Based on prices, MPT’s mathematical analysis on data the basis of which changes with time and circumstance makes its predictions nonsense and virtually useless. It fails to capture the fundamental drivers of prices, i.e. market psychology. What is most important is market history by analyzing:

- What were investors thinking at the time with the data at the time?

- How did they behave?

- What were the expected outcomes?

- What were the actual outcomes?

- Had we known the outcomes how could we have invested at the time?

- What aspects are predictable, what aspects are not and over what timeframe?

- Is there similar opportunity today?

Only a few investors capture these elements in their analysis. The most famous in modern time is Warren Buffett. Reading and constructing one’s own perception from first-hand materials has been Buffett’s approach from his teens. When he began his career in the offices of Graham-Newman, Buffett located a closet of newspapers saved as a historical record of prices when needed. Buffett used these in 1954 to develop his understanding of how people thought and responded to the data available at the time to events leading to and through the Great Depression. His long-term investment timeframe comes from the perspective he gathered while at Graham-Newman. He stated he spends most of his time reading and thinking, 5-6hrs a day, being sure to review multiple major daily news sources.

Read. Read Some More.

Buffett has attributed a great deal of his success to his borderline obsessive penchant for reading. According to some reports, he estimates he’ll spend as much as 80% of every day reading. Buffett starts every morning with several newspapers. He doesn’t keep a computer at his desk, preferring instead a world encyclopedia and the day’s printed news.

Buffett said he reads as many as 500 pages from books each day, according to CNBC. “That’s how knowledge works. It builds up, like compound interest,” Buffett said. “How to Make Your Life Successful Just Like Billionaire Warren Buffett”, thestreet.com, Oct 10, 2017

Prices reflect the end result of investor perceptions not the basis. Once one begins this process of historical review, one will recognize that ‘investment bubbles’ as opposed to occurring once in a while, are present nearly every day in one form or another. Bubbles form whenever there are a sufficient number of investors directing capital with the same general perceptions and prices trend far from long-term fundamentals. The value to a contrarian investor comes from understanding that nearly every bubble-situation provides an investable opportunity at some point. The correct use of hindsight identifies that every market has its bubbles and that excesses from fundamentals always reverse even though events creating each bubble differ from cycle to cycle. The most useful hindsight is developing a focus on how past investors translated fundamentals and events into market prices at the time. It is this type of hindsight which lets one judge current opportunities.

Biographies and news reports are great sources to develop one’s judgement. Works by Ron Chernow, John Brooks, Doris Kearns and Robert Lefevre are good starting points. The goal is to develop one’s investment perspective from the lessons which come from reading between the lines and lessons of human nature one draws between key figures of human history. One wants to develop broad economic and fundamental benchmarks which hold up over multiple investment business cycles, how these have been typically translated to market prices and in turn how extreme market prices fed back into shifting economic activity. One will find that every investor has something partially correct most times. Value investors claim fundamentals drive prices while Momentum Investors claim prices drive fundamentals. They are both right but right at different times during the cycle and not uniformly spaced throughout the cycle. The judgement one desires is to understand what factors are operating at any point in time and judge the investment opportunity or lack of opportunity.

Not all biographies are valuable. Those which provide the greatest insight to the personalities and the thinking of their subjects provide the greatest insight to human behavior. John Brooks wrote a series of books on the movers and shakers of Wall Street during tumultuous periods revealing motivations behind the actions.

Once in Golconda: A True Drama of Wall Street, 1920–1938

The Go-Go Years,

The Takeover Game

Business Adventures

Chernow focused in part on our Founding Fathers, Hamilton, Washington but also Paul Warburg, John D. Rockefeller and John P. Morgan

- Chernow, Ron (1990). The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance. Simon & Schuster. ISBN9780671710316.

- (1995). The Warburgs: A Family Saga. Pimlico. ISBN9780712662109.

- (1997). The Death of the Banker: The Decline and Fall of the Great Financial Dynasties and the Triumph of the Small Investor. Vintage Books. ISBN9780375700378.

- (1998). Titan: The Life of John D. Rockefeller. Warner. ISBN9780751526677.

- (2005). Alexander Hamilton. Penguin Press. ISBN9781101200858.

- (2010). Washington: A Life. Penguin Press. ISBN9781101444184.

- (2017). Grant. Penguin Books. ISBN9781594204876.

Doris Kearns is most famous for her biography of Abraham Lincoln but her other works should not be ingnroed.

- Lyndon Johnson and the American Dream. 1977. ISBN0060122846. OCLC429528985.[41]

- The Fitzgeralds and the Kennedys: An American Saga. 1987. ISBN9780312909338. OCLC731388852.[42]

- No Ordinary Time: Franklin and Eleanor Roosevelt: The Home Front in World War II. 1994. ISBN978-0-671-64240-2.

- Wait Till Next Year: A Memoir. 1997. ISBN0684824892. OCLC37567424.[43]

- Every Four Years: Presidential Campaign Coverage from 1896 to 2000. 2000. ISBN0-9655091-7-6.[44]

- Team of Rivals: The Political Genius of Abraham Lincoln. 2005. ISBN0-684-82490-6.

- The Bully Pulpit: Theodore Roosevelt, William Howard Taft, and the Golden Age of Journalism. 2013. ISBN978-1416547860.[45]

- Goodwin, Doris Kearns (2018). Leadership in Turbulent Times. USA: Simon & Schuster. p. 496. ISBN1476795924.

Edwin Lefèvre wrote “Reminiscences of a Stock Operator”,1923, a thinly disguised biography of Jesse Lauriston Livermore, a famous early 20th century Momentum Investor. Society is comprised of widely differing personalities and skill sets. Charles Slack wrote “Hetty: The Genius and Madness of America’s First Female Tycoon”, 2004, who was well known as a Value Investor. When J. P. Morgan called a meeting of New York’s financial leaders after the stock market crash of 1907, Hetty Green was the only woman in the room.

Daily news reports reflect the most popular investment views at the time. They are excellent at marking the market psychology on any topic or investment theme. Often, articles provide charted data to bolster the story. Make a habit of saving copies of articles which seem important at the time with titles, dates, referenced sources and key words. Saving 8-10 articles every day leads to saving 2,000+ points of information annually and builds a personal historical reference library for use later when one recognizes that something that caught one’s attention has become important investment theme. What one saves early on will change as one’s judgement develops. Fortunately, the Internet permits searching for past articles whenever one needs which permits one to follow how ideas developed over many years. Daily news reports capture details of events and thinking which are always lost whenever events are summarized after the fact. If there is one lesson learned from Buffett, it is how much and what he reads. Each investor will put the information together unique to themselves.

The goal is to understand how markets work by understanding how humans think and behave. The reading of one book or article should lead one to the next. It does not matter the order in which one finds material as long as one makes notes in margins of concepts deemed important at the time saves copies to reference at a later date. Being able to quickly retrieve previously read sources is essential in deepening one’s perception of nuances influencing investment outcomes. One’s investment judgement is based on one’s knowledge the improvement of which never ceases.

At some point one’s reading lead to the US Constitution and its support of individual rights above all considerations. The US Constitution in the first five amendments places protections to individual rights above all other considerations. The US Constitution is the only governing document which does not have government by a few or one group superseding individual rights to life, liberty and property. The simplicity of this self-governance document and how it came to pass comes from the divergent personalities of the Founding Fathers believing the ‘Golden Rule’ should be enshrined in self-governance. Nowhere else does such a government exist. Over time this has resulted in cultural rules which govern the most important and freest capital markets, respected more by outsiders than by the US itself. Those in the US take the US Constitution much for granted and ignore its fundamental importance. Despite this, those outside the United States, have made the United States Dollar (US$) into the strongest and most globally desired and transacted currency.

An aspect of capital little investigated is that it carries the cultural perspectives of the individuals who direct it. Cultural influence in directing capital is the major aspect of the aspect of politically motivated and non-profit donations is well known and so understood that it is taken for granted. What remains little understood is the impact cultural shifts have had over recent decades of globalization. The process occurred slowly. So slowly that most were unaware of its influence till well after the fact. There are bits and pieces, points-in-time articles which mention the influence but the general perception of a significant cultural capital shift has been slight.

Little appreciated has been the cultural shift in capital allocation which began in the 1990s as Western investors sought returns in areas previously thought as not investible but emerging as high return opportunities. These were the Emerging Markets. Western investors saw then Emerging Markets as virgin opportunities as global trade expanded transferring capital and manufacturing facilities to lower labor-cost countries. To take advantage of perceived returns, investment markets were supported and assets monetized. Eventually, Emerging Market Indices were created as investing became institutionalized. MPT was quickly applied with broad advice for investors to balance portfolios across all asset classes including Emerging Markets. Little concern was expressed that China, Turkey, Russia, Brazil had different protections to property rights and might have far different risk than that known in US and European markets. It was believed that there was a drive towards globalization that would force adherence to similar sets of rules and behaviors. Hindsight indicates that expected outcomes did not evolve as anticipated. Foreign markets did not only not provide the growth opportunities but have since highlighted the importance of the US marketplace.

Only in hindsight is the capital shift recognized that began in the mid-1990s and continues today. It is a capital shift carrying cultural preferences which have distorted historical Western valuations. As assets were monetized in Emerging Markets, capital began to drift to US and European markets seeking better personal property protections. This was not apparent at first and only makes itself apparent through the persistent over-valuations of Sovereign Debt and real estate which have been the cultural preferences.

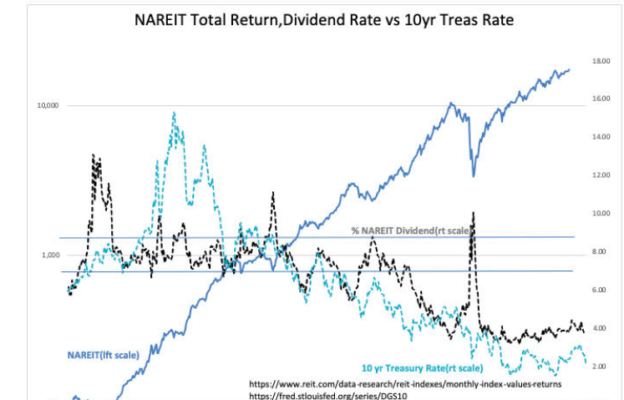

One can see in the dividend history of Equity REITs that a history of dividend yields between 7%-8% held fairly firmly till late 1993. Yields began to drift lower with some fluctuation till 2003, when the concept of Financial Planning and global diversification took hold in the US which demanded a greater pace of asset monetization in Emerging Markets to accommodate the influx of capital. Foreign investors having raised capital shifted some of their newly-liquid wealth into US and Western real estate causing REIT dividend yields to fall. The same pattern can be seen in US Treasury and European Sovereign Debt rates.

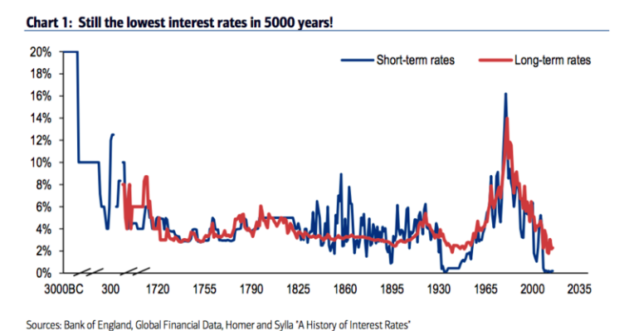

https://www.businessinsider.com/chart-5000-years-of-interest-rates-2015-9

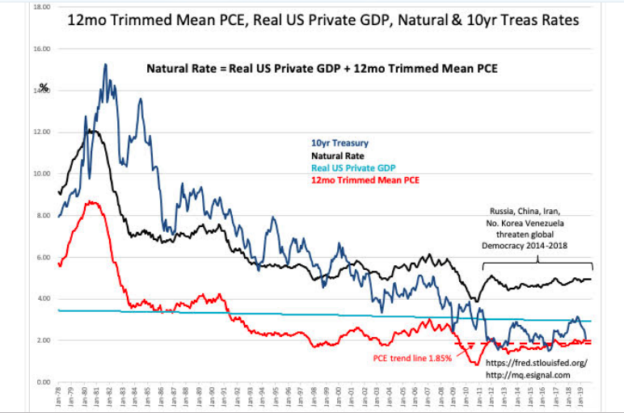

A useful guideline is the Natural Rate. Based on economic fundamentals, the Natural Rate and 10yr Treasury have tended to track closely as inflation fell during the 1980-1990s following established Western investor perceptions. But in 2003 the 10yr shows a decided trend lower reflecting foreign capital shifting to 10yr Sovereign Debt. As described by Hernando de Soto Polar in “The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else”, 2000, real estate and debt are known investments in Emerging Markets while equity has not been part of the culture. It should be noted that the 10yr Treasury yields declined sharply since 2014 and widened the spread to the Natural Rate by 300bps when Russia invaded Ukraine and No. Korea, Turkey, Venezuela, China and Iran threatened global Democratic trends sending even more capital to Western markets. Over time the preference for Sovereign Debt and real estate is likely to normalize and one must be alert to the signs.

Capital carries the cultural preferences of its decision makers. Taken for granted is the belief that capital seeks the highest rate of return. When markets are global, a relatively high rate of return can occur simply by escaping to a strong currency while one’s own native currency deteriorates due to autocratic leader’s nationalization of property. The capital gains from very modest gains on property thus shifted while not attractive to Western investors has been well above the norm for these investors. Investors in seeking successful outcomes need to always consider outcomes sought by other investors new to markets. The returns for Western investors exploiting Emerging Markets for high returns were not realized, Since 2010 returns after an initial repricing have been flat, as one after another Emerging Market swerved towards various levels of corruption and government control. Those who had the greatest benefit were those who monetized assets and transferred capital to Western markets.

To become a member of ValuePlays for less than a dollar a day and get FREE months, see our 4th of July offer…

NOTE: there are only 25 memberships available at these prices…