“Davidson” submits:

It may seem like the current market/investment cycle is different time. It is not. Every cycle has unique and unexpected aspects which leave investors feeling they are in the witches’ caldron in this scene from Macbeth. The fact remains that the current mix of events is as disconcerting as experienced in previous markets. Investment themes today are no less and no more confusing than they have ever been. The trick to navigating markets is to keep it simple and focus on ‘Big Picture’ and build a portfolio comprising skilled management teams.

Song of the Witches: “Double, double toil and trouble”

By William Shakespeare (from Macbeth)

”Double, double toil and trouble;

Fire burn and caldron bubble.

Fillet of a fenny snake,

In the caldron boil and bake;

Eye of newt and toe of frog,

Wool of bat and tongue of dog,

Adder’s fork and blind-worm’s sting,

Lizard’s leg and howlet’s wing,

For a charm of powerful trouble,

Like a hell-broth boil and bubble.

Double, double toil and trouble;

Fire burn and caldron bubble.

Cool it with a baboon’s blood,

Then the charm is firm and good.”

Investing is a matter of knowing how much detail one can know, how much detail is truly useful and selecting that information which proves more reliable over time. Investing is a process of out-guessing other investor’s perceptions. Investing is an art with some logic thrown in. Market prices are established by investor psychology responding to evolving information which investors translate to anticipated changes in business valuations. The logic portion of investing is a focus on the indicators of economic drivers responsible for evolving information before investors have responded. The art portion involves judgement based on experience to guess the changes of direction in investor psychology to one’s advantage. Investing is a ‘mind-game’ involving a complex mix of shifting inputs many of which are unexpected. The marketplace is a literal minefield.

Investing over time relies on distilling vast quantities of information to their essential elements that prove useful. In this process one develops a mix of ‘Top-Down’ and ‘Bottom-Up’ criteria. These criteria must be internally consistent when making investment commitments. The process has similarity to a barbell.

Investment Criteria:

1) Top-Down indicators reflect the broad economic context and trend

2) Bottom-Up details specific skilled management teams and market pricing to fundamentals-“3% Solution”

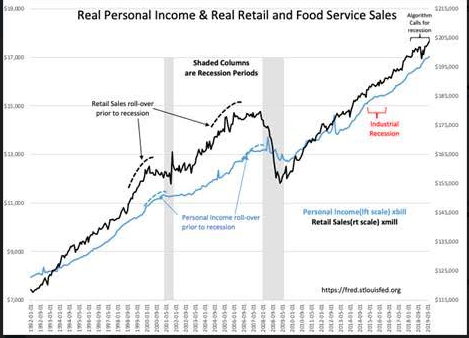

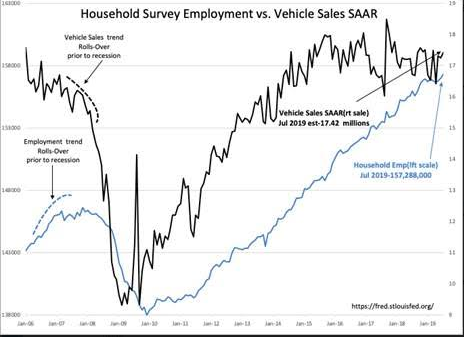

The Top-Down context is elucidated by current hard-count economic trends. By hard-count refers to the counts of actual individuals working, unemployed, wage growth, things sold and produced. Hard-count data differs from many other commonly used indicators such as the Purchasing Managers Index, Michigan Consumer Sentiment or price trends which depend on market psychology. Market psychology indicators develop after-the-fact in response to hard-count data. Two of many useful hard-count indicators are Real Retail Sales and Real Personal Income. In turn, Retail Sales and Personal Income are based on employment. The methodology of data collection makes individual reports useless as reported data sees revision every month. Only hard-count trends provide insight. Whenever investor psychology differs markedly from hard-count data, that is when investors are zigging when the data is zagging, investment opportunity is present

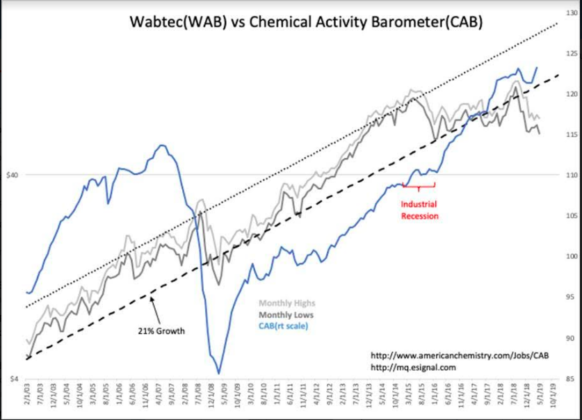

The Bottom-Up criteria is comprised of roughly 3% management teams of the R3000 or ~100 corporations. The process is to identify skilled management teams using their financial performance, understand their approaches by comparison of what they say they expect to do vs. what they did and establish market pricing criteria to business fundamentals which help one to Buy Low/Sell High. Such management teams can be identified in any investment sector even the most mundane of businesses such as Wabtec(WAB), a company which sells parts to the transportation sector. Performance of companies is based on management skill not the products they produce. Investors have always recognized and paid higher prices for financial performance. The goal then is to identify skilled managements underpriced by investor pessimism and be patient till investor psychology turns optimistic. During the process, one must monitor to assure that management continues to be on track to repeat financial performance.

Hindsight teaches us that “Double, double toil and trouble” is apt for every market cycle. Hindsight also teaches us that identifying skilled management teams at the right pricing is the better approach regardless of market environment. Key to this process is developing enough information to give one confidence in management’s ability to navigate through unexpected headwinds. The current market is no different in its crosswinds than markets of the past.

Thus far, as messy as things look from the outside, investment opportunities continue prevalent.