“Davidson” submits:

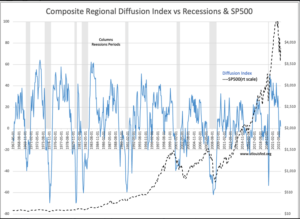

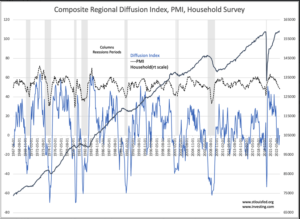

When investing one must differentiate between those indicators based on sentiment i.e., market psychology, and those based on hard counts of economic fundamentals, even though every fundamental indicator is an estimate at a point in time subject to revision later. The consensus often conflates both as having equal economic importance when they decidedly do not. Telling the difference in importance is not difficult but one needs to look long-term, understand how each is constructed and make the proper comparisons. It is periods such as today with the experience of 12mos of pessimism and recession predictions behind us continuing to forecast dire consequences to equity prices which create a historical divergence between sentiment and fundamentals that makes it crucial that investors understand the opportunity at hand. Two charts display five data sets, 3 sentiment and 2 economic, from 1967 to Present. The charts are placed one atop the other as it is impossible to plot all the information in one display. One atop the other makes it easier to see the correlation and lack of correlation which the consensus improperly conflates.

When making investing decisions it is important to understand how the consensus thinks and navigate the environment to benefit one’s own decisions. To follow the consensus is to generate consensus returns which we all know is not the goal of a serious investor. One must monitor consensus thinking and apply a contrarian approach but also do so thoughtfully and selectively with fundamental economic and business trends as a guide. It is economic fundamentals which eventually emerge into the consensus thinking and produce returns that are better than average. It is best that one does this on an individual security basis. It is individual CEOs heading individual businesses which emerge as long-term the drivers of market indices. Good CEOs are present in every industry. Being selective rather than using ETFs or equity indices provides for outperformance. In turn, it is in listening to these CEOs’ commentaries that adds the essential detail and color necessary to gaining insight to economic fundamentals.

Three data sets correlate closely with each other and not with the other two except when there are recessions. The other two correlate and not with the other three but for specific periods of economic activity. That is how one tells the difference and assigns sentiment to the former and fundamentals to the latter. Recessions are the periods of which every investor seeks to avoid the downside and take advantage of the next cycle upside. It should be obvious to all, but apparently is not, that the SP500, Regional Fed Diffusion Indices and the PMI reflect consensus sentiment. These coincide with every period of recession fear. Employment and marked recession periods are hard-data economic measures,. The Household Survey, it should be noted, is often dismissed by the consensus as it is arrived at by a statistical survey and not by the hard count reports submitted to those reporting weekly employment data to the Bureau of Labor(BLS). The facts are, the Household Survey, conducted since Jan 1948, has proved a good measure in counting total employment including the self-employed. The Establishment Survey based on BLS data does not. Their difference represents those who are self-employed. The Unemployment Level is based on the Household data and deemed very valuable as a measure while the trends in the Household data is not. Consensus thinking is indeed confusing. The consensus also responds to every monthly report as if a new trend has been established when what is more important is the 6mo-12mo trend of reports.

The SP500 reflects daily market economic perception much of which over the short-term is based on price trends traded by algorithms using Eugene Fama’s concept of The Efficient Market. That concept is that market prices reflect all known and unknown information. This is so accepted a truism that Fama received a Nobel Prize for his work. The Fed Diffusion and PMI indices are surveys regarding how people ‘feel‘ about business conditions and not hard counts of those conditions. These three do not correlate with basic economic measures. They routinely fail to predict recessions and economic trends. If one studies the fundamental data, this data provide signals up to 2yrs prior. Employment trends flatten up to 2yrs prior to recessions with other hard=data economic indicators providing complementary signals. That the Household data is clearly in an uptrend is counter to the consensus recession forecasts.

One should ask why does the consensus so frequently forecast economic declines when they just as frequently miss the mark. It is an obsession prevalent with using Modern Portfolio Theory and the belief that a mathematical solution describes market/economic behavior. They ignore fundamentals believing that price-trends will determine economics and that this can be traded using algorithms. This thinking has come to dominate markets recently as +/- 1,000pt days have become routine with some Momentum driven issues having 20% swings on single days for no apparent reason. Everyone seems to be playing this game such that some have commented that newer investors come from the gaming world using gaming techniques. Mostly ignored is the trend of Household data just reaffirmed with the Dec 723,000 gain.

Fundamentals remain in a strong uptrend. Ignore the consensus and trust the fundamentals. The history from 1967 is definitive. When sentiment is as pessimistic as it is today, markets have either already bottomed or they are making a bottom. Certainly, the consensus view is well out of sync with fundamentals in calling a recession the data indicates is nowhere in sight.

Be bullish when the rest of the world is not!