There is a growing chorus that feels the current situation will be resolved with a “V” recovery in which upside is a violent as the downside has been. To wit:

Here is the theory:

“Davidson” submits:

Wesbury has had this stance for some time. One way I would explain this is that this was not a consumer lead economic slow down. Consumers were actually still in good shape re: credit scores and could have continued to buy cars and houses if the lending institutions were lending. BUT, the lending institutions stopped lending and consumer sales hit a wall. Consumers do not stop dead this way, especially after nearly 3yrs of slow down that began at the beginning of 2006 in housing and autos. This whole slow down is an institutional/governmental heart attack on top of a normal slow down that began with the effect of Mark-to-Market on Lehman, AIG, Bear Stearns and then was kicked over the cliff with SEC Cox’ ban on short selling.

This has been such a misunderstood economic panic that was caused by first cheap money, then encouraged by political avarice, fostered by poor regulation and the incredibly stupid belief in the “Free Markets Self Correct” syndrome and then topped off by incredibly inane elimination of the “Up-Tick Rule”, the passive approach to naked short selling, the political decision to let Lehman fail so that Republicans could display some “Character?” during the Presidential election and the rest is history. The consumer was in fact OK till the credit markets and importantly the Money Markets seized with now bankrupt Lehman commercial paper.

Politicians and regulators just do not see that it is they who are the problem, it is they who have failed to act in accordance with the regulations that they passed. Politicians and regulators are looking for some one else to blame because they are so thick in the middle of causing this mess that I really don’t think they even have a clue as to what they have done. And they think that they are the solution to the problem??

The market is healing on its own. That this is occurring you can see from the rise in Treasury rates as funds flow into various market channels looking for opportunity. I watch with fascination the activities of Warren Buffett and numerous savvy investors buying up discounted assets especially real estate. The signs are there for all to see.

I am all in and have been since January ’09.

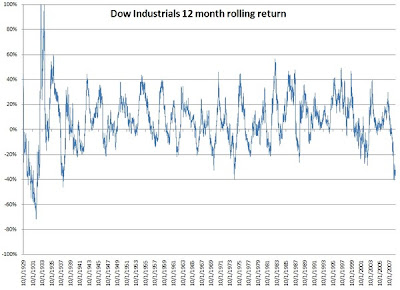

Could it be? Consider the following chart from Howard Lindzon

It shows, far from being an abnormality, “V” recoveries in equity markets are the norm. Now, the question we need to answer is “Are we at the bottom of the “V” or are we going down to a point between where we are now and the bottom of the 1931 “V”?”

The optimists will say we are at the bottom while the pessimist will say we will pass 1931. I lay not in either camp. My take is that we fall further then shoot up. How much further, who knows, and anyone who tells you they do is lying, they are guessing. My take is that based on the news flow and economics trends, which are still negative in the aggregate, more downside is in store. I know recent numbers have been encouraging but a month does not a trend make (nor does two).

In that vein, Henry Blodget writes:

Prof Shiller’s work (above chart) shows clearly that stock values are mean-reverting. The only trouble is the time they take to mean-revert. If things go badly over the next few years, stocks could bounce along the bottom for another decade or more.

For example, Jeremy Grantham, whose shop (GMO) produced the forecasts above, reminds us what happened in the 1970s:

“Today all equities are moderately – one might say, boringly – cheap. The forecast for the S&P has been jumping around +6% to +7% real, with other global equities slightly higher.

To put that in perspective, a 1-year forecast done on the same basis we use today that started in December 1974 would have predicted a 14% return (which, by the way, it did not deliver since the market stayed so cheap). For August 1982, the forecast would have been shockingly high – over 20% real! So do not think for a second that this is as low as markets can get. “

(It’s worth noting, though, that 1982 was the start of the great bull market. Jeremy also warns of the possibility of another sucker’s rally, so don’t get too comfortable waiting for the bottom:

“Now, I admit that Greenspan and 9/11 tax cuts caused the “greatest sucker rally in history” from 2002-07. We therefore cannot rule out another aberrant phase in which extreme stimulus causes the market to rally once again to an overpriced level for a few more years, thus postponing the opportunity to make excellent long-term investments yet again. But I think it’s unlikely. “

One thing seems certain: Stocks are cheaper now than they have been at any time in the past two decades. That’s encouraging for those with another couple of decades to invest and–increasingly rare these days–cash to put to work.

We’ll see….I think we have a bit deeper on the “V” to go..

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

2 replies on “Do We Get A "V"??”

Wesbury has only been wrong for 1.5 years now. Gonna “nail it” one of these times.

He has been a perma bull, I don’t get why people cling to a word he says.

Check it out: an in-depth analysis of Russia by Michael E. Reyen, and the risks that investment there entails:

http://changealley.blogspot.com/2009/02/bullish-on-bear.html

…