So, after reading that the WSJ was actually increasing circulation figures in an environment that is seeing newspaper circulation plummet, I began digging into it owner, News Corp.

Overview:

OVERVIEW OF THE COMPANY’S BUSINESS

The Company is a diversified global media company, which manages and reports its businesses in eight segments:

• Filmed Entertainment, which principally consists of the production and acquisition of live-action and animated motion pictures for distribution and licensing in all formats in all entertainment media worldwide, and the production and licensing of television programming worldwide.

• Television, which, principally consists of the operation of 27 full power broadcast television stations, including nine duopolies, in the United States (of these stations, 17 are affiliated with the FOX network, and ten are affiliated with the MyNetworkTV network), the broadcasting of network programming in the United States and the development, production and broadcasting of television programming in Asia.

• Cable Network Programming, which principally consists of the production and licensing of programming distributed through cable television systems and direct broadcast satellite operators primarily in the United States.

• Direct Broadcast Satellite Television, which principally consists of the distribution of premium programming services via satellite and broadband directly to subscribers in Italy.

• Magazines and Inserts, which principally consists of the publication of free-standing inserts, which are promotional booklets containing consumer offers distributed through insertion in local Sunday newspapers in the United States, and the provision of in-store marketing products and services, primarily to consumer packaged goods manufacturers in the United States and Canada.

• Newspapers and Information Services, which principally consists of the publication of four national newspapers in the United Kingdom, the publication of approximately 147 newspapers in Australia, the publication of a metropolitan newspaper and a national newspaper (with international editions) in the United States and the provision of information services.

• Book Publishing, which principally consists of the publication of English language books throughout the world.

• Other, which principally consists of NDS Group plc (“NDS”), a company engaged in the business of supplying open end-to-end digital technology and services to digital pay-television platform operators and content providers; Fox Interactive Media (“FIM”), which operates the Company’s Internet activities; and News Outdoor, an advertising business which offers display advertising in outdoor locations primarily throughout Russia and Eastern Europe.

So, why consider buying?

Looking forward at the business. I divide it into entertainment (film ,tv, book) and News (papers, cable tv (broadcast)). The first is very dependent on the consumer and the timing of releases vs prior years so the period to period comparison is not always apples to apples and one would expect it to be highly cyclical. The news and papers I would consider to give a more steady gauge as to the health of the overall company.

Here are the segments operating income that tend to back the assertion of certain segments being more volatile.

For instance, 2008 Film Results:

For the three months ended December 31, 2008, revenues at the Filmed Entertainment segment decreased $491 million, or 25%, as compared to the corresponding period of fiscal 2008. The revenue decrease was primarily due to a decrease in worldwide home entertainment revenue from theatrical and television products. The three months ended December 31, 2008 included the worldwide home entertainment release of Horton Hears a Who, the worldwide theatrical releases of The Day the Earth Stood Still, Australia and Max Payne and the domestic theatrical release of Marley & Me and their related releasing costs.

Also contributing to the three months ended December 31, 2008 were the pay television performances of Juno and 27 Dresses. The three months ended December 31, 2007 included the home entertainment performances of The Simpsons Movie, Live Free or Die Hard and Fantastic Four: Rise of the Silver Surfer and the theatrical releases of Alvin and the Chipmunks and Juno. For the six months ended December 31, 2008, revenues at the Filmed Entertainment segment decreased $814 million, or 23%, as compared to the corresponding period of fiscal 2008. The revenue decrease was primarily due to a decrease in worldwide home entertainment revenue from theatrical and television products, as well as a decrease in worldwide theatrical revenues as a result of the difficult comparisons to The Simpsons Movie and Live Free or Die Hard in the six months ended December 31, 2007.

Fox News:

For the three and six months ended December 31, 2008, Fox News’ revenues increased 18% and 19%, respectively, as compared to the corresponding periods of fiscal 2008, primarily due to an increase in net affiliate and advertising revenues. Net affiliate revenues increased 37% and 32% for the three and six months ended December 31, 2008, respectively, primarily due to an increase in the average rate per subscriber, a higher number of subscribers and lower cable distribution amortization as compared to the corresponding periods of fiscal 2008. Advertising revenues increased 6% and 8% for the three and six months ended December 31, 2008, respectively, primarily due to higher volume and higher pricing as compared to the corresponding periods of fiscal 2008. As of December 31, 2008, Fox News reached approximately 95 million Nielsen households.

Here are the most recent results vs rival CNN, MSNBC. Fox wins every hour..if you combined their results, they still do.

From the recent 10-Q

The Company’s revenues decreased 8% and 2% for the three and six months ended December 31, 2008 as compared to the corresponding periods of fiscal 2008. The decreases were primarily due to revenue decreases at the Filmed Entertainment, Television and Book Publishing segments. The decreases at the Filmed Entertainment segment were primarily due to decreased worldwide home entertainment revenues. Television segment revenues decreased primarily due to decreased advertising revenues as a result of general weakness in the advertising markets. The decreases at the Book Publishing segment were primarily due to strong title offerings in the corresponding periods of fiscal 2008 with no comparable titles in fiscal 2009.

These decreases were partially offset by increases in revenues at the Cable Network Programming and Newspapers and Information Services segments. Cable Network Programming segment revenues increased primarily due to increases in net affiliate and advertising revenues. The increases at Newspaper and Information services were primarily due to the inclusion of revenue from Dow Jones & Company, Inc. (“Dow Jones”), which was acquired in December 2007.

This is very important news. At a time when ad rates are falling like stones throughout the industry, News Corp. is actually increasing them. That can only be taken as it having a industry best “brand” that advertiser recognize and want and one could take that even further to say they do have a moat around their news division.

Essentially you have News’ cable operations getting stronger during the industry downturn and this bodes well for the recovery.

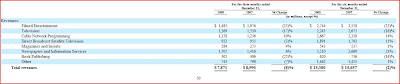

Here are the revenue results (click to enlarge):

Cash:

As of December 31, 2008, the Company complied with all of the covenants under the revolving credit facility, and it does not anticipate any violation of such covenants. The Company had consolidated cash and cash equivalents of approximately $3.6 billion as of December 31, 2008.

Debt (from 10-K):

News has $13 billion of debt outstanding. Over $12 billion of that does not come due for in excess of 5 years ($1 billion is due in less than 5) and of that $12 billion, 30% has maturities extended out until 2035 and 2037. This will not be a strain on cash.

Valuation:

Even after writing down $8.4 billion in Q4, NWS shares prices at $8.50 sell at 65% of book value of $29 billion. 20%o the current market cap of the company as of 12/31 is the cash sitting on the books. Here are the write-down details:

As a result of this impairment review, the Company recorded a non-cash impairment charge of approximately $8.4 billion in the three and six months ended December 31, 2008. The charge consisted of a write-down of the Company’s indefinite-lived intangibles (primarily FCC licenses) of $4.6 billion, a write-down of $3.6 billion of goodwill and a write-down of Newspapers and Information Services fixed assets of $185 million in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” As a result of the continued adverse economic conditions in the markets in which the Company conducts business, the Company will continue to monitor its goodwill, indefinite-lived intangible assets and long-lived assets for possible future impairment.

Insider Controlling Shareholder:

As of December 31, 2008, Cruden Financial Services was the beneficial owner of 306,623,480 Shares, constituting approximately 38.4% of the total number of outstanding Shares at such date. All of the 306,623,480 Shares beneficially owned by Cruden Financial Services are also beneficially owned by the Murdoch Family Trust. Cruden Financial Services has the power to vote and to dispose or direct the vote and disposition of the Shares owned by the Murdoch Family Trust. Cruden Financial Services, the sole trustee of the Murdoch Family Trust, is a Delaware limited liability company with six directors.

As of December 31, 2008, the Murdoch Family Trust was the beneficial owner of 306,623,480 Shares, constituting approximately 38.4% of the total number of outstanding Shares at such date. The Murdoch Family Trust is a trust governed by Nevada law whose trustee is Cruden Financial Services. Cruden Financial Services, as sole trustee, has the power to vote and to dispose or direct the vote and disposition of the Shares owned by the Murdoch Family Trust.

As of December 31, 2008, K. Rupert Murdoch was the beneficial owner of 317,290,709 Shares, constituting approximately 39.7% of the total number of outstanding Shares at such date. Of the 317,290,709 Shares beneficially owned by K. Rupert Murdoch, 306,623,480 of such Shares are directly owned by the Murdoch Family Trust. Cruden Financial Services has the power to vote and to dispose or direct the vote and disposition of the Shares owned by the Murdoch Family Trust. As a result of Mr. Murdoch’s ability to appoint certain members of the board of directors of Cruden Financial Services, the corporate trustee of the Murdoch Family Trust, Mr. Murdoch may be deemed the beneficial owner of the Shares beneficially owned by the Murdoch Family Trust. Mr. Murdoch, however, disclaims any beneficial ownership of such Shares.

This is much like my AutoNation (AN) purchase. A company doing well in a poor operating environment. 75% of operating profits are from very stable and growing segments of the company. The other 25% is cyclical and release date dependent which causes volatility. Currently shares are excessively being punished for that section of earnings and being given very little credit for the other 75%.

That gives us a ValuePlay…I’m getting very close to buying some at these levels…

Disclosure (“none” means no position):Long AN, none