“Davidson” Submits:

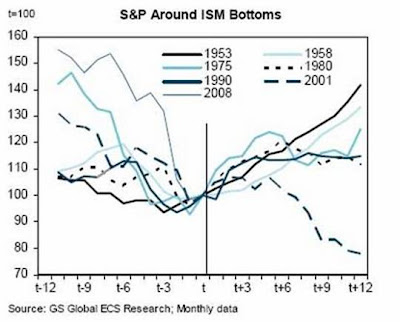

The Institute for Supply Management survey was released Friday morning at 10AM with the Purchasing Managers Index (PMI) at 40.1% vs. 36.3% last month. Turns in this series has a good history of predicting future improvements in US GDP and stocks but for (as you can see below) 2001 when we experienced 9/11.

Based on the historical relationship of the PMI bottoming 2mos after the SP500 this supports the contention of a number of analysts that the “Internal Bottom” (defined as the number of SP500 stocks making what proved to be the low for the next 12mos) was made in October of 2008. Many bullish analysts said this at the time, but when the SP500 continued to hit new lows due to the large cap stock dominance in the index, the importance of “Internal Bottom” vs Index Bottom was lost in the cacophony of bearish forecasts on CNBC.

The relationship of the SP500 at ISM PMI bottoms is reproduced below the ISM Index vs. GDP chart.

My conversations with insightful individuals assure me that they consider this relationship important with the caveat that unforeseen events can trip up expectations. I recommend a balanced approach that is allocated for each investor’s risk tolerance.

Disclosure (“none” means no position):