Goldman Sachs did a REIT presentation the other day and the slides are all over the place. There was one in particular that matters to those of us holding General Growth (GGWPQ) shares.

Now that it looks like debt maturity extensions are just about all but a given, we need to turn our heads to what the judge in the GGP Chapter 11 case decides to value the properties at. He will most likely do that using a Cap Rate. The lower the cap rate, the higher the value of the assets and the more recovery left for shareholders.

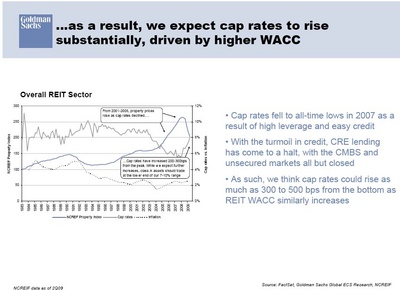

Here is the applicable slide (from @zerohedge) from Goldman Sachs (GS):

The have estimates of a 7%-10% range for cap rates going forward. There is the kicker in the bottom bubble. The quote “While we expect further increases, Class A assets should trade at the lower end of our 7%-10% range”.

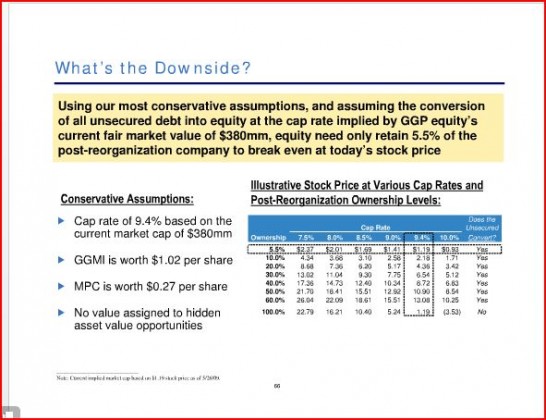

This is big. When Bill Ackman at Pershing Square presented his GGP idea in May, he had the following slide that was at the time called by doubters as “overly optimistic”:

Now we have Goldman making the case for Ackman. With Simon Properties (SPG) trading at an implied cap rate of roughly 7%, and GGP having Class A malls (think Boston’s Faneuil Hall (Quincy Market) and Baltimore’s Inner Harbor) to think that GGP will get an 8% cap rate (or less) coming out of Chapter 11 early next year is wholly in the realm of reason. Of course this assumes no systemic shocks to the economy and that the current economic trends essentially continue.

Should they get that then common shareholders would need only 20% of the reorganized company (assuming all unsecured debt converted into equity) to see their current share price almost double.

This is getting almost better by the day…..

Full Presentation:

GGP Presentation 5.27.2009