Somebody decided to call me out on my General Growth thesis and did so by putting me in the same sentence as Goldman Sachs (GS) and Bill Ackman. Can’t decide to argue with or thank them….I’ll do both.

Now full disclosure: This site is the same site that earlier had one of their “experts” copy verbatim one of my AutoNation posts and claim it as their own (they eventually removed the post). So no assumptions of their “expert status” ought to be assumed per their claims…

The author’s (Mr. Leonard) comments are in blockquotes:

Here is the full article

For one thing, neither of them take into consideration the coming debacle resulting from the 100’s of department store closings I am predicting will take place in early spring 2010. Those of us in the industry are well aware of how many Sears, Bon-Ton and Dillard’s stores are struggling to stay afloat until after the Christmas season. Without some sort of “Christmas miracle” many of their under performing stores in “C” level malls will disappear. This will start a whole new media blitz about “The End Of The Malls” which in turn will impact the stocks of all mall REITS, even those with very little exposure to “C” level malls or the specific department stores.

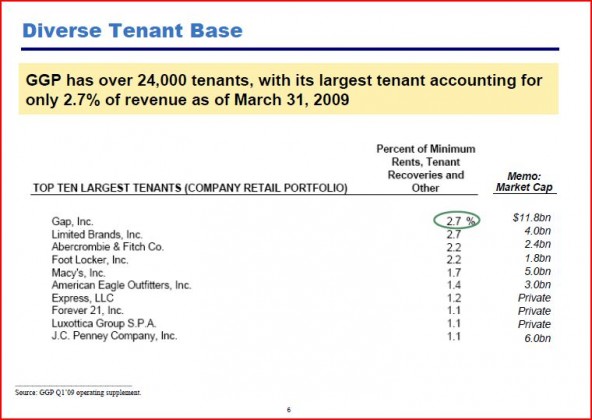

Well, lets look at those retailers and see what their impact on GGP would be. Now, it is a great leap of faith to assume he is correct most of them will go under (Sears will not). But, for arguments sake, lets just assume he is correct.

So, it would be, um….. negligible at best?

The last sentence puzzled me “This will start a whole new media blitz about “The End Of The Malls” which in turn will impact the stocks of all mall REITS, even those with very little exposure to “C” level malls or the specific department stores.” Yeah, so? What does this have to do with GGP’s value post Chapter 11? Answer? Nothing…

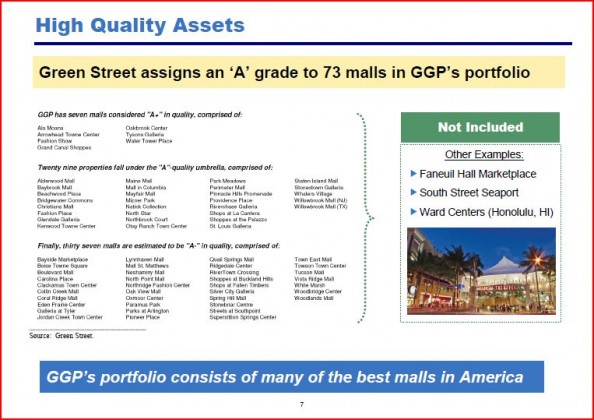

If we go back to Econ 100, we know that as the supply of something dries up, those who have it left have more pricing power. Going with this, as the authors “C” level malls go under, shoppers will be forced to travel up the mall food chain the the “B” and “A” malls, as traffic there increases, they grow stronger. He is essentially saying that because Zales Jewelers is suffering, Tiffany’s is doomed. Apples and oranges. As we see below, GGP is essentially an “A” mall operator:

I am sorry but I am having a hard time believing that “Tommy’s Fish Emporium” and “Nancy’s Food Mart” going under in a class “C” strip mall in Newton, MA and taking the whole strip mall down with it is going to have any effect on GGP’s Regional Natick Mall. If anything, this will help as shoppers will frequent those malls left in greater numbers. I know the argument, “more vacant space will lower rents”. In some cases this is true and we have seen some of this. BUT, in the class “A” malls, vacancy rates are not rising appreciably and rents are not falling anywhere near the rest of the industry. Essentially they are feeling the effects of the recession, but are not being bowed by it like at the lower end. Gap (GPS), Limited Brands (LTD) or Abercrombie and Fitch (ANF) are not going to be tripping over themselves to fill cheap spots in recently vacated class “C” malls and GGP knows this. I just do not see a Victoria’s Secret next to a Subway…

For another thing, both Goldman and Mr. Sullivan (as well as Mr. Bill Ackman who had previously made a major presentation with similar predictions) make certain assumptions that require a great leap of faith to accept. They all assume “no systemic shocks to the ECONOMY and that the current economic trends essentially continue”.

Without commenting on the exact definition of “economy and economic trends”, they are both in trouble from the first day of their predictions. The “economic trends” in the mall REIT industry continue downward as we speak and if my predictions are correct, the downward slide will accelerate in Spring.

While I will thank Mr. Leonard for putting me in the same sentence as Goldman Sachs and Bill Ackman, I just do not understand the argument. I think all three of us have been pretty straightforward in saying that we are in store for a slow slog as time goes on. The “slow recovery” is the most optimistic scenario I think anyone has put forward. Maybe he wants precise GDP predictions, not sure but, none of us three can be consider rosy in the general economic outlook. Clearly a Sept. 11th even or other “systemic shock” cannot be predicted or built into a REIT forecast nor should it be assumed as I think he is doing. We have also all said the REIT industry will suffer (Ackman just this week offered a “short” in the REIT sector). What we are saying is the GGP Chapter 11 is a very unique case.

I also would question all three prognosticators blind eye towards the vast differences between mall REIT’s exposure levels to malls that are either already “under water” or those under performing malls that have been allowed to deteriorate to the point that they are in need of tens of millions of dollars of renovation and remodeling costs. In recent weeks I have been asked to appraise certain GGP malls for private clients. In several instances I was surprised to find “C” level malls that had occupancy and rent levels that would seem to justify an 8% cap rate until I dug deeper and learned of very expensive renovation plans that had been delayed for years. If the costs of these much needed repairs and replacement items were factored into the value, the implied cap rate would have risen to roughly 9% or 10%. I just wonder how aware Goldman or Ackman or Sullivan were about these looming issues.

“C” malls at 7% cap rates? I am shocked he found any and am more than sure both Goldman and I said those “C” mall ought to be around 10% cap rates. I am confused as to why Mr. Leonard is arguing my point back to me.

GGP is a has $26B worth of assets and he is really going to extrapolate its value from checking out “certain” “C” level malls? OK, I’ll play along.

There isn’t really any material effect on GGP from the 30 grocery anchored strip malls (class “C”) they own (they own 130 “B” malls) as 75% of NOI comes from “A” properties. Here is the kicker. These are mortgaged with “non-recourse debt”. This is where a simple valuation of the malls in Chapter 11 is wrong. GGP, if these malls are a drag on valuation can simply “put” these malls to the mortgage holder. Since the loan is “unsecured”, the mortgage holder has no claim on any other asset other than the specific property. If it is a dud, see ya’ later. The majority of GGP’s debt is unsecured.

Finally, after all is said and done about the proper cap rates to use on all the GGP malls, using whatever comparisons to Simon or other mall REITs these analysts wishes to use, the fact remains that none of them have taken into consideration the single most unique aspect of GGP’s real estate portfolio. Naturally I am referring to the single biggest anchor to GGP’s profit potential, namely their vast over priced residential land holdings in Las vegas and elsewhere. Once these are factored into the mix I doubt that there is ANY EQUITY LEFT OVER FOR THE VULTURE FUNDS CURRENTLY CIRCLING AROUND THE GGP STOCK

Mr. Leonard clearly has not read anything I have written (40+ posts) other that the last one nor did he look through Ackman presentation as this statement is patently false. Nor does he address ANY of the legal issues surrounding the Chapter 11 case.

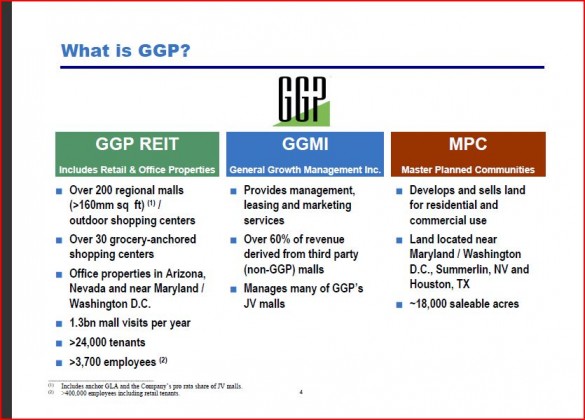

Ackman divides GGP into three units:

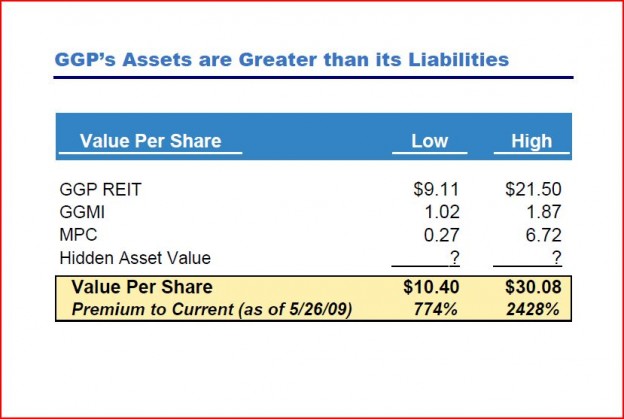

He then at the end assigns a value for each. I will post the entire presentation at the end for all to read (including the Mr. Leonard).

You’ll notice the “vastly overprice residential land communities” at the low end of the valuation are essentially valued at 0 ($.27) and the Vegas communities “potential” are valued at nothing (that is the “hidden value” category). Sort of makes that last paragraph um………irrelevant? GGP single biggest profit generator and valuable asset is its Class “A” malls, not undeveloped land in the Nevada dessert…

Here is the problem. Mr. Leonard whipped off a quick post charging Bill Ackman, Goldman Sachs and myself of not offering “details” when he clearly has not looked into any of the work put forward on the subject. Moreover, he offers no details himself to back any of his claims. Mr. Leonard is clearly overly negative on the sector for whatever reason (see previous posts of his on the site) and rather than offer substantive evidence to back his claims other than “I say so”, he instead chooses to take the work of others (or pieces of it) and pick erroneously at it. Goes to that site’s past history in general I guess…..

Oh well….

Full GGP Presentation:

GGP Ackman