This is great….

The US$ has received the 3rd Degree by the media and their associated pundits of late. It seems that we as a society can never be happy unless we have something to worry about. The latest pending calamity is always in the headlines and great for advertising dollars but does little to educate a wider audience except to have them focus on the very short term and by this causes government officials to do the same in response(they do want to get re-elected so they better be responsive and “Do Something!”)

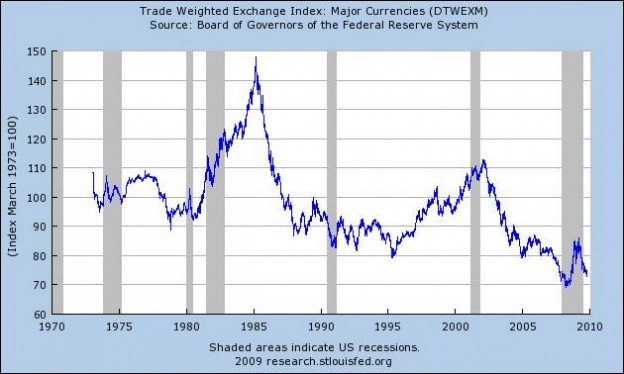

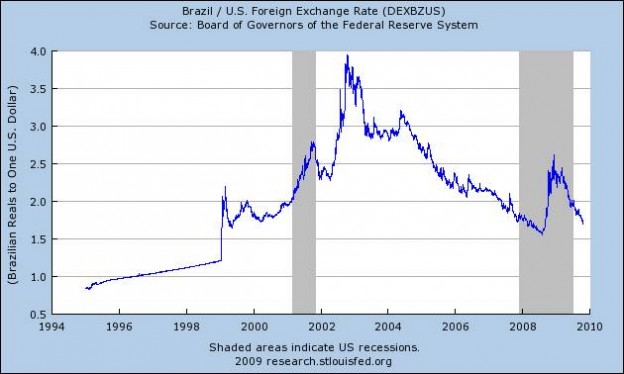

My view of the US$ which is plain to see below in the Trade Weighted Exchange Index and in the Brazil/ US and US/Euro Exchange Rate Indices is that the world is getting stronger as the US exports its greatest asset, i.e. capitalism, free markets and Democracy. In fact you cannot separate these three concepts from each other. They do not exist independently but are unique to freely operating and self-organizing societies and is the reason why the US remains greatly admired by aspiring societies and vilified by demagogues who seek personal power to the detriment of others. In free markets economic and political power is diversified throughout society to the greatest extent possible and leads to rapid innovation as well as reward.

As Socialist, Communist and Totalitarian governments evolve towards self-organized and free markets which they discover are the most productive in meeting their citizens’ needs, we should witness the US$ as having less importance in the world as the only safe haven available during times of geopolitical and economic despair. This is what I see in the Chart of “The Trade Weighted Exchange Index”. However, even during the recent crisis the US$ became a haven for many and this persists with T-Bills yielding less than 0.1% and 10yr Treasuries at ~3.5% and well below what historically has been the fair market rate of return currently 4.76%(Market Capitalization Rate). Fear persists.

The long term weakness in the US$ is in my view much more due to the improving relative liquidity, safety and rates of return in emerging Democracies. I include Europe as an emerging Democracy which began a dramatic change under Margaret Thatcher in the UK, was repeated in Ireland and now seems to be afoot under Merkel in Germany. This is a process that the US gradually exported with 50yrs of Cold War against the former USSR, protection of West Germany in a Democratic fold which was able to absorb with great magnanimity when the Berlin Wall fell. The courageous act by West Germany to absorb East Germany on October 3, 1990 with 1-1 currency swap exposed West Germany to an enormous but temporary inflation impact. Germany still supports the inhabitants of the former East Germany with subsidies, but has the economic vibrancy to do so.

One can see Democracy’s global expansion in both the Brazil/US and US/Euro Exchange Rate histories. (Note that the relationship to the US$ is inverse in Brazil/US chart vs. the US/Euro chart due to conventional use) Over the years as Brazil and Europe have become more capitalistic, more democratic and developed more towards freely organized markets the US$ has been in a gradual decline. The need to use the US$ as the sole reserve currency diminished over time as other financial markets and subsequently these currencies elsewhere have gained greater global confidence. THIS IS GOOD!!

But, in this most recent financial crisis in which almost all markets fully participated with their own home-generated excess lending behavior, the safe haven of last resort was and remains the US$. In this environment Bernanke had to supply not just liquidity to the US financial markets, but to the world which sought the safety of 233yrs of the US meeting its financial obligations. Bernanke expanded the Fed’s balance sheet to do this well beyond what many expected and this has caused in my view the current agita, panic, anxiety and general fear that we have lent too much, too quickly and that we will never be able to pay this off with our own economic activity. AND, this is topped-off with the argument that the US$ will become worthless with hyperinflation and etc, etc, etc.

I think not!

Bernanke in my view seems to understand all the risks and is in the process of reversing the liquidity as it becomes unnecessary. M2 growth, the accepted measure of money supply has been pulled back in recent months to the historical trend. It is not in Bernanke’s interest to tell the financial markets exactly when he will act as it reduces the Fed’s flexibility. But, he has made it clear that liquidity reversal will happen and that he is conscious of too much liquidity causing dangerous inflation.

US$ weakness over time is something we desire as a sign of spreading democracy. The success of this process is measured in decades not seconds. The media with 15sec sound-bites is taken out of context of a long term process of which we should be proud and quick to disparage. A proper understanding of history in which social, economic and political histories are viewed on a time line of decades and centuries is very helpful in our current situation.

Meanwhile, the current economic trend continues to improve.