Key point, Hovde is still short (and getting killed on it).

Here is the first round from Hovde and my response to it.

Here is Whitney Tilson’s response.

Here is Pershing’s response.

Here is Hovde’s latest…

![]()

I am going to ignore most of the NOI argument because it has come down to an argument over what expenses and revenues ought to be included or excluded. Readers know where I stand and can make up their own mind where they want to be.

What I instead want to focus on it much like the first Hovde piece, some of the simply glaring “inaccuracies”.

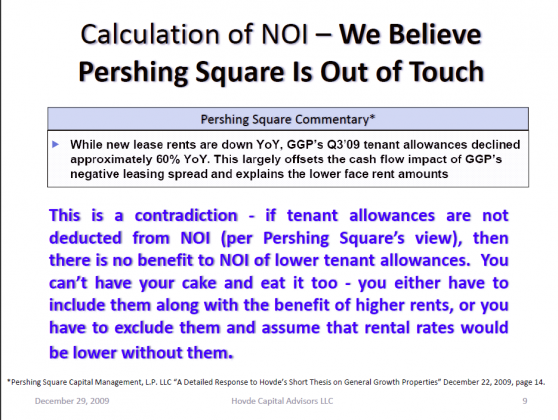

Hovde is right in their rebuttal, if that is what Pershing was arguing. See, pg. 14 in Pershing’s presentation (the commentary referenced) was from the section “Other Cash Flow Items”, it has nothing to do with NOI. Hovde is trying to refute an argument Pershing never made.

They then go into a rental market over view and again, that comes down to a “how do you see the data” scenario.

Look at the copy at the right side:

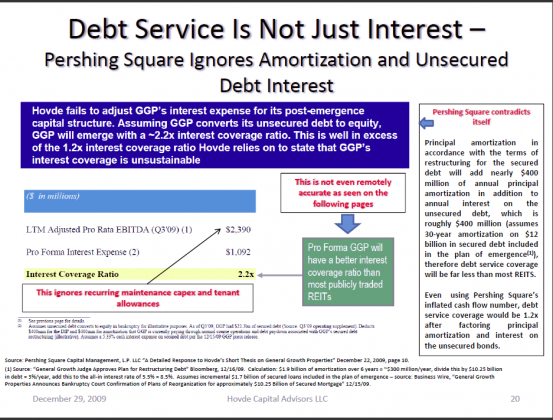

Principal amortization in accordance with the terms of restructuring for the secured debt will add nearly $400 million of annual principal amortization in addition to annual interest on the unsecured debt, which is roughly $400million (assumes30‐year amortization on $12billion in secured debt included in the plan of emergence (1)), therefore debt service coverage will be far less than most REITS.

Even using Pershing Square’s inflated cash flow number, debt service coverage would be 1.2x after factoring principal amortization and interest on the unsecured bonds.

Really? Pershing produces a slide of interest coverage “assuming GGP converts unsecured debt to equity” and then Hovde argues it is inaccurate “after factoring principle amortization and interest on unsecured debt”. Um, Eric (that is Hovde’s first name), if unsecured debt is converted, there is NO MORE principle and interest payments on that debt.

Really? People actually reacted to this today? Really?

Keep your eyes on the above caption as it states how “Pershing ignores capex and Tenant allowances (TA)”

Then look at the following slide….

Ooops. Guess they didn’t did they? Again, Pershing presented both scenarios.

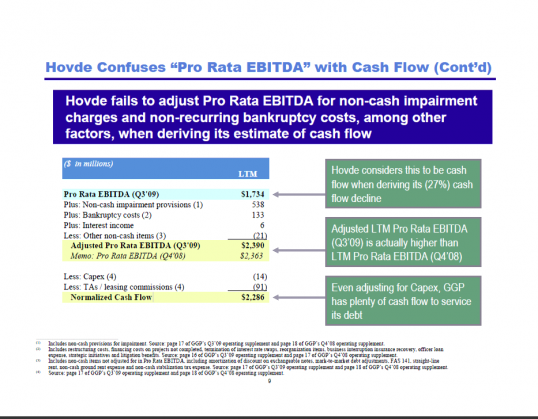

What is also not lost on me is that Hovde even now seems to be admitting their EBITDA calculation from the 1st presentation was near $700m off (too low) due to the inclusion of non-cash and Chapter 11 related items. Since they now use Pershing’s data, without refutation of what was said by Pershing about their EBITDA number, we can only conclude they are classifying their miscalculation as a “mulligan”?

Hovde also igniores this little tidbit:

The substantial majority of GGP’s assets are financed with property-specific, non-recourse debt. Assets whose values have declined to levels below the mortgage debt can be returned to lenders thereby creating additional value for GGP equity holders

Meaning Mall “A” whose value has plummeted and has a loan from the 2006 peak can simply be “put” back to the lender without recourse to GGP. It then removes debt that is > the carrying asset value improving both the balance sheet and cash flow. OR, the bank, wanting to avoid this, can negotiate better terms that accomplish the same thing. Either way, GGP is 100% in the drivers seat.

This is no little thing and the fact Hovde ignores it is stunning.

“Surprised at the debate”? The centerpiece of valuing a CRE property is essentially the cap rate applied to it and Hovde was surprised that there was debate on their rate and comp? 1/3 of their entire case against GGP was the comps they provided. Did they expect people just to take them as gospel and accept them? Not possible.

What you’ll also notice here is that the 3 Macerich (MAC) transactions which were the centerpiece of the previous “analysis” are mysteriously missing from this one. One can only assume that their inclusion as legitimate comps was so wholly eviscerated they chose not even to defend them in this one. They make no effort to defend their choices of them.

They do include again the Simon (SPG) Prime Outlet deal and its indication of a 8% cap rate but ignore the Kimco deal and its 7.5% cap rate on $156 per. sq. foot in sales vs GGP’s >$400. They also neglect to say outlet malls typically have sales roughly $300 per. sq. foot. Again, making these lower class “B” or “C” malls, giving them a higher market cap rate that Class A Regional Malls like GGP and Simon. Simply put, this means both GGP and Simon would have cap rates significantly lower than the Prime Outlets.

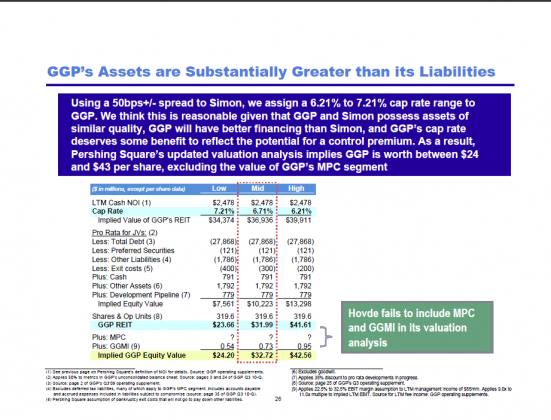

Hovde then goes into a rather lengthy argument as to why the Master Planned Communities of GGP and its management business aren’t worth very much. Again, not sure the point as Pershing does it both ways, gives no value to the MPC’s, and gives insignificant value to the Management:

Then he attacks the “strategic acquisition” scenario with Simon. Now, this is legitimate as even I have said before I did not think Simon was the best fit for a total purchase for many of the reasons Hovde presents (note: Hovde did not make these assertions in the first presentation, only after they were made in other places). But, Eric, why eliminate the possibility of both Westfield Group and Brookfield Asset Management (BAM), both of who have less leverage, could easily do a deal and would not encounter the same FTC issues Simon potentially would? In fact, Hovde does not even mention the other two despite both of them confirming talks with GGP.

Further, why not discuss the potential JV scenario as it has been discussed by Simon, Brookfield and Westfield. Since we are on a roll here, why not talk about the possibility of a joint bid? Any two of the three could easily make a bid for the entire company and then place it into a separate JV.

Hovde goes onto doubt Simon has any interest in GGP at these share price levels. Well, he might want to ask David Simon about that.

Hovde then wanders into the state of retail and again, this comes down to a “how do you view” the data (glass 1/2 empty or 1/2 full type thing). Hovde laments the decline (“death”) of the US Mall while ignoring mall traffic this holiday season was UP vs last year. Agree to disagree

He then tries to refute Whitney Tilson’s take but again either purposely omits or does not know that Tilson’s debt service scenario is with unsecured debt converted to equity while Hovde’s does not assume that. Specifically, Hovde states “The company’s annual debt service is $1.5 billion (pre‐plan of emergence)”. Yes, total current debt service is (actually) $1.4B including unsecured debt (FYI, when you emerge from Chapter 11, that number is lower so that you do not end up back there again). You’ll note below that Tilson’s debt service number states “senior debt”. He then backs unsecured conversion out of the equity value (assuming conversion).

Hovde is essentially arguing his apples are better than Tilson’s while Whitney stands there with a bag of oranges.

Tilson says:

Reasonable people could argue endlessly about what the appropriate cap rate is, so we believe it is useful to value GGP another way: based on cash flows. Our simple (and we believe conservative) valuation of GGP’s REIT business is:

NOI $2.4 billion

Minus senior debt service* $1.1 billion

Minus cap ex $0.3 billion

Equals cash flow of $1.0 billion

Simon Properties trades at 14x this number. If we apply this multiple to GGP, the unsecured debt plus the equity is worth roughly $14 billion. Netting out the unsecured debt leaves approximately $7 billion for the equity, equal to more than $22 per share.

* Assumes the remaining senior debt gets renegotiated on similar terms; see this morning’s press release here.

Hovde also ignores the following points:

Why would Simon or Brookfield pay a premium for GGP?

The bankruptcy creates a once-in-a-lifetime opportunity for a large, strategic buyer to acquire GGP. Assets such as GGP may not be on the market en mass for a very long time if not ever. Whomever could obtain them and the reorganized entity instantly becomes a powerhouse in the US Mall industry. There is a large premium to be had for that.

Where will demand for shares come?

GGP will be a must-own equity upon emergence – as likely the 2nd or 3rd largest market cap REIT in the U.S. – for all REIT mutual funds, ETFs, institutional managers and index funds. This will create large, immediate, demand for shares.

See, here is the thing. People can argue all day about what ought to be included in NOI, what an appropriate cap rate ought to be, what the current and future states of retail will be or who is being either too optimistic/pessimistic. But, after going through both of Hovde’s presentations I simply find a staggering amount of dishonesty in my opinion.

From comp properties in the first presentation that disappear from the second one, an EBITDA calculation that included one time charges and Chapter 11 charges that is effortlessly altered in the second presentation without a word of explanation and intentional misrepresentation of both Tilson’s and Pershings share valuation’s components, one had to wonder why anyone would trust a singe slide without fact checking it..

I have no qualms with one “talking their own book”, we all do it. Being honest, I prefer those who do, it makes their work more passionate and I know their bias going in. For the record, we all have a bias, even those who “have no skin in the game”. Those who talk their book just tell you what it is ahead of time and we the readers can go from there.

My problem with Hovde is the illegitimacy of what they are doing for the reasons stated above. I have not addressed purposely many of their assumptions I simply disagree with, people can do that. I have and will continue to attack the I can only assume intentional misrepresentations/errors/omissions in their product.

Do not expect a rebuttal from Pershing on this. Hovde 1.0 was bad, Hovde 2.0 was worse and simply can’t get any better. I think the market reaction today as it digested this ought to let us know what people thought of it. I’m gonna assume the folks at Pershing have far better things to do than get dragged into this.

Hopefully, Hovde saves themselves from more embarrassment and ends this….

One reply on “Hovde Takes Another Shot…..Airball $$”

[…] citations to see of they are valid, they aren’t. This in fact reminds me of Hovde and GGP in December of 2009 in his used of comps that were […]