A picture is indeed worth a million words….

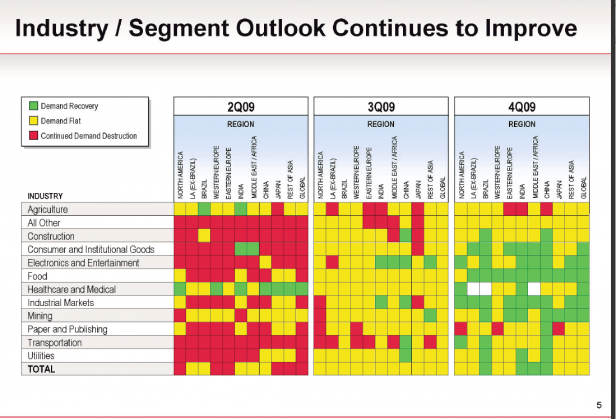

This is a slide from Dow Chemical’s (DOW) earnings call yesterday. Why is it important? Simply put “Dow makes the stuff that everyone uses to make stuff”. Dow has a global footprint and it tied to every major region of the world. They are invoilved at both the ground floor with their basic chemical business and the top with their specialty division. Almost no part of the overall manufacturing food chain is untouched by Dow.

Because of that, what they see for demand is the best indication of how the global economy is doing…

Here is the picture as of Q4 2009:

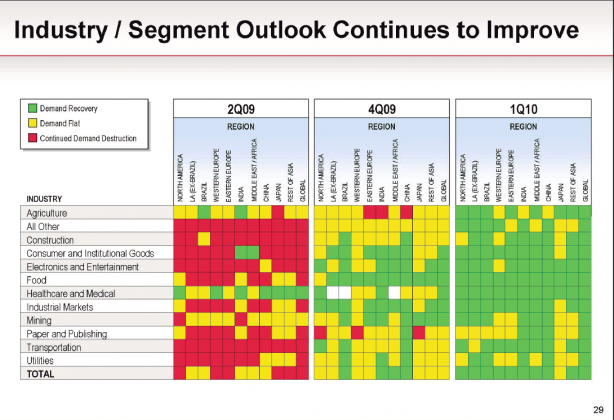

If we include Q1 2010 to date, it looks even better:

Bottom line is that if your portfolio is tied exclusively to the US, you may be leaving gains and strength on the table. Now, personally I do not buy individual stocks on foriegn exchanges (this isn’t to say it is a bad idea, just not for me) but it is plenty easy to do through US based firms like Dow.

Another choice could be GE (GE) but personally I am not a fan of their finance division and think it is pretty likely to be an albatross around GE’s neck for some time.

Anyway, try to ignore some of the doomsayers out there regarding China and the global outlook. Remember, people freaked out over China because their GDP “slowed” from 10% to 8%. I think we would be more than happy for that type of “problem” here. Get yourself some of China, there are plenty of way to do it without blindly investing in stocks over there.