It is really unfortunate that once again the MSM has made almost no attempt to look at any of these issues up until now. Maybe I should say still haven’t? They have simply parroted the erroneous statements by the likes of David Simon and the Creditors Committee like the lemmings they are. One should not be surprised, they have been flat wrong on GGP for over a year now, why stop now?

Tell me if any of this sounds familiar (emphasis mine):

General Growth’s extraordinary success provides multiple options to satisfy its corporate-level debt and achieve significant value for its shareholders under a plan of reorganization. Indeed, General Growth has come a long way from a time when its debt traded in the range of 10 to 30 cents on the dollar. Today, General Growth’s stock is trading millions of shares each day at over $13 per share. The market value of the stock and thirdparty

proposals demonstrate that General Growth has a multi-billion dollar equity value.This has made General Growth an unusual debtor, one with the fiduciary duty to maximize value for shareholders.

General Growth’s summary to Creditors Objections (emphasis mine):

General Growth has received the support of the Equity Committee for the requested six-month extension, however, the Creditors’ Committee has objected to any extension. Its Objection raises four points. Each is flatly wrong.

First, the Creditors’ Committee alleges that General Growth has not made progress on the restructuring of TopCo (as defined below). In fact, General Growth has made exceptional progress, especially following the last exclusivity extension, in formulating and implementing its strategy to emerge with a stronger balance sheet. That plan has been communicated many times to the Creditors’ Committee.

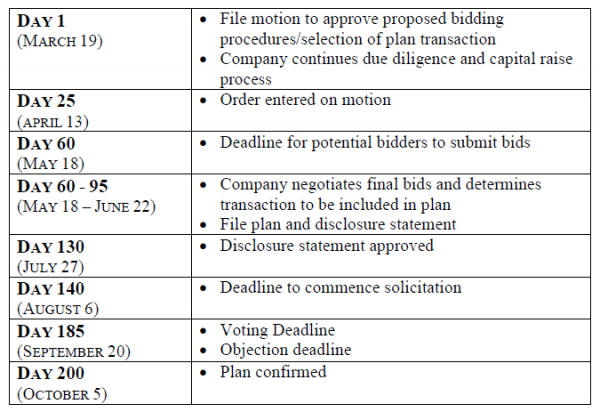

Second, the Creditors’ Committee claims that General Growth’s capital raise and emergence process will force uncertainty on creditors by failing to pursue a quick cash-based M&A transaction. The Creditors’ Committee’s position is flawed. Any transaction will require the same time period to accomplish, as outlined by General Growth’s emergence timeline. There simply is no additional risk to creditors by General Growth’s process, particularly when the question of solvency is not close.

Third, the Creditors’ Committee’s contention that the retention of UBS Securities LLC (“UBS”) to assist in this process ignores fiduciary duties is unfortunate. It also is hard to understand given General Growth’s fiduciary duty to shareholders. Given General Growth’s current equity trading value and the ability of debt holders to sell their claims for a full cash recovery today, it is incumbent on General Growth to explore, within the appropriate bounds of reason, a recapitalization that involves sources of equity and/or debt capital that may provide the best outcome for stakeholders.

Fourth, and perhaps most disappointingly, the Creditors’ Committee has adopted as its agenda a desire to usurp control of the emergence process in an effort to truncate any effort to realize the fair value of the enterprise for shareholders. The Creditors’ Committee has done this under the guise of General Growth’s lack of transparency. Months ago, General Growth provided the advisors to the Creditors’ Committee detailed models and projected cash flows forecasting General Growth’s businesses, which are the underpinnings of the business plan that has since been finalized. General Growth identified a member of the senior management team to liaise with the advisors to the Creditors’ Committee.

General Growth’s advisors have had numerous calls and meetings with the advisors to the Creditors’ Committee explaining the capital raise process and rationale for UBS’s retention. The process has resulted in countless meetings and calls without complaints regarding information flow. The Creditors’ Committee’s argument that General Growth has failed to be transparent with respect to its capital raise process is wholly undermined by the fact that, to date, General Growth has been transparent in all other aspects of its restructuring and has engaged with the financial advisors to the Creditors’ Committee to describe General Growth’s capital raise process. General Growth expects to continue to conduct its process in a manner that is transparent to its stakeholders.

Later:

General Growth has a fiduciary duty to maximize value for all

stakeholders. Since all of General Growth’s restructuring alternatives, including the agreement in principle with Brookfield (the “Brookfield Agreement”), contemplate full recovery for unsecured creditors, the equity holders are the fulcrum class. It is a basic tenet of Delaware law that the fiduciary duty of a board of a solvent Delaware corporation, such as GGP, runs to its shareholders. N. Am. Catholic Educ. Programming Found., Inc. v. Gheewalla, 930 A.2d 92, 99 (Del. 2007); see In re Trados Inc. S’holder Litig., 2009 WL 2225958, at *7 (Del. Ch. Jul. 24, 2009) (“[I]t is possible that a director could breach her duty by improperly favoring the interests of the preferred stockholders over those of the common stockholders” in a merger that pays nothing to common stockholders); Blackmore Partners, L.P. v. Link Energy LLC, 864 A.2d 80, 86 (Del. Ch. 2004) (finding a reasonable inference of disloyalty where pleadings asserted that a merger wiped out equity holders and solely benefited creditors). There is no question that General Growth is obligated to conduct the TopCo restructuring process in a manner that maximizes value for equity holders. Thus, it is not surprising that the board of GGP, in the exercise of its fiduciary duties, did not bend to pressure from the Creditors’ Committee to rush to pursue the proposal from Simon (the “Simon Letter”).

Also:

The Creditors’ Committee contends that by rejecting the Simon Letter General Growth is improperly risking a full cash recovery for unsecured creditors for the purpose of inflating equity value. In the context of this case, such assertion is ludicrous. Creditors in this case who want cash have been and can continue selling their debt for prices equal to, and in some cases greater than, par plus accrued interest. There are significant debt holders, including Brookfield, who prefer to convert their debt claims to General Growth equity. General Growth should have the opportunity to propose a plan that offers creditors a choice of cash or General Growth equity so that creditor preferences can be addressed

Full Brief:

ggp ext

Filing in Support of GGP

ggp support