This is big deal…..though, not unexpected…

Here are my thought’s on 3/2 on the then upcoming hearing.

Saying General Growth has done a “superb” job considering the interests of all of its creditors and shareholders, Judge Gropper said he wants General Growth to move quickly so that it doesn’t “miss the market” to get full recovery for its creditors. “The playing field will not be tilted” against bidders, he said. “Entities willing to make a proposal to finance or acquire the debtor will have that opportunity.”

General Growth had asked for a six-month extension. Simon and General Growth’s committee of unsecured creditors lobbied against anything longer than 45 days, arguing that General Growth should immediately accept Simon’s $10 billion offer.

With the four-month extension, General Growth now intends to embark on a two-pronged process of simultaneously soliciting offers to acquire the company or recapitalize it. It would aim to file an exit plan by June. Any new offers in the interim would be judged against a plan General Growth has unveiled for Brookfield Asset Management Inc. to provide $2.6 billion to finance General Growth’s release from bankruptcy protection.

Simon Chief Executive Officer David Simon unveiled a $10 billion buyout bid for General Growth on Feb. 16. General Growth has said it will evaluate that bid along with others submitted.

Tom Nolan, General Growth’s president and chief operating officer, said during the hearing that “four or five” companies so far have signed nondisclosure agreements to examine confidential data about General Growth’s malls as they consider whether to make bids for all or part of the company. Among those that are doing so are Simon, Brookfield and Australian mall owner Westfield Group.

GGP Commented:

General Growth Properties, Inc. (“GGP”) today announced the Bankruptcy Court has approved an extension of the exclusivity period during which GGP has the right to file a plan of reorganization through July 15, 2010, and an extension of the period to solicit acceptances of a plan of reorganization through September 15, 2010. During the exclusivity period, no other party is permitted to file a competing plan of reorganization.

“We are pleased with the Bankruptcy Court’s decision today,” said Adam Metz, chief executive officer of GGP. “The extension is consistent with our timeline for evaluating all alternatives for emergence and recognizes our tremendous accomplishments in these large and complex Chapter 11 cases in a short amount of time. We are looking forward to emerging from bankruptcy as soon as reasonably possible and we are committed to continuing to work hard to achieve the best outcome for all of our stakeholders,” continued Mr. Metz.

Simon Properties said:

“We appreciate the Court’s decision to shorten the exclusivity period requested by General Growth. The Court has made it abundantly clear that General Growth must now conduct a truly fair process with all parties on a level playing field. Today we have been permitted to commence due diligence, and we will determine our best course of action as we move forward.”

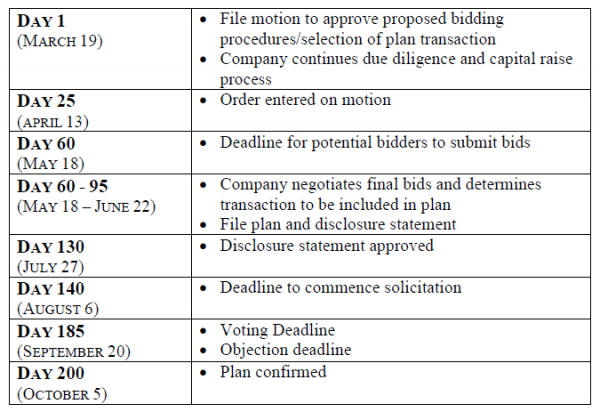

I guess Simon did a decent job of saving face. They can spin the extension anyway they want but the Judge gave GGP what it needed. With a plan to emerge from Chapter 11 by Oct. 5th, the extension to Sept. 15 all but wraps up the process. Any bidder who is serious about being a part of the GGP bidding will have to act in the next 60 days to be considered. The final date for votes to be submitted for whatever plan GGP chooses is set for Sept. 20th.

Yes, I know that is 5 days after the current exclusivity is set to expire BUT, based on everything this Judge has both said and done up until this point, if GGP has a plan and support of a large contingency of stakeholders, the last thing he will do is end the exclusivity and essentially start the process over in Sept..

We also got word during the hearing that Westfield has indeed signed a NDA and is digging through GGP. That leaves two mystery signers of NDA’s we have not heard about yet. Bottom line? More bids are coming.

Other potential bidders are Vornado (VNO) and China Investment Corp. (CIC) thought neither of those are confirmed. Here are some thoughts on a possible Vornado deal from 3/3’s morning show with @wsmco.

The ruling ought to be posted tomorrow and we will take a look through it then…

But for now, the process is moving along perfectly…..the next steps are to sit back and wait to see the bids come in…