Good stuff. FAS 157 caused far too much pain and panic….

“Davidson” submits:

George Santayana is attributed with the quote, “Those who cannot learn from history are doomed to repeat it.”

And, Sir Francis Bacon said it best when he said, “Knowledge is Power”.

Investors have very short memories which actually has a psychological label

“The Recency Effect”- is a cognitive bias that results from disproportionate salience of recent stimuli or observations.

In short, investors are often deceived by thinking that what has just been observed is viewed as the future trend!! Only by examining history carefully does sufficient knowledge provide corrected perception.

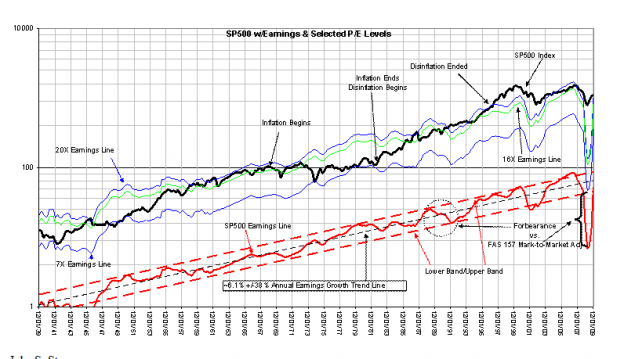

Below is the updated chart of the SP500 and reported EPS from 1939 thru Dec 31, 2009. The most important information on this chart is in my view the “Forbearance vs. FAS 157 Mark-to-Market Adj” and the second most important information is the “Annual Earnings Growth Trend Line”. Together these two pieces of information tell an incredible story.

1st The long term “Annual Earnings Growth Line” represents the durability of the US economy through many difficult and trying economic conditions almost all of the worst of these were imposed by human activities. Yet, the average annual earnings growth of the SP500 has been ~6% for nearly 70yrs. I hope that you view this as I do as an incredible record and at the same time a very strong statement of the power of democracy, free markets and the inherent abilities of the human race to adjust to and over come catastrophe and move forward.

2nd The “Forbearance vs. FAS 157 Mark-to-Market Adj” comparison should prove a history lesson that we should not repeat. The FASB accounting rule FAS 157 commonly called the “Mark-to-Market” accounting rule was installed November 2007. The resultant mark down of book values in the next 18mos as over-levered investors sought to sell suddenly illiquid assets shattered investor confidence during a very stressful period. A difficult situation became horrific.

The real estate and foreign lending excesses of the 1988-1990 period has been viewed by experts as being a significantly worse financial debacle, but sounder reasoning provided by insightful individuals with some historical common sense applied “Forbearance” to troubled assets. Those with common sense and a sense of US history knew that fear would be temporary and that “Mark-to-Market” pricing during fearful times did not represent a true reading of long term economic value.

The very rapid resurgence of SP500 earnings from a 12mo $6.86 reported for 1Q March 2009 to a $50.97 reported 4Q December 2009 is a significant degree a simple writing-up assets that had been written-down 12mos before. Such is the power of FAS 157!!

It is my hope that a lesson is learned that will not be forgotten. Much fear remains with investors, but this should lift in time. The actions that have been taken in response to counter the foolish use of leverage, the sub-prime lending, the removal of financial regulations and government actions to counter the issues it caused in the first instance will over time work themselves out and not likely prove harmful. Just disruptive!

Current economic conditions are better than most believe and the equity markets are very likely to rise to improving market sentiment.

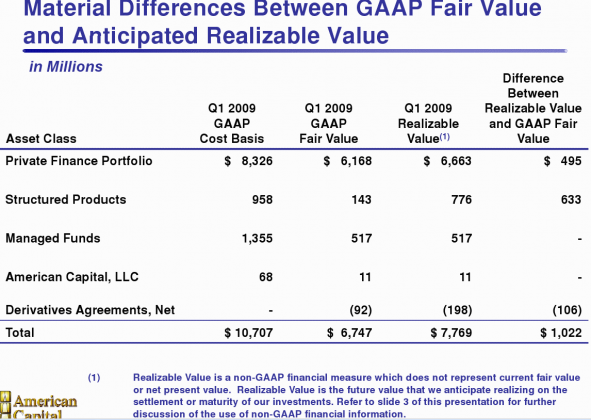

This effect was a large part of out investment in ACAS. Remember this?

ACAS was experiencing large write downs due to FAS 157 on assets it was not going to sell and based on cash flows were still functioning profitably. Yet, FAS 157 nearly took it under. Without discerning between assets held to maturity and those for sale, a single company that gets itself in trouble in an industry holding non liquid assets can then effect the assets value of all other participants. Since this slide, ACAS has seen the very assets written down now significantly increase in value (with very little change in performance) and NAV rise along with them. I have argued in the past that income producing assets being held to maturity need to take into account the income performance of them in any valuation, not simply what the guy next door who got in way over his head is forced to dump them for.

One of the reasons that CRE has not become the “next shoe to drop” everyone predicted it would was because the Fed/IRS modified the accounting of modified CRE loans last October. Previously modified loans had to be written down even if the modification lead to a safer outcome for both the banks and the lendee. This simple adjustment saved large CRE losses for banks and allowed many CRE owners to modify loans, saving the properties.