“Davidson” makes some salient points..

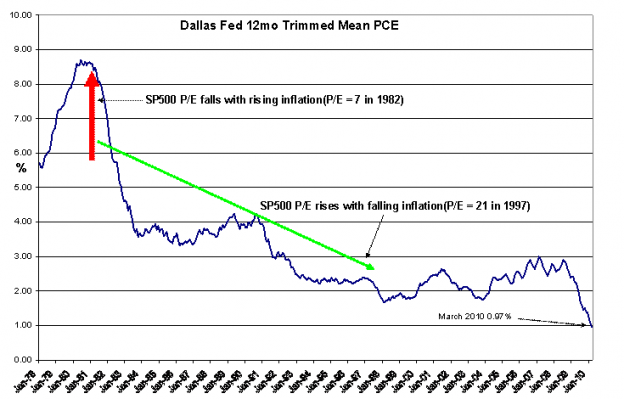

The problem with the high level of fear concerning an inflationary spiral is that inflation as measured by the Dallas Fed PCE is low and falling as shown by the chart of the Dallas Fed 12mo Trimmed Mean PCE with a March reading of 0.97%. This is the lowest recorded level in the entire series since Jan 1978. Why then do so many believe that inflation is a problem?

The issue is deeply rooted in the John Mills vs. John Stuart Mill debate of 1867 as reported by Justin Fox in “The Myth of the Rational Market” which set the stage for 143yrs of accepting “Market Prices” as actually representing true economic values. The concept of “Mark-to-Market” goes back centuries as alternatives for valuation were simply not available. Prices have been the culturally accepted valuation measure for so long that even professional investors were aghast at the $1Trillion loss in “market value” last Thursday during ~40min of odd trading. But, this drop was so rapid and severe that few investors truly believed that the real values had changed in the blink of an eye. Now the search is on for the culprit, but this event revives the 1867 debate as to exactly what do market prices represent.

If we are able to understand that rapid price change over ~40min last Thursday did not represent underlying asset value change, then over the longer term what does price change represent?

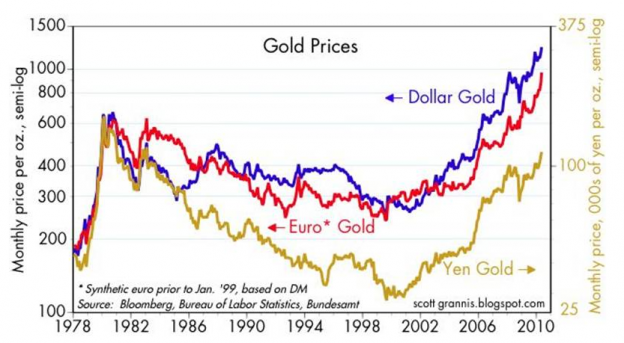

The answer is lies partially in the comparison of Scott Grannis’ chart below of gold prices as represented by the three major currencies, US$, Yen and Euro with gold’s price movement being recently reflected in almost all commodity prices(Commodity charts sent in last week’s email). Clearly the Dallas Fed Trimmed Mean PCE of consumer prices does not show a flow-through to the consumer of a host of very high commodity prices. This does not mean that consumers will not feel the effect of high commodity prices, but it is not happening now and has not happened for the past 12mos-24mos. What do high commodity prices mean?

My interpretation is that market prices represent first and foremost the current “Market Psychology”. Fadel Gheit, the highly ranked Oppenheimer & Co. Energy: Oil and Gas Analyst, has spoken often that current oil prices near ~$85bbl are some $20bbl higher than supply/demand would justify. That we see all commodity prices at such high levels is in my opinion more a reflection of fears that inflation may occur and that global currencies may be devalued by their respective governments. There have been reported examples in China that individuals have bought copper ingots thinking to preserve wealth believing that currency devaluation would occur. The fallacy of this thinking is that if one country devalues its currency that all would have to follow. But, is this likely to occur?

Global participants know that the issues of Venezuela and Greece are clearly not solvable by devaluation. Out of balance fiscal issues can only be solved by sound fiscal discipline. The flood of investors to commodities is similar to the ‘90’s “Internet Bubble”, the 2008 “Peak Oil” mania, the “Global Warming” mania and a host of prior market psychology examples that later proved to have no factual basis. Famous in history is the 1637 “Tulip Bubble”.( At the peak of tulip mania in February 1637, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftsman. It is generally considered the first recorded speculative bubble.) What each proved was that without adequate information investors became caught-up in market price trends believing that prices themselves carried investment insight that was hidden. It is a long term cultural belief that market prices represent the knowledge of the most sophisticated and savvy private investors .(This is the basis of Eugene Fama’s “Efficient Market Theory” ) The examples of professionals relying on market prices and price trends as forecasting tools are available throughout the day on CNBC and are prime examples of these cultural biases. Market prices without any other factual information to the contrary has often become the sole determinant of investment decisions. With the facts revealed, investors rapidly reversed course. The Dallas Fed Trimmed Mean PCE supplies the factual basis that the current inflation fears are not justified.

The current divergence of commodity prices vs. inflation indicators is a good example of “Market Prices” differing with reality. Without some grounding in long term fundamentals investors are forever bound to mistake market prices for true asset values. It appears that many investors have already made their “bet on inflation”. The simple fact that so many have committed to coming inflation as de facto leads me to be a contrarian. History is replete with expert forecasts not proving reliable. Notably among those important of financial forecasts has been inflation which is a man made problem and just as importantly is and has been solvable by simple actions. While one cannot reliably forecast inflation (or much near term market action), one can certainly note when too many investors are to “one side of the ship”.

I think inflation fears are well overblown. If this is so, then investor adjustments to an opposite view could prove volatile. But, knowing this and that the global economy is yet to be fully functional and that market valuations historically rise as global economies improve, I continue to recommend a balanced exposure to equity asset classes. The Return/Risk continues to appear quite favorable for most asset classes except Sovereign Debt which does not offer adequate returns. At some future date equity prices will gradually reflect unfavorable Return/Risk and adjustments will be suggested.

The “Keystone” to investing using asset classes is quite simple even thought it takes considerable effort to execute. Market and asset class performance is unpredictable over the short term, but some what predictable over 10yrs+. By defining roughly the levels of higher and lower Risk as part of Return/Risk, one can adjust Risk exposure accordingly. Basic to comprehending this is in understanding the human need for certainty, precision and causality. We try to predict “How much?”, “When?” and “Which marketplace?” and we believe culturally that mathematical analysis will provide solutions. We have fostered this belief in mathematics since 1867. Mathematics is the basis of most of modern day hedge funds.

The problem with this effort is that mathematical relationships hold only in physics and chemistry, the hard sciences. Only in physics can fixed relationships between “things” be described, i.e. A + 2B = C or in chemistry 2H2 + O2 = 2H2O. The “2H2 + O2 = 2H2O” relationship works not just on earth, but throughout all of space as we know it. “2H2 + O2 = 2H2O” is not subject to how some one feels! The investment markets are based on business returns as reflected in market prices. Market prices are influenced to such a degree by “Market Psychology” that most of the time the true return of the underlying asset is not fairly reflected. This is the reason for the development of the Market Capitalization Rate(MCR).