“Davidson” is on a roll. For those newcomers not aware who Davidson is, it is a pseudonym. He wishes to remain anonymous. Suffice it to say he is a very, very smart individual who in early March 2009 during one of our conversations, whit the DJIA at 6700 said, “it is time to go all in” and laughed at the market collapse. Call of the decade in my book. For that reason, his commentary is worth considering seriously

Submitted:

Brian Wesbury commented on employment.

“The headline payroll number for May came in below consensus expectations and the shortfall was due to the private sector. However, the details of the report – beside the welcome drop in the unemployment rate to 9.7% –confirm the V-shaped recovery is now hitting the labor market. Average weekly hours in the private sector increased to 34.2 in May from 34.1 in April. That’s the equivalent of 315,000 jobs. In other words, had employers kept hours per worker unchanged, there was enough labor demand for private payrolls to increase 356,000 in May (the actual gain of 41,000 plus 315,000). That would have blown away the consensus expected gain of 180,000 for the private sector.”

I disagree with Wesbury. I think the surveys missed the true employment growth. The trends leading this report from PMI, HWOL and et al were quite positive. The fact that the surveys cover ~1% of the population which is then scaled to produce a current est. leaves plenty of room for statistical error. The accelerating employment growth since Dec2009 does not suddenly slow down. In recoveries they accelerate and are the source for consumer spending especially car and light truck sales which have been so strong of late. Economic cycles are slow ponderous things and do not start and stop. Measuring economic activity has always been fraught with errors which are corrected over time and even then becomes only our best estimate. I think the survey sample was an anomaly which will be corrected next month. The data shows similar patterns throughout its history.

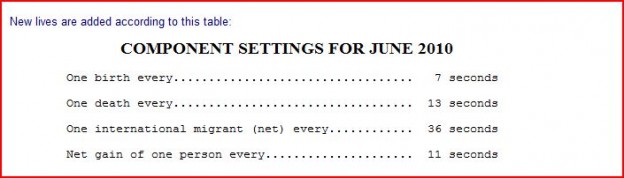

Mostly missed in the thinking of our employment data is the relentless demand push that comes year-over-year growth in population. In the US there are over 309,425,353 individuals today according to the Census Bureau Population Clock,.

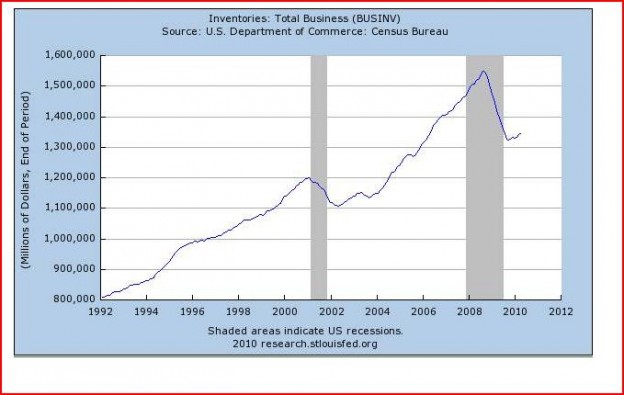

We tend to ignore demand-build during recessions that amounts to 5,733,818 individuals every 2yrs. These 5,733,818 individuals need housing, clothing, medical care and food. Historically recessions have been accompanied with ~1.4mill layoffs. But, all individuals continue to consume and inventories become depleted which with a progressively larger population forms a base at progressively higher levels and becomes the leaping off point for the next business cycle. This last recession was much stronger with ~8.4mil layoffs, but all still must have the essentials. Add to this another ~5.7mill individuals, then excess inventories get used up fairly quickly-see the St Louis Fed Total Business Inventories Chart. The demand is substantial and growing at one new individual every 11secs or 238,909 every month.

It is hard to view today’s events negatively.

One reply on “$$ “Davidson” …. New Demand Every 11 Seconds”

[…] The relentless effect of a growing population on demand. (Value Plays) […]