Some huge savings for shareholders here

We expect to use the net proceeds of this offering to repurchase, assuming an offering price of $14.00 per share, $1.6 billion of the common stock issued to Fairholme, Pershing Square and Texas Teachers on November 9, 2010, the effective date of the Plan ($1.8 billion if the underwriters’ option to purchase additional shares is exercised in full). The investment agreements with Fairholme, Pershing Square and Texas Teachers permit New GGP to use the proceeds of a sale of common stock of New GGP, including the common stock offered hereby, for not less than $10.50 per share (net of all underwriting and other discounts, fees and related consideration), to repurchase the amount of New GGP common stock to be sold to Fairholme, Pershing Square and Texas Teachers, pro rata as between Fairholme and Pershing Square only, by up to 50% (or approximately $2.15 billion in the aggregate) within 45 days after the effective date of the Plan. In connection with our election to reserve Pershing Square’s shares for repurchase as described above, 35 million shares (representing $350 million of Pershing Square’s equity capital commitment) were designated as “put shares” in accordance with the Investment Agreement for Pershing Square. On November 9, 2010, the effective date of the Plan, Pershing Square funded $350.0 million to New GGP in exchange for unsecured notes issued by New GGP to Pershing Square which will be payable six months from the effective date of the Plan (the “Pershing Square Bridge Notes”). The Pershing Square Bridge Notes are prepayable at any time without premium or penalty. In addition, we have the right (the “Put Right”) to sell up to 35 million shares of New GGP common stock, subject to reduction as provided in the Investment Agreement, to Pershing Square at $10.00 per share (adjusted for dividends) on the first business day six months following the effective date of the Plan. One of the ways that New GGP may raise the cash to repay the Pershing Square Bridge Notes is to exercise its Put Right. New GGP intends to repay the Pershing Square Bridge Notes in cash shortly after the effective date and following completion of this offering. Accordingly, the Put Right will terminate upon repayment of the Pershing Square Bridge Notes.

Bottom line is GGP expects to raise an additional $450M more than what was provided in the original financing from BAM, Fairholme and Pershing (assuming $14 price). Now many folks are going to start screaming “but it is trading at $15.40….why is it less than market prices”. Think about it, this money has already been raised at $10.50, now it is being replaced at $14 (assuming that is the price). This isn’t fresh capital being raised so to speak. Because it is not being raised to pay down debt, expand operations etc, one must expect it to be done at a discount to current prices (at least I did). BUT, it is big win for shareholders.

Remember just a few months ago we were talking about being very happy if they sold more at $12 and everyone was thrilled. Now we get ~$14…..

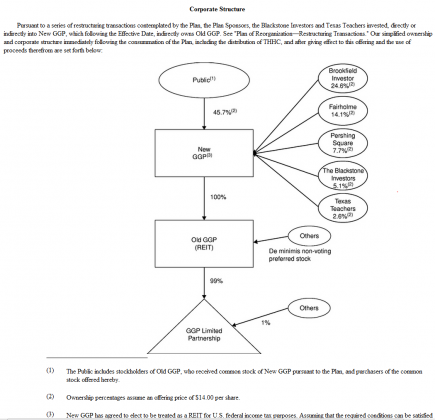

Here is the new structure post offering:

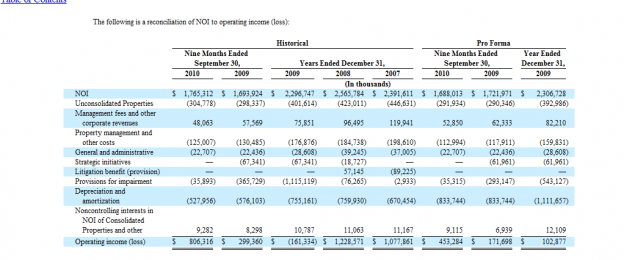

Here are financials with a WARNING FOLLOWING:

The pro forma condensed consolidated financial information is presented for illustrative purposes only and is not necessarily indicative of the results of operations or financial position that would have actually been reported had the transactions reflected in the pro forma adjustments occurred on January 1, 2009, on January 1, 2010 or as of September 30, 2010, respectively, nor is it indicative of our future results of operations or financial position. In addition, Old GGP’s historical financial statements will not be comparable to New GGP’s financial statements following emergence from bankruptcy due to the effects of the consummation of the Plan as well as adjustments for the effects of the application of the acquisition method of accounting.

The reasoning for putting the financials up is to give a decent idea of YOY operating performance. Actual #’s will change once the full effects of Chapter 11 are accounted for. Because it should all shake out in Q4, Q1 2011 should be clean.

One reply on “$$ GGP Files Offering, Expects to Sell at $14 & Replace $10.50 Funding”

[…] This post was mentioned on Twitter by Todd Sullivan, vlad0. vlad0 said: RT @ToddSullivan: $$ GGP Files Offering, Expects to Sell at $14 & Replace $10.50 Funding http://bit.ly/aZ929Y […]