We’ll break this down….

Shares of shopping mall REIT General Growth Properties (GGP) are down 77 cents, or 5%, after the company last night priced a common stock offering below the day’s closing price, washing out anyone who’d ridden the shares up and up since the company came out of bankruptcy on November 9th.

Some, of course, made money on the offering, including Pershing Square Capital Management and Fairholme Funds, two of the equity investors who helped recapitalize GGP, and who got into the stock at a substantially lower cost basis, on the order of around $10. They also still hold deep-in-the-money warrants on the stock at conversion prices of $10.25 to $10.50.

But for anyone who’s not in on the ground floor like that, the offering seems pricey, opines Credit Suisse analyst Andrew Rosivach, who has a Neutral rating on GGP shares, and thinks shares of Taubman Centers (TCO), the Bloomfield Hills, Michigan, owner of regional malls, might be a better bet.

“Ground floor”? Let’s not forget when Pershing and Fairholme made their offer in conjunction with Brookfield Asset, they were at the time the “high bidder”. They topped a $10 a share offer from Simon with a $15 offer (for the combined GGP/HHC) and set the high price for the stock. They actually got their stock at year highs at the time and investors who bought in the days leading up to the official announcement of the deal actually have a lower cost basis for the combined entities. The insinuation that BAM, Pershing & Fairholme somehow got favorable pricing has no merit.

One reason for the run-up into yesterday’s offering: GGP effectively created a short-squeeze, says Rosivach, by offering fewer shares than originally anticipated. They originally told the street they would offer more than 200 million shares, then backed down to 155 million shares, sending investors scrambling for shares.

This is backwards also….GGP only reduced the number of share because demand for them was so strong. GGP committed to raise “x” amount of money. not sell “x” number of shares in accordance with the plan of reorganization. Because demand for them was so strong, they did not need to issue as many.

The question, says Rosivach, is how many investors who got in last week are long-term investors, how many planned to flip the shares, and how many are simply index investors who are buying GGP because they are anticipating its inclusion in the REIT indices next month?

Rosivach knows that he hasn’t heard enough from GGP about what the future will look like. It seems odd, he notes, that GGP has not disclosed any projections for 2011’s expected funds from operations.

“This is really a quasi-IPO for this stock,” observes Rosivach, “For a company emerging from bankruptcy not to give projections for what we can expect, that seems unusual.”

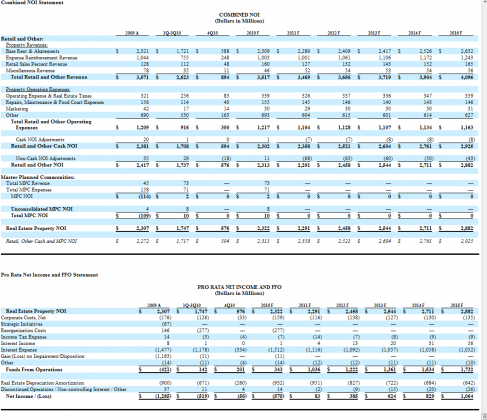

This is mystifying. One of the requirements for a company exiting Chapter 11 is that they provide these very projections to affirm the assumed outcome of the proposed plan or reorganization. Now, these are not numbers intended for an investment decision and are not “certified” but are simply for the feasibility of the plan. But, with a little work, one can come to some conclusions. With that said, here they are:

Here is the full filing GGP 8K 11/1/2010 (click to open .pdf). It is long and the projections are near the end. You’d have to go through the whole thing to find them I guess?

Here is a link to the GGP road show for the new shares. The road show, if you watch it lays out what is coming, it doesn’t “spell it out” but does lay it out. A little work required…..

Taubman and other peers of GGP, such as Simon Property Group (SPG), have pulled back of late, even as GGP shares climbed in value while the company did a roadshow for the offering.

“A week ago, I thought GGP was fairly priced it was at $14.50,” right after the exit from bankruptcy, says Rosivach. “I thought it made sense then, but then the stock ran as peers fell apart.”

That means that even after today’s dip, GGP is getting about the same valuation as TCO and others, even though there’s less certainty as to what its earnings will be. Both GGP and TCO have an implied cap rate of about 6.4%, according to Rosivach’s data, slightly ahead of the implied cap rate for most U.S. REITs, and TCO’s funds from operation multiple of 15.8 times is just a tad above the 15.5 times that GGP fetches.

OK…..Let’s discuss.

Using current NOI and FFO number for GGP in making a valuation make no sense. Why? The numbers are depressed from being in the Chapter 11 process for 18 months. Also, comparing Taubman and GGP together isn’t really a valid comp. GGP has a national footprint and Taubman for lack of a beter word is a local operation. They do have very high quality malls, just on a far smaller footprint (TCO has 80M sft vs GGP’s 200M sft.). SPG and GGP are the comps. On that level, GGP is not valued as well as SPG and if you take into consideration the improvement that is sure to come, the valuation gap becomes even larger meaning GGP still has room to go. Investors looking at GGP understand that results will improve next year (assuming no double dip which would affect the whole sector, just consistent economic growth) simply from no longer being in Chapter 11.

In Chapter 11 GGP was able to maintain their malls (fix leaks, plumbing etc). What they could not do is invest substantial sums to improve them (build new wings, material upgrades etc.) or expand operations. This put GGP at a competitive disadvantage when dealing with retailers in areas where they had competition.

Now out of 11, they can expand promotional activity to draw traffic to their malls, have increased leverage with retailers, are able to increase cap ex to improve existing locations, enter JV’s and even make an acquisition or two. Investors looking at results today are seeing the bottom of what they will be. If you watch the road show, GGP laid out how debt reduction, increased occupancy and leasing rates are going to materially add to NOI.

So, doing a little work, one just has to take current numbers and do some addition. I think those that have have been the buyers as of late…

There has been a TON of erroneous analysis on GGP since Day 1 in April 2009. It won’t stop now just because they are out of Chapter 11.