Davidson submits:

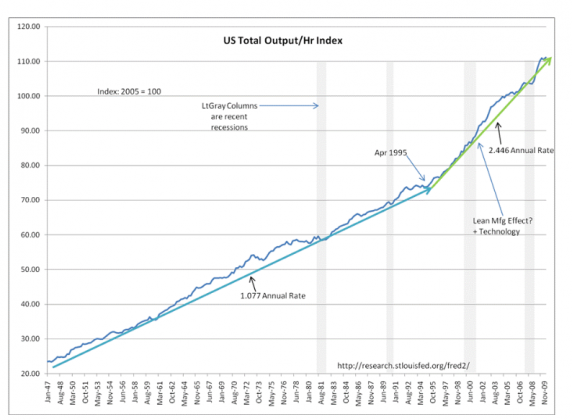

If one is looking at month to month trends, one can lose track of the much larger significant market drivers. A signicant economid driver in my opinion is shown by the US Total Output/Hr Index(2005 = 100). The US Output/Hr Index, a productivity based index, began Jan 1947as one of the measures begun during WWII. US Total Output/Hr reveals a dramatic improvement beginning April 1995-see chart. One cannot assert a definative conclusion as to specific causes and effects unless one studies the causality behind this change in detail, but my discussions with various CEOs who are responsible for producing this dramatic improvement in their own productivity tell me it is their use of technology within the context of applying Lean Mfg techniques. There are multiple acronyms for the various new approaches for which many credit Toyoya and its “Toyota Way” as the major stimulus. Some of these are “Just In Time” (JIT), 6-Sigma, “Time Based Competition” (TBC), “Time Based Manufacturing” (TBM) and “Quick Response Manffacturing” (QRM). When one learns in detail what is being done at each company, it quickly becomes apparent that no single template can be applied to all businesses. Each company is unique and each which has begun a Lean Mfg program has found it best to develop its own “flavor”.

Danaher calls their process the Danaher Business System (DBS). Caterpillar calls their process the Caterpillar Production System (CPS). Carlisle Coompanies refers to their approach as the Carlisle Operating System (COS). The sharp rise in US Output/Hr Index is a measure of this improvement which has been the result of Lean Mfg concepts gaining wider and wider acceptance. The rate of US Total Output/Hr has more than doubled since April 1995. It is likely that it may have even been responsible for companies finding themselves with excess labor in 2005-2007 as productivity soared and then found it necessary to shed employees in 2008-2009. But, the sharp recovery in production with fewer employees since June 2009, has impoved the US global trade position and I would expect it to continue. This should result in more jobs in the US in future months and years.

Net/Net:

- Lean Mfg results in Doubling/Tripling Production w/ ½ Space, ½ employees, w/ much higher quality, w/ 80%-90% reduction in employee reportable accidents, w/ significant incentive compensation increases and benefits which all lead to significant improvement in corporate profitability and global competiveness.

- Lean Mfg directly leads to higher global sales and most importantly the recapture of jobs formally outsourced to countries with much cheaper labor costs.

- Companies that embrace Lean Mfg have shown substantial improvements on Revenue, Market Share, ROE and hiring.

If one listens to the Bullishness/Bearishness as it is reflected in the media chatter there has been a significant shift towards the Bullish side of the table. What this does is that it changes the interpretation of economic data from one of ingnoring the positive to one of ignoring the negative.

Market Psychology is enormously important at all times, but so is knowing when to be a contrarian or when to “go with the flow”. Now it is time to “go with the flow”.

I continue to recommend that the current investment environment is a good time to invest in equities. Most investors in my opinion are not aware of the Lean Mfg effect and its potential to generate significant interest in US equities in particular and economic recovery in general.

2 replies on “US Total Output/Hr Soars”

[…] The unrelenting rise in US manufacturing productivity. (ValuePlays) […]

[…] This post was mentioned on Twitter by Todd Sullivan, Slawabor Henryk' Son. Slawabor Henryk' Son said: US Total Output/Hr Soars Value Plays http://bit.ly/dI4MeW #market #finance #US #equities […]