“Davidson” submits:

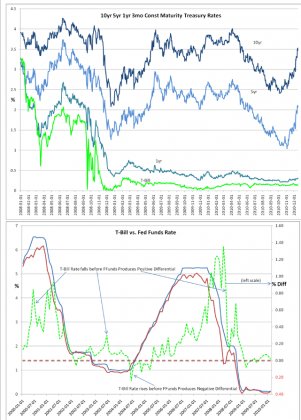

Many have warned that the recent rate rises may hurt the recovery, this is not what historical experience provides the careful observer. Below are two charts. The 1st represents the 10yr 5yr 1yr and 3mo Treasury Rates daily from Jan 2008 to Present. The 2nd is a repeat of an earlier T-Bill vs. Fed Fund Rate history from Jan 2000 to Jun 2010.

Click to enlarge:

Together these charts provide helpful investment insight especially now as 10yr and 5yr Rates are rising and now a worry for many. Rising Rates in historical experience come from investors selling bonds to transfer their capital to better performing asset classes. In the early stages of a recovery this means that capital placed in “Safe Treasuries” is moving to higher return investments elsewhere. The fact that the SP500 is rising tells us that some of this capital is moving into LgCap stocks. Capital can also and is very likely moving into takeovers, business supply chains, inventory and expansion projects, i.e. capital equipment spending. In early 2009 10yr and 5yr rates moved higher as investors became less skeptical and invested in commodities and stocks in the US and globally. In May 2010 there was the fear of a “2nd Dip” and capital returned to the safety of Treasuries. Now, once again capital is returning to stocks, but not as aggressively to commodities. This is not due to Fed action in my estimation, but due to continued positive direction in auto sales, employment, industrial production, exports, personal consumption and importantly the surprising profitability in US corporations. In a recovery economic activity and corporate profits draw capital from the safety of Treasuries to the equity markets.

In a recovery surprising upsurges in economic activity and corporate profits draw capital from the safety of Treasuries to the equity markets.

The 2nd chart reveals that once capital flows out of T-Bills which comes about 2yrs into a recovery, T-Bill rates begin to rise. Only after T-Bill rates rise does the Fed raise the Fed Funds rate. The Fed waits till the recovery has become sustainable which is a GDP level near historical levels before it finally raises rates above the that of the T-Bill. Many believe that the Fed controls rates! The Fed is a follower! The market’s Supply/Demand controls rates-the Fed follows. The same is true when interest rates are falling.

Many believe that the Fed controls rates! The Fed is a follower! The market’s Supply/Demand controls rates! The Fed only follows.

If one is aware of the what controls interest rates, then seeing the current rate rise becomes a positive event for equity investors.

2 replies on “Rising Rate Positive for Equities”

[…] interest rates and the stock market. (ValuePlays, […]

[…] Rising Rate Positive for Equities Value Plays […]