Been getting a ton of questions on Orion and its volatile tax rate. Here is the explanation:

Orion used to grant incentive stock options (ISO’s) up until July 2008. ISO stock compensation expense is not deductible for income taxes until the individual exercises and sells the shares. In the spreadsheet below:

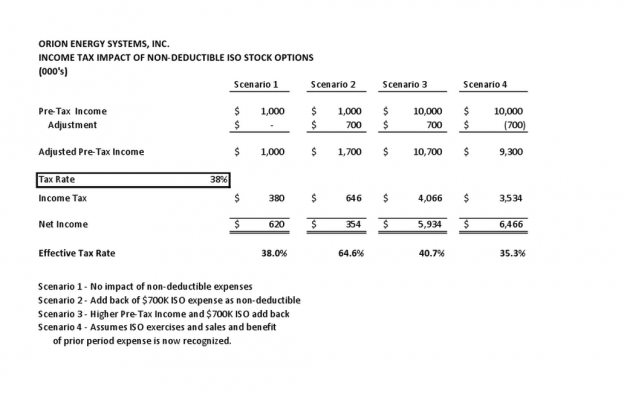

- Scenario 1 demonstrates income tax expense without any adjustment using a blended 38% federal and state rate.

- Scenario 2 now includes the impact of the approximately $700K of non-deductible ISO expense. While pre-tax GAAP income isn’t changed, they essentially record expense on a higher baseline after the add-back. You can see what that does to the effective tax rate.

- Scenario 3 demonstrates that as pre-tax income grows, the impact of the add-back on the tax rate is significantly reduced.

The simple answer is that when pre-tax earnings are relatively small (EPS guidance range from $.01 to $.03), minor shifts in pre-tax income can have very volatile effects on the tax rate. The higher pre-tax income climbs, the more normalized the tax rate becomes.

Orion has a healthy inventory of tax credits and tax assets (pg. 14 and 15 10Q below) to offset the cash flow impact of income tax expense. Also, as the share price rises and they in turn have an increase in option exercises and possible sales, they will receive a benefit to their tax rate in the future (Scenario 4). It is harder to predict the timing on this as the driver is really individual behavior (stock sales). GAAP doesn’t allow them to record any of this future upside until the sale transaction happens. So, we are in a perverse situation. While we do not like to see large inside sales, in effect, the sale of this stock from these options will have a positive effect on EPS as the tax rate will be significantly lower.

I put together a spreadsheet under a few assumptions and how the options effect the tax rate (click to enlarge)