Today’s Case-Schiller came out and it looked bad (did anyone expect it to look good?). Seeing that we are getting positive on RRE (we turned positive on CRE in 2009) lets look into the numbers to see how they may affect some of out holdings.

Howard Hughes own Master planned communities in Las Vegas, Maryland, Houston

Let’s look at the Maryland Communities of Columbia, Emerson and Fairwood. It matter because DC has been the most resilient of the US housing markets and posted an increase in the latest Schiller data.

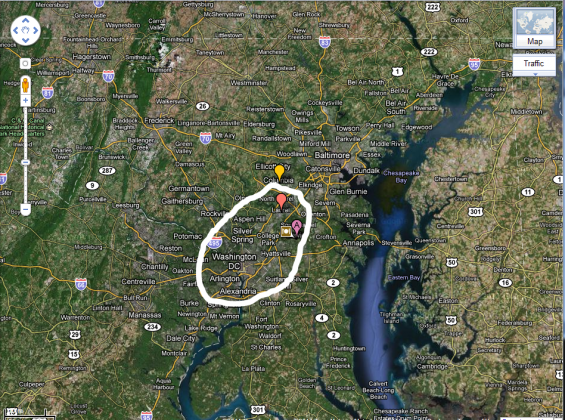

The followng map shows the locations of the HHC communities. The white line is the area used for the DC Case-Shiller market:

HHC has the Fairwood and Emerson communities inside the DC market and its largest community, Columbia lies just outside it.

If we look at the Columbia, MD data:

We can see from March of 2009 prices have stabilized and the trend does seem to be rising. It is clear Columbia is benefiting from its proximity to the DC market. While total sales in the area are down, the price stability does tell us there is supply/demand equilibrium or even that demand (or lack of supply) is slowly driving prices higher. That bodes well as HHC develops the area.

Las Vegas:

It showed one of the smallest “drops” in the Shiller data but lets gets more local information:

We’re down to 14846 available properties. The amazing thing is that this is happening without a home buyers’ tax credit, even though all the major banks have resumed foreclosures. The list of homes to be sold on the “courthouse steps” is still daunting, so this number may not stay low. Unfortunately, the price of available units is down. The number of short sales available and contingent continues to go down, which is probably a good sign (unless of course it means the homes that would be short sales now will be foreclosures by summer!). Closings are up as the end of the month approaches, and may remain elevated through spring and summer. However, seasonal buying patterns have been disrupted by the large number of low price distressed properties available over the last few years.

Also:

There were 3,669 properties sold in Las Vegas-Paradise metropolitan area in January, according to the San Diego-based real estate firm MDA DataQuick. While that was down 20.8 percent from the previous month, it was less than the 24.3 percent drop normally experienced between December and January. In addition, January home sales were up 9.9 percent from a year earlier, when the stimulus of the federal homebuyer tax credit coupled with low home prices and encouraged many consumers into relocating to the city.

Prices today are even lower than they were a year ago, down 6.2 percent from January 2010, said the report. That’s encouraged large numbers of investors and all-cash buyers to enter the market. Absentee buyers – mainly investors – made up 49.2 percent of all Las Vegas home sales last month, while all-cash purchases made up 54.5 percent – the highest percentage recorded since the company began tracking the data in 1994.

With home prices so low, relocating families around the country are beginning to purchase new homes with cash more often. According to the National Association of Realtors, 23 percent of national home sales in January were cash transactions.

Next comes Houston and HHC’s Bridgeland and Woodland’s communities:

Following is the most recent Houston MLS Report, covering Houston homes for sale, originally published by the Houston Association of Realtors, covering data from January 2011.

Despite the bone-chilling winter weather, Houston’s housing market heated up in January, recording the first increase in property sales since June 2010.

Pricing also heated up in the first month of the new year, with the average price of single-family homes reaching the highest level ever for a January in Houston.

January sales of single-family homes throughout the Houston market rose 7.5 percent when compared to January 2010, according to the latest monthly data compiled by the Houston Association of REALTORS® (HAR).

Positive activity was recorded in all segments of the housing market, with the sharpest increases in sales volume taking place at opposite ends of the pricing spectrum.

Luxury home sales helped propel the average price of a single-family home, which increased 2.2 percent from January to $196,879.

The January single-family home median price—the figure at which half of the homes sold for more and half sold for less—dipped 3.2 percent from one year earlier to $139,000, due to hefty sales volume among homes priced at $80,000 and below.

Foreclosure property sales reported in the Multiple Listing Service (MLS) declined 4.7 percent in January compared to one year earlier.

Foreclosures comprised 24.7 percent of all property sales in January, down from the 26.7 percent share they held at the beginning of 2010. The median price of January foreclosures fell 4.0 percent to $80,600 on a year-over-year basis.

January sales of all property types in Houston totaled 3,413, up 9.5 percent compared to January 2010.

Total dollar volume for properties sold during the month was $643 million versus $574 million one year earlier, representing an 11.9 percent gain.

Additionally

Another positive prediction for Houston came from Mike Inselmann, president of Metrostudy research firm, last month. Speaking of the local homebuilding market, he said he believes it has hit its bottom and is on an upswing. After a flat couple of years, Inselmann predicted increases in home starts between 1.3 to 6.6% over 2010. And while he noted that it’s hard to call a little over 1% growth a recovery, again it’s all in the perspective. “We’re at the bottom,” he said. “Most non-Texas markets are still searching for the bottom.”

So what’s helping make Houston’s future brighter? As Alex Villacorta, senior statistician at Clear Capital states, “Understanding which path a given market is likely to follow is dependent on several key factors, but the two clear drivers are local unemployment rates and the prevalence of distressed homes.” Houston’s percentage of homes sold as foreclosures is around the national average of 26%, but it had a year-over-year drop in January of 2%, a positive sign. And as for jobs, economic forecasts are predicting over 18,000 new jobs this year for Houston.

With jobs, of course, come people. Allied Van Lines’ annual moving survey listed Texas as the state with the most net relocation gains (i.e. more people moving in than moving out), a title our state has held for the last 6 years. And people need homes. As Inselmann pointed out, 15,000 apartment units were absorbed in 2010, leading to higher demand this year. Higher demand generally leads to higher rent, and higher rent will send some renters into the homebuying market.

Some of these predictions seem to coming to pass. The Houston Association of Realtors’ market report showed that total home sales rose in January for the first time in seven months. Additionally, average home prices increased 2.2%, continuing an upward trend that began in mid-2010. A single-family home’s average selling price was $196,879, the highest on record for a January in Houston. While much of the price increases are attributable to gains in the luxury home market, the $150,000-250,000 market segment also saw growth starting in December, its first uptick since last May. In fact, all home markets saw increases last month, and while we’ll need to see a few more months of growth before calling it a trend, Houston’s market certainly started 2011 on a positive note.

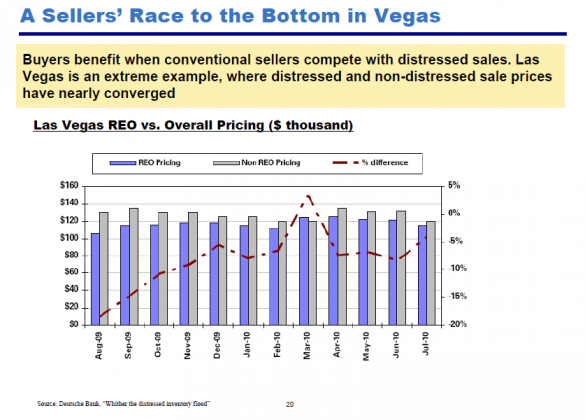

So what does it all mean? It mean in owning shares of HHC, you are getting exposure the RRE in two very strong markets in both the DC area and Houston. We are also getting exposure to the Las Vegas market. We have said for some time now that the pricing gap in Vegas between bank owned RE and for sale real estate, being as small as it was would help expedite the bottoming process (see below)

If we look into the data now we see inventories falling and sales increasing for the first time in a while. That tells us the trends are starting to go in the right direction. This is further illustrated even by the YOY price decline for Vegas being right in the middle of the 20 city Shiller index now vs 2009-10 data. Given that Vegas suffered from the most excess in the bubble, the fact they came down so hard so fast and now seem to have leveled off and is attracting interested buyers, it is positive news.

This of course ignores all the CRE HHC owns in Vegas, Hawaii and NYC. You can view the whole list here. I like having exposure to housing in both the DC and Houston market through HHC and like even better the exposure we have to premium developments in Vegas. We have covered the CRE they have in other blog posts and its potential.

Bottom line we feel this is just real cheap…..