Short answer? There are millions more shoppers in the US every year and for 2010 and 2011, the amount of retail space added to accommodate them will is at the lowest levels…….ever recorded.

From Retail Traffic. If you invest in retail stocks, this needs to be a publication on your regular reading list.

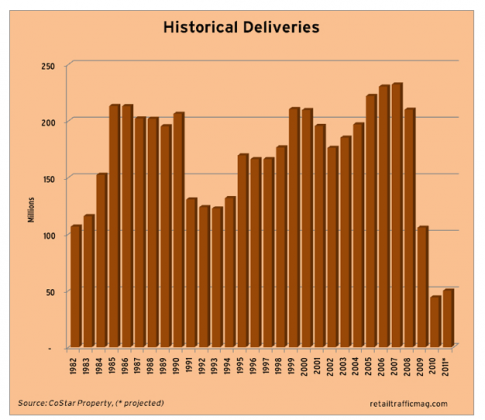

According to the CoStar Group, a Washington, D.C.-based research firm, last year’s retail delivery pipeline represents the lowest figure the firm has on record for the industry going back to 1958.

Moreover, retail construction starts in 2010 totaled approximately 23 million square feet—one of the lowest years on record and the fourth straight year the figure fell. In fact, the full year figure for construction starts in 2010 was lower than in any single quarter in 2006 or 2007. Even with the seeming burst of new announcements in early 2011, experts predict the high unemployment rate and stringent lending criteria will continue to give most developers pause.

As a result, as 2011 unfolds, the number of new starts will likely end up being the same or lower than in 2010, says Chris Macke, senior real estate strategist with CoStar. And the amount of retail space delivered—including single-tenant construction—will be about 50 million square feet, according to Marcus & Millichap.

- Retail real estate developers delivered approximately 45 million square feet of space in 2010—the lowest amount CoStar has ever recorded.

- Projections are that the industry will deliver about 50 million square feet in 2011.

- The amount of space delivered in 2010 was half as much as 2009 and less than 20 percent of the total delivered in 2007, when 232 million square feet of space came on line.

- Retail construction starts in 2010 totaled approximately 23 million square feet—one of the lowest years on record and the fourth straight year the figure fell. In fact, the full year figure for construction starts in 2010 was lower than in any single quarter in 2006 or 2007.

Source: CoStar Group

As the recovery continues and retailer continue their expansion, available space will shrink, rapidly. We have already had 7 straight quarters of net space absorption and that shows no sign of slowing down. The major mall owners like Simon ($SPG) and GGP ($GGP) will naturally be the main beneficiaries of this trend as they hold the most high quality space in America.

Of the two we clearly like GGP better at current valuations we feel there is considerably more upside to GGP.

Patience is need as this trend will unfold over the next few years, not weeks or months.