In a word? Yes.

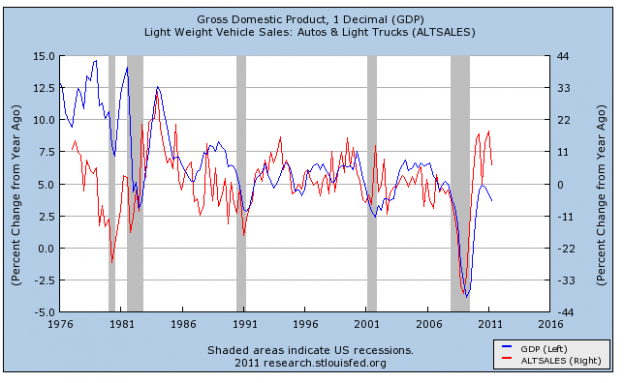

Here is a nifty chart from the St. Louis Fed. Lt. truck /auto sales and GDP, both in YOY % change. Recession areas are shaded

You’ll note that each recession coincided with auto sales going negative on a YOY basis (the auto data only goes back to ’76).

So, what do we have here in the US? We have $F expanding capacity (and hiring) at US plants due to demand, we have news today that Audi is undergoing a large expansion to meet US export demand:

“We’re extremely busy at the moment and have every reason to believe this uptrend will continue for some time, certainly through next year,” Albrecht Reimold, head of the carmaker’s factory in Neckarsulm, Germany, said in a telephone interview.

Audi’s second-biggest plant, where its 111,100-euro R8 sports car and the 48,900-euro A7 four-door coupe are built, is running extra shifts after adding about 500 workers this year, said Reimold. He expects output to jump 21 percent to a record 260,000 vehicles in 2011.

The busy assembly lines at the plant in southwest Germany are part of broader expansion at the Volkswagen AG (VOW) unit, which is adding capacity in Spain and boosting production in China. Audi, Bayerische Motoren Werke AG (BMW) and Daimler AG (DAI)’s Mercedes-Benz are adding shifts, shortening breaks and building new factories, even after economic gloom caused the Stoxx Europe 600 Index to tumble 23 percent from its February peak.

“We’re aware of expectations that conditions may change to the worse, but we trust our own forecasts suggesting that things will stay good,” Reimold said in the Aug. 17 interview from the plant, which employs 14,000 people.

Targeting Records

BMW, Audi and Mercedes, the world’s three largest makers of upscale cars, are targeting record deliveries this year, boosted by growing wealth in China and a rebound in spending in the U.S. after the recession.

2010 auto sales were 11.5M units, up from 10.5M in 2009. Even the most pessimistic projection for the remainder of 2011 (8.5 months in) are for 11.8 to 12M units. Edmunds, as recently as last week said they expect 13M units for 2011, a 13% increase over 2010 (at the end of July, US sales were 11% ahead of 2010). Even that number is artificially low as the Japan disaster hindered auto sales for all makers due to parts shortages throughout the spring. IMO, this is the main reason for the lower than expected Q2 GDP numbers, the “experts” underestimated the effect of the tsunami.

Chrysler has seen a ~35% US production increase through July of 2011 and has given no indications it intends to slow that pace down for the remainder of the year. GM reports a similar story.

Yes, SAAR declined this summer (as it usually does) but expect that to come back now that $HMC and $TM are seeing assembly lines return to normal levels. Those consumers who have been waiting for those vehicles, will nowe able to buy them.

It is also worth noting that auto sales are a leading, not a trailing indicator. They fall before GDP does and rise before it does coming out of recessions. So, based on what we expect for the remainder of 2011, one would have to discount the double sip scenario even beginning much less coming to fruition barring a massive shock to the system.

Now, I have to condition every post to say I am not a raging bull here either. I have been saying for months I expect slow, anemic growth, but growth non the less for 2011. People love to call you either a bull or a bear and I have to say I am neither. I don’t see 1% to 2% GDP a “bullish” forecast, more “moderate”?

IF I am going to lean negative, I need to see a sharp decline in auto sales, a sharp decline in rail shipments and some of the other core data points we follow turn south also. So far, we have seen none of that happening and in fact all continue to increase, albeit stubbornly.

One reply on “Do Rising Auto Sales Discount Double Dip Scenario?”

[…] Todd Sullivan: Do Rising Auto Sales Discount Double Dip Scenario? […]