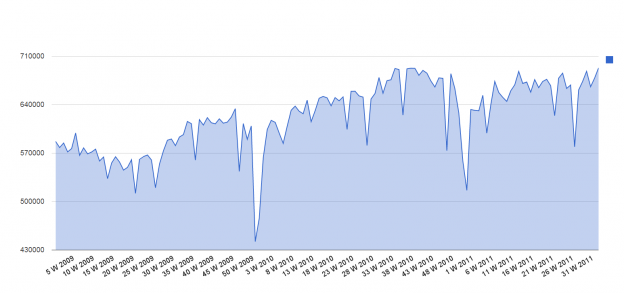

As rail traffic meandered along for the past several week (not unusual for July) we have been saying here we needed to see a move above 690K-700k cars (at/above last years highest levels) to confirm both our growth thesis for the US economy and further dampen double dip fears. Had we seen continued flat lining of the data or a downturn in it, we would begin to become very concerned.

Well, last week we got good news. Total N. American rail traffic jump 28k cars to 692K. Now, remember, this is in the face of what everyone has been saying was a “major slowdown” in economic activity in August (week 33 ending 8/20). This rail traffic defies those claims. When you consider that Mexican and Canadian traffic was essentially flat (Canada up a bit Mexico down a bit) we are left with virtually all of the gain being US.

All US carriers saw gains with $UNP and BNI ($BRK) showing the largest of them. As for “what” was being moved, by far auto saw the largest % gains (near 10%) followed by metals (6%).

Here is the chart: