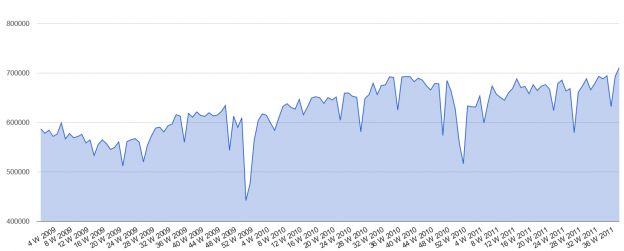

This is wonderful news. For some time now I have been saying that to be more positive on Q4, we needed to see rail traffic pass the magic 700k level. Last week we got our wish as total N. American rail traffic hit 711k cars. This trend, should it continue would push us from what has been a “cautiously optimist” stance to more of a “very optimistic” one (for lack of a better term).

Going forward, we should peak in the next week or so before gradually sliding into the Holiday’s (2009 has a week 43 peak but that was with the economy coming off the very low summer lows). Increased optimism will come from stubbornly high/increasing traffic data and increased worry will come if the date simply begins to race downhill (note: it always does during holiday weeks so ignore them). “Race downhill” would be defined as >5% drop between now and Turkey Day.

As for the data intermodal traffic hit the highest level in the 3yr data series, auto’s hit the 2nd highest level since Q1 2010 which was the highest level in the 3 yrs and both metals and stone & related products came within a hair of having the highest total in the three years. These are huge reading as they are base level fundamental indicators. The US has not had a recession with an expanding auto industry and metals and stone go to construction/manufacturing activity.

As for the carriers, $KSU was flat while both $BNI ($BRK.A) and $UNP saw largest % gains.

One reply on “Rail Traffic Passes Important Level”

[…] Rail traffic continues higher. (ValuePlays) […]