“Davidson” submits:

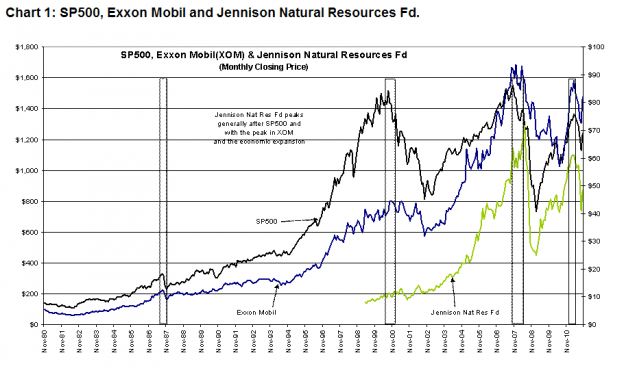

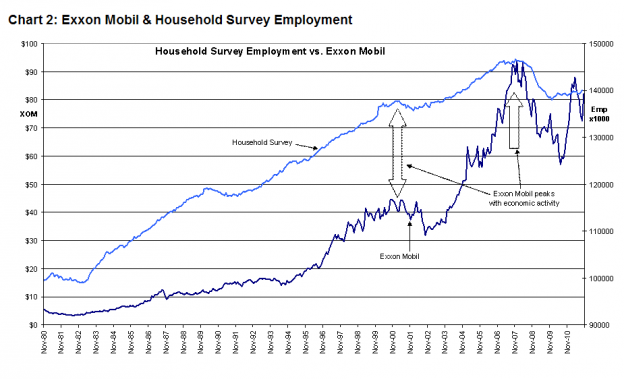

With Natural Resources seemingly reversing their quite high prices one might wonder why not sell this asset class? The longer view holds the answer. In Chart 1 below I have the price histories of the SP500, Exxon Mobil ($XOM) and Jennison Natural Resource Fd (one of the favored natural resource managers). Jennison’s price history begins May 1999. In Chart 2 I have Exxon Mobil and the Household Survey Employment my proxy for economic activity.

One should be able to see in Chart 1 that Exxon Mobil and Jennison peak generally later in the economic/market cycle vs. SP500. This is due to inflation fears which often occur late in most economic cycles as the economy runs above the long term trend of ~3% Real GDP. Our current environment is decidedly still early in the economic cycle as one can see from Chart 2 with the Household Survey well below earlier levels which cause excess economic activity. I anticipate that more is yet to come for Jennison and other Natural Resource managers and historically this occurs through expanded economic demand for commodities rather than the short term financial demand caused by traders anticipating the “end of the world”.

My view is that we have just finished a period of excessive fear in which many investors especially hedge fund managers used the ultra low interest rate environment to bid commodity prices to extreme levels because many believed that the US and other countries would inflate their way out of the financial crisis of excess leverage the past 15yrs. This was the long-commodity/short-currency carry trade I have often mentioned in earlier comments. The problem with this thinking is that if all countries try to do this at the same time then no country can inflate vs. other countries to create a more favorable position. In other words, if every one does it, no one gains. This leaves all countries having to work through their individual problems taking appropriate steps not to “beggar thy neighbors”. The US did this and now it appears that the EU is headed in a similar direction. Economic activity continues to recover. Time is a terrific healing agent!!

The current economic situation is one of gradual recovery with employment as my major proxy for economic activity still well below long term trends. Historically, employment needs to move to excess before markets are fully valued and various economies are pushing their limits. We have a long way to go yet in this process.

Even though it seems that we are very far off the March 2009 lows, employment still has a substantial period of gain ahead in my estimation. Housing and construction employment has been the laggard sector of the economy as financial institutions have been regulated to raise Tier 1 capital. Banks have not been generous lenders and housing reflects this. Once banks reach Tier 1 benchmarks, lending for construction should begin to flow and those who have been so long unemployed should find opportunities improving.

The “end of the world” is gradually easing in my opinion and the economic justification for including Natural resources as an asset class is returning with the EU announcements of this morning.