The first two high-flyers got some “valuation religion” in a fast way recently. I am going short $CRM for the same reason. Now, my distaste over the company is nothing new, I wrote about it in the past. With earnings coming out this week even a good quarter can’t save the rest of 2011 for them.

Here are the previous posts on it, here and here. Nothing has changed for the company since then other than a deal for Assistly ($50M). The company is still losing money on a GAAP basis, insiders still sell shares as fast as they get them and the company has still made the switch from reporting GAAP EPS to reporting “non GAAP” because well, that’s the only way they can show a profit that way and it still trades at over $120/share.

Regarding stock comp:

Stock-Based Awards. We recognize the fair value of our stock awards on a straight-line basis over the requisite service period of the award which is the vesting term of generally four years.

We recognized stock-based expense of $102.2 million during the six months ended July 31, 2011. The requirement to expense stock-based awards will continue to materially reduce our reported results of operations. As of July 31, 2011, we had an aggregate of $582.6 million of stock compensation remaining to be amortized to expense over the remaining requisite service period of the underlying awards. We currently expect this stock compensation balance to be amortized as follows: $114.0 million during the remaining six months of fiscal 2012; $193.3 million during fiscal 2013; $163.2 million during fiscal 2014; $106.0 million during fiscal 2015 and $6.1 million during fiscal 2016. These amounts reflect only outstanding stock awards as of July 31, 2011 and assume no forfeiture activity. We expect to continue to issue stock-based awards to our employees in future periods, which will increase the stock compensation amortization in such future periods.We recognize as an operating expense the payroll and social tax costs, as applicable by jurisdiction, when stock options are exercised. The impact of stock-based expense in the future is dependent upon, among other things, the timing of when we hire additional employees, the effect of long-term incentive strategies involving stock awards in order to continue to attract and retain employees, the total number of stock awards granted, the fair value of the stock awards at the time of grant, changes in estimated forfeiture assumption rates and the tax benefit that we may or may not receive from stock-based expenses. Additionally, we are required to use an option-pricing model to determine the fair value of stock option awards. This determination of fair value is affected by our stock price as well as assumptions regarding a number of highly complex and subjective variables. These variables include, but are not limited to, our expected stock price volatility over the term of the awards.

As of July 31, 2011, there were 3.2 million restricted stock awards and units outstanding. We plan to continue awarding restricted stock to our employees in the future. The restricted stock, which upon vesting entitles the holder to one share of common stock for each restricted stock, has an exercise price of $0.001 per share, which is equal to the par value of our common stock, and vests over four years. The fair value of the restricted stock is based on our closing stock price on the date of grant, and compensation expense, net of estimated forfeitures, is recognized on a straight-line basis over the vesting period.

$3.2 additional shares comes to $400M of more stock comp expense in ADDITION to what is issued from here on out which, according to the company: “These charges have been significant in the past and we expect that they will increase as we hire more employees and seek to retain existing employees.” (Q2 10Q pg 35)

But wait, there’s more….

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable subscription contracts with customers and consist of sales commissions paid to the Company’s direct sales force.The commissions are deferred and amortized over the non-cancelable terms of the related customer contracts, which are typically 12 to 24 months. The commission payments are paid in full the month after the customer’s service commences. The deferred commission amounts are recoverable through the future revenue streams under the non-cancelable customer contracts. The Company believes this is the preferable method of accounting as the commission charges are so closely related to the revenue from the non-cancelable customer contracts that they should be recorded as an asset and charged to expense over the same period that the subscription revenue is recognized. Amortization of deferred commissions is included in marketing and sales expense in the accompanying condensed consolidated statements of operations.

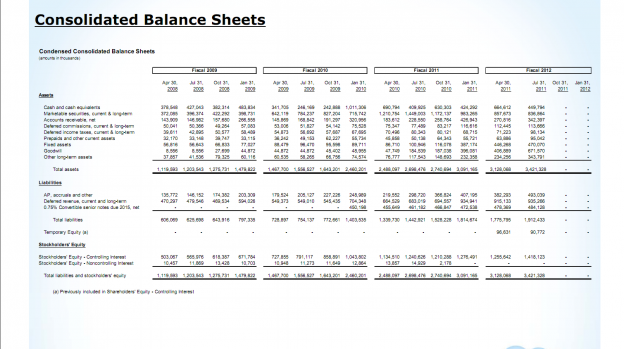

This is more hiding the true employee compensation costs. A customers signs an 24 month contract. $CRM pays the employees commission in full, yet they account for that payment over the full 24 months of the contract. In other words, in a 24 month contract, in each quarter $CRM will account for 1/8 of the full bonus it already paid. So, how much is this amounting to? As of July 31st, $131M is recognized as “accrued compensation” (10Q pg. 22). This is sneaky because it takes an expense paid, and moves it from the income statement to the balance sheet. $CRM is amortizing only $24M of that a quarter (up from $19M last year) as an actual expense despite the fact they have already paid it out (slide 3 below). Why does that matter? If they expensed the whole $130M this year (like they should) we would have to add ($.97) to this years GAAP losses ($131M/135M shares) meaning the $(.09) to ($.11) loss guidance would be revised to ($1.06) to ($1.08) loss. More than a little difference……and not standard procedure in the industry. You have to read the 10Q to find it as you’ll see the balance sheet they provide below conveniently lumps all liabilities into 1 line (slide 2)

But wait, there is still more….

Capitalized internal-use software amortization expense totaled $3.8 million and $3.2 million for the three months ended July 31, 2011 and 2010, respectively. Acquired developed technology amortization expense totaled $17.1 million and $3.9 million for the three months ended July 31, 2011 and 2010, respectively.

So, when $CRM develops software, rather than expensing that cost when it is incurred as is the industry norm, they again move the expense to the balance sheet and amortize it drip by drip to improve near term results (10Q pg21). As of July 31, $CRM had $198M of “capitalized costs” on the balance sheet that are in reality current expenses and took a total of….drumroll…. $20.9M of actual expenses in Q2. Again, $198M in unrecognized expenses comes to ($1.46) more in costs the company is putting off into the future.

And still more……

Market Risk and Market Interest Risk

In January 2010, we issued at par value $575.0 million of 0.75% Notes. Holders may convert their Notes prior to maturity upon the occurrence of certain circumstances. Upon conversion, we would pay the holder an amount of cash equal to the principal amount of the Notes. Amounts in excess of the principal amount, if any, may be paid in cash or stock at our option. Concurrent with the issuance of the Notes, we entered into separate note hedging transactions and the sale of warrants. These separate transactions were completed to reduce the potential economic dilution from the conversion of the Notes.

For 20 trading days during the 30 consecutive trading days ended July 31, 2011, our common stock traded at a price exceeding 130 percent of the conversion price of $85.36 per share applicable to the Notes. Accordingly, based on the terms of the Notes, the Notes were convertible at the option of the holder as of July 31, 2011 and are convertible at the holders’ option for the quarter ending October 31, 2011. Upon conversion of any Notes, we will deliver cash up to the principal amount of the Notes and, with respect to any excess conversion value greater than the principal amount of the Notes, shares of our common stock, cash or a combination of both.

What does it mean? $CRM, currently could be forced to convert the $575M note to 6.7M more shares of stock AND, since the conversion parameters have been tripped, $40/share more on those shares ($575M/$85/share conversion). That will add an additional $270M in cash drain OR stock dilution depending on how they pay it above the $575M (at today’s price). Think about that, in 2010 they issued the noted paying .75% interest but will end up paying back and additional >50% of the amount borrowed. Shit, Vinny the loan shark doesn’t charge that kind of vig.

This too is classified as a liability on the balance sheet that will become a very real expense.

What is even worse? Rather than pay the cash and have to expense it all at once, $CRM will pay it in shares and add them “stock comp expense” or “capitalized interest cost” it and then omit that very real expense from their “non GAAP” results they will report to investors if stock comp or recognize it in drips if the capitalize it……Shady at best.

*Note: $CRM has not said this is what they will do but given past and current actions, anything other than this would be shocking.

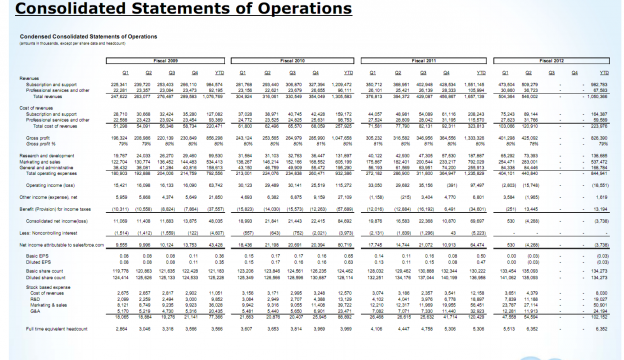

The company is also losing efficiency. Gross profit YTD is 79%, (slide 1) the first time is has dipped below 80% since the Q1 & Q2 2009 just post Lehman. That looks to continue to fall. While revenues are up dramatically in FY 2012 for the 1st 6mos, expenses are outstripping that rise causing a $63M operating profit to become a ($19M) loss. Basically $CRM is selling dollar bills for $.90, losing money on each transaction and standing up and yelling “look how many dollars I am selling!!”

Remember, while the reported loss here does include stock based comp, is does NOT include the games they are playing with commission expense and “capitalized software” expense. IF those expenses were accounted for like the rest of the software industry does, the losses above would be over $100M.

Slide 1

So, why do all this then? Easy…… IBGYBG (I’ll be gone you’ll be gone). Eventually, the $CRM revenue rise has to slow. $ORCL is getting into the game in a much larger way with its recent purchase of Right Now and $MSFT is making a push. That will both put pressure on sales and margins. Law of large numbers says $CRM’s growth HAS to slow. The problem for them they are adding costs to those future periods through VERY aggressive accounting. So while we will see a slowing of sales or sales at lower price points compressing margins, there is still a steady stream of costs that will continue to hit the bottom line also.

For a company that is not profitable now, that is a very bad mixture.

But what do current execs care? They are all cashing in stock as soon as they get it so doing anything and pressing accounting rules to prop up the stock price now for them makes sense. They cash in 10’s of millions of dollars worth and walk away when the music stops. Not sure if that holds water? CEO Benioff made $900k cash last year and $20M after cashing in stock, CFO Smith made $480k cash and $4.8M after stock, Pres van Veenendaal $394 cash and $4.7M after stock. Pick an officer and the story remains the same. I get the whole “when officers hold shares they do what is best for the stock price” argument. BUT, when the shares are doled out like Halloween candy and sold the second the options vest, this argument falls flat (there are 10.5M ($1.3B worth) shares still outstanding in option grants, 10Q pg 26 and 3M shares of restricted stock ($434M worth)). These aren’t long term holders but folks who want the price to hold up now so they can cash in. They’ll worry about later much later and by then they’ll have plenty of cash so later won’t matter. They certainly aren’t spending a dime of their money buying shares…….but shareholders are for them. Now would be a good time to point out that the company has reserved, in addition to the $13.8M shares already doled out another 21.2M shares for future options and grant to insiders………Think about that, with 135M shares currently outstanding, the additional 35M shares that could be issued would dilute shareholders by 26% (note: this includes possible (almost guaranteed) dilution from the convertible notes issued and discussed above).

In short here the incentive is reversed. Jack up that stock price now anyway possible. IMO that explain the very aggressive accounting detailed above and the sudden switch from GAAP to “non GAAP” EPS reporting as GAAP results have cratered. When does the music stop? I can’t say for sure but it seems like we are hitting an inflection point. When the day comes, due to the fact a company with no GAAP EPS trades at $125/share, it will be swift and dramatic. Just ask shareholders of $GMCR who found out eventually questionable accounting catches up with you and $NFLX shareholders who realized that yea, valuation really does matter……………

Now, I know there are other shorts out there who are short simply on a valuation basis. For me, an insane valuation is not enough just to short. We have seen insane valuations get more insane and more insane over time. There needs to be a reason for for people to stop, take a look and realize that something is amiss. For $NFLX, is was the realization that due to competition and increased content costs the company’s growth and fundamentals were going to slow dramatically. For $GMCR it was Einhorn’s lifting the veil on accounting “issues” that as more people looked at, seemed to make sense. In both cases the stocks were over valued the whole way up but became even more over valued until something happened to make the music stop.

What will it then be for $CRM?

1- Q3 results will disappoint and Q4 outlook, if one is given will not impress

2- Competition is eating into sales growth (like $NFLX) and this is causing dramatic margin compression. It is interesting to note the company blames sales payroll and commissions for this, yet does not account for these commission in the quarter they are paid…….interesting……

3- Despite the very aggressive and very questionable accounting of costs, GAAP results continue to decline dramatically. Were these costs accounted for conservatively, GAAP results would be described as “catering”

4- Even momentum traders who have bid the stock up to these levels are weary of it gauging from the price being stalled. After the $NFLX, $GMCR (previous momentum darlings) collapses, even a whiff of problems at $CRM will have the momentum crowd running for the hills faster than a French Infantry soldier in combat.

5- Low hanging fruit. In last year’s 10k (pg. 20) $CRM as much admitted their only avenue for growth now was much larger accounts:

As more of our sales efforts are targeted at larger enterprise customers, our sales cycle may become more time-consuming and expensive, we may encounter pricing pressure and implementation and customization challenges, and we may have to delay revenue recognition for some complex transactions, all of which could harm our business and operating results.

As we target more of our sales efforts at larger enterprise customers, we will face greater costs, longer sales cycles and less predictability in completing some of our sales. In this market segment, the customer’s decision to use our service may be an enterprise-wide decision and, if so, these types of sales would require us to provide greater levels of education regarding the use and benefits of our service, as well as education regarding privacy and data protection laws and regulations to prospective customers with international operations. In addition, larger customers may demand more customization, integration services and features. As a result of these factors, these sales opportunities may require us to devote greater sales support and professional services resources to individual customers, driving up costs and time required to complete sales and diverting our own sales and professional services resources to a smaller number of larger transactions, while potentially requiring us to delay revenue recognition on some of these transactions until the technical or implementation requirements have been met.

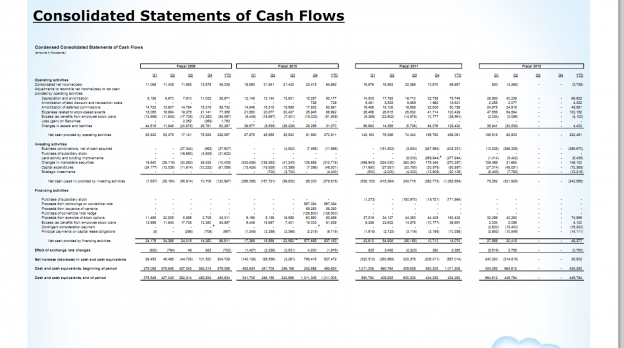

Larger accounts will lengthen the sales process and lower margins as the costs involved with developing larger accounts dwarfs that of smaller one. One also has to assume that $ORCL is going to be targeting these accounts which will add to pressure on $CRM. This goes to what we see in $CRM’s cash position. At the end of Q2 it has fallen from $1.8B to $1.2B (YOY). Now the bulls will point out to the $400M of cash deals the company did last year as a reason for the drain. We would point out that the company also issued $550M of convertible notes (above) so the net/net for the company ought to have been a $100M addition if the sold reason for the drain was the acquisitions. The fact that the cash drain after Q2 was $600M should be concerning especially considering this drain is accelerating as it was $400M after Q1.

From the 10K

We expect marketing and sales costs, which were 48 percent of our total revenues for fiscal 2011 and 46 percent for the same period a year ago, to continue to represent a substantial portion of total revenues in the future as we seek to add and manage more paying subscribers, and build greater brand awareness.

Now remember, the 48% is an artificially low number due to the way $CRM accounts for commissions to its sales people. Deferred commissions stand at $133M as of Q2 v $77M last year.

What if the doubters are wrong? What if $CRM’s strategy works? What would be a fair multiple? 50X earnings? Let say non of the options or grants outstanding are exercise so we’ll keep the shares outstanding at $135M. What does the company need to earn for that 50X earnings multiple at current prices ($125)? Using those number we get to $2.50/share or $337M in net income. That sounds reasonable until you consider that the best year the company ever had was NI of $84M in FY’10. So, to reach a 50X multiple, which is extreme, we need the company to triple its best year for NI at a time when NI, far from growing at a rate that would cause it to triple sometime this decade, is collapsing into losses for this year and most likely next. Remember, all that assumes ZERO dilution from options/grants. If we add those shares in we’ll need the company to achieve NI of $357M. Doubtful

So, what would be fair? Well computer software companies like $MSFT, $ORCL, $CA, $SAP that are profitable all trade at 20X earnings or under. So lets apply that to $CRM. Let’s assume $CRM blow it out next year and has a record year for $NI and earns $143M (would have to use fully diluted shares then). That gives us a cool $1/share in EPS and at a 20X multiple, a $20 stock. Even if we go to 50X earnings we have a share price 60% lower than today and remember, that also assumes the company beats its best ever year for NI by 75%.

For the bullish case “recent acquisitions will boost earnings” camp to bear out, one has to believe $400M in deals are going to have a material affect on a $18B company. Deals of that size help in the margins, they don’t reverse course from a company losing $$ have having record results.

When does reality hit? If not when Q3 results are reported this week (preliminary FY2013 guidance is expected to be given then), then I would think when Q4 results are reported. Citigroup ($C) raised $CRM to a buy from neutral today. The cynic in me says it is the last gasp to jack up the price this week so folks can squeeze some more profit out of it before earnings come out.

$CRM 10Q 7/31/2011

4 replies on “Netflix, Green Mountain…….Is Salesforce.com Next?”

[…] The short case for Salesforce.com ($CRM). (ValuePlays) […]

[…] The short case for Salesforce.com ($ CRM). (ValuePlays) […]

[…] continues this post from earlier this week. Read this first as the reasoning still hold and I don’t want to repeat it […]

[…] continues this post from earlier this week. Read this first as the reasoning still hold and I don’t want to repeat it […]