Was doing some work on $WFC yesterday and came across some interesting information in their most recent investor presentation. The charts below compare $WFC and their performance in several areas to $BAC, $JPM and $C. What is interesting is the relative performance of the banks vs each other and the valuations given to them by the market. Personally, and I think it show that $C is still a bit of a mess trailing the pack in almost ever category. Further, with its global franchise and reliance on it, we also have to keep in mind events overseas will have an out sized effect on $C vs the other three. Because of that, I will ignore $C for the rest of this because as I see it, they are still solid 4th place horse in a four horse race. If you are looking at banks and the EU scares you, $C should be 1st off your list.

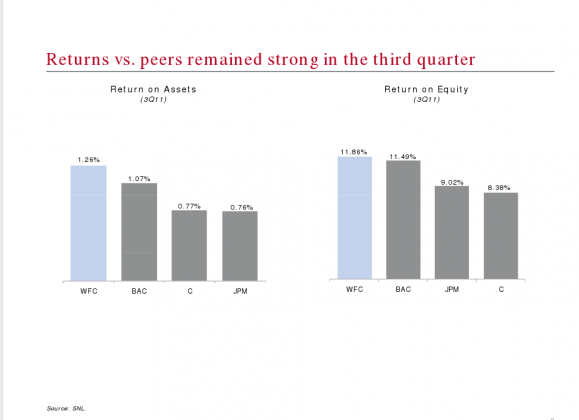

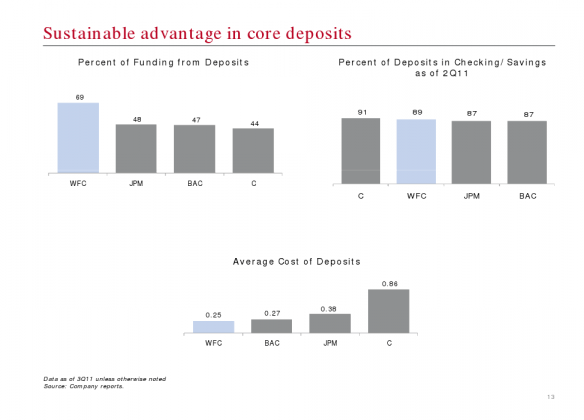

But, when we come to the other three, their performance is rather similar. They tend to switch back and forth between 1st and 3rd and even when in 3rd, the performance of #1 isn’t really that far superior.

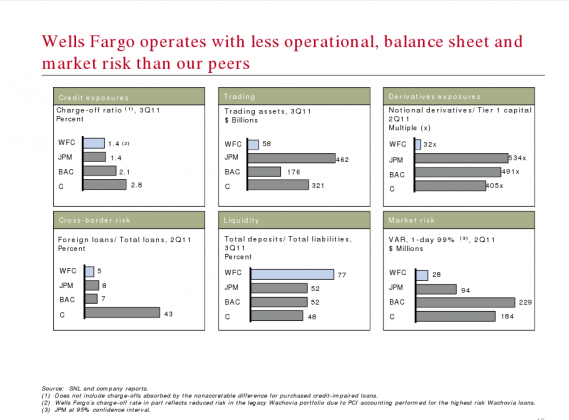

Not included here are leverage ratios. As of 9/30 $JPM = 5.4% $BAC= 7.3% and $WFC = 8.9%. I add this data because $WFC left it off their presentation (prob because they trailed the pack).

Now what gets really interesting is how these banks are all valued. Currently $WFC trades at 1.6X tangible book, $JPM trades at just over 1x tangible book and $BAC trades at just under .5X tangible book (that is “point 5”).

Arguments can be had all day about the “who should get a higher ratio” and the why’s of it. It is worth noting that all three, operationally, are performing relatively similar. I will point out that absolute $$ amounts will vary due to the size of the asset base theses ratios are based off. For instance a bank with $1T in assets vs a bank with $500B in assets will have an absolute higher $ return of assets even if the two banks % return on assets are the same. I am also staying away from the PE measurement as reserve building/releasing will wreck havoc with earnings reporting. Because of that the most stable (comparable) is tangible book value, so that is what I am using.

The question is, does $WFC, who operations are performing similarly to $JPM and $BAC deserves a 50% valuation premium to $JPM and a 200% premium to $BAC. OR, one could ask if the other two deserve the stark discount to $WFC? My two cents is, given the current litigation/regulatory environment, $JPM probably has the most reasonable valuation until that specter clears. $WFC is rarely mentioned as having any litigation risk yet they clearly do. The other end of the spectrum is $BAC who is valued as if they will lose every case against them and be forced to pay the whole amount they are being sued for. Wholly irrational…..For more on securities suits and settlements as a % of losses claimed see this post . For more on $BAC litigation, simply do search on the blog for “$BAC” (use the “$” sign) and read the posts.

Some will immediately say “$BAC has Countrywide issues”…yes, they do. But $WFC has Wachovia issues. John Mack famously said to Tim Geithner when Geithner tried to get Mack to merge with Wachovia “they were writing mortgages with their eyes close over there…….its a shit sandwich”. The point isn’t to claim one is worse, the point is to state all three have ancillary issues. Did $BAC make risky loans? Have they screwed up? Is Countrywide perhaps the worst deal ever? The answer to all three very well may be yes. The point is despite all that, as a bank, they are performing on par with the other two.

No, I am not saying “short $WFC”. Not by a long shot, the big three banks better capitalized now then they were in ’07-’08. What I am saying is that the valuation gap between the banks is due, not to wholly to operational metrics but to litigation perceptions. Perceptions always swing to the extremes and right now that perception of $BAC is more than just a little bit negative. Because of that the litigation risk is being massively overstated thus excessively depressing the stocks valuation.

Does it mean the stock will double in a week or so? No. It does mean that buying here around the $6 level does give you a good MOS as the current price reflects perceptions, not fundamentals. We also know that while perceptions may rule the short term, over time fundamentals will win out when it comes to valuation.

Now, I am hearing rumblings out there that due to $BAC CEO Moynihan saying yesterday that banking has changed and won’t be a profitable as before, investors should not buy the banks “expecting double digit returns”. This line of thinking omits one VERY important little detail. In order for that line of thinking to be accurate, the current valuation of the stocks must be “fairly valued”. Right? If we are going to say “banks will only grow EPS 5% annually (just throwing out a #) then our ultimate return is based on our initial valuation. If bank X is trading assuming 20% annual EPS growth our return will be less and if bank Y assumes negative EPS growth now, our return will be much more. So, to get to a standard staring place, we probably need another 30% in the increase in valuation for $JPM and 200% increase in valuation at $BAC (assuming 1.3X tangible book is “fair” currently) to worry about single digit EPS growth going forward. So yes, those investing in banks now ARE expecting double digit returns……very healthy ones actually.