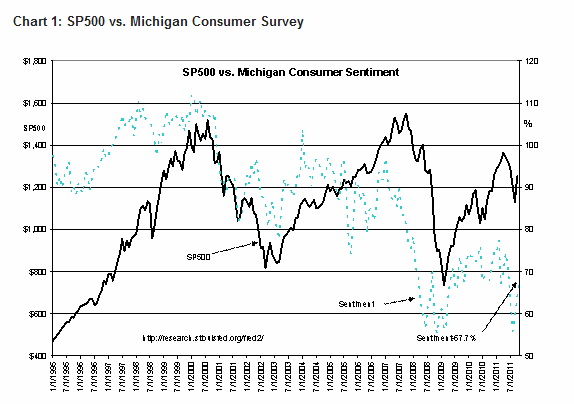

We are in a period which could properly be called “The Great Pessimism”. No matter how good the news on the economic front, i.e. auto sales, retail sales, industrial production, global trade, corporate earnings, personal income and etc., the media and individual outlook is remains decidedly pessimistic. It seems that the only individuals whose views are disseminated by the media are what I have labeled “Virtuous Pessimists”. It is as if it is a virtue next to godliness to be pessimistic. It is as if a pessimistic view is some how more truthful than those who offer a more positive view. The Nov 2011 University of Michigan Consumer Sentiment Survey was reported higher at 67.7% and the media interprets this as bearish for the economy. The history of the SP500 ($SPY) vs. Univ. of Michigan Consumer Sentiment Survey is plotted in Chart1.

But, as I have presented previously, sentiment does not drive the economy. Sentiment is a temporary phenomenon and is shaped by many short term events one of which is the direction of the stock market. Over the longer period of a business cycle, I have shown that sentiment is driven by the economy as is the stock market. Using sentiment to predict the economy has no factual basis. Investors need to be factual not emotional!

- Market sentiment does not drive the economy!

- Basic needs of society drive the economy!!

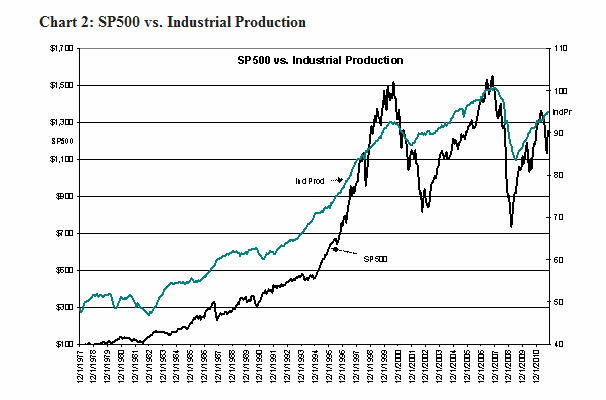

In Chart 2 the SP500 is plotted vs. Industrial Production. The media quantified the Nov 2011 report as weak yesterday and leading towards recession. WHAT? What is weak about this trend? This trend looks very much like every recovery since 1977 and a top is nowhere in sight. Industrial Production does not occur in a vacuum. It is caused by rising employment.

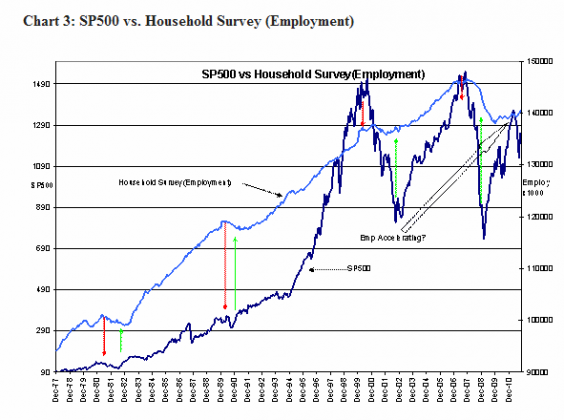

Chart 3 shows the SP500 vs. Household Survey (Employment). The Household Survey is the broadest measure of employment that we have. It should be quite easily observed that we have been in a recovery uptrend similar to 2002-2003’s recovery and furthermore it should appear that we may be on the verge of acceleration in the trend. Most of the media continue to characterize employment gains as non-existent. WHAT? What is weak about this trend? Employment is a lagging indicator for market lows (GREEN ARROWS) but a leading indicator for market highs (RED ARROWS). The recent upticks in this data series forecast acceleration in the economy, not a slow down and certainly not a recession.

I call this period “The Great Pessimism”. Pessimism results in lower priced stocks and lower priced stocks provide better investment opportunities for business cycle investors. I continue to recommend that investors add equity to their portfolios at this time. Those who assume the role of the “Virtuous Optimist” while all about them are pessimistic get the better business valuations.

“The Great Pessimism” is a great investment opportunity for Business Cycle Value Investors!