“Davidson” submits:

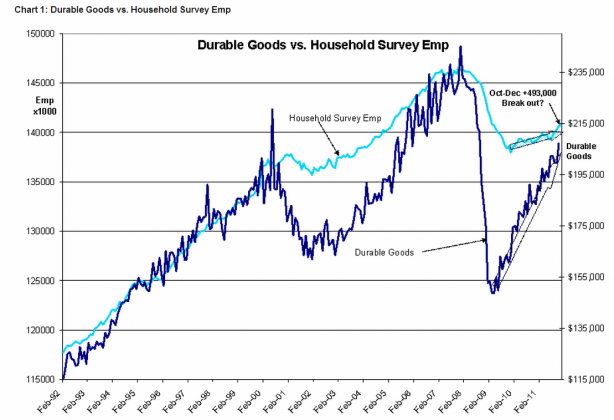

The Establishment and Household Survey Employment reports were released today with better than expected figures. The Household Survey revised November higher by 34,000 so that the total for Dec is 210,000 higher than the previous Nov figure. Since October, the Household Survey has risen 493,000 and appears to be acceleration from the trend of the past 2yrs-see Chart 1. The Household Survey captures best the total employment situation and is the source of the drop in the unemployment figure to 8.5%. This may be a considerable acceleration of the employment trend, but the actual confirmation of the new trend must wait for 2mos-3mos of additional information to be certain. BUT, THE REPORTS SINCE OCT 2011 LOOK VERY GOOD!

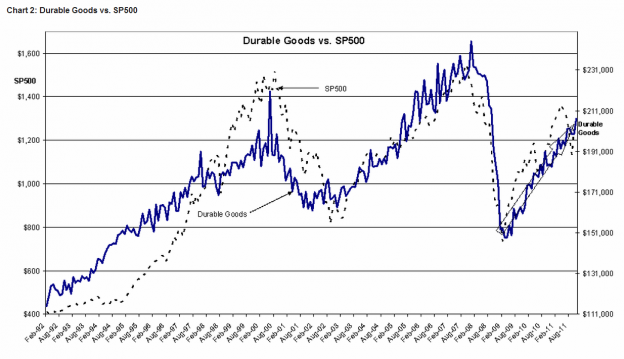

Employment and Durable Goods trends look quite good. The Durable Goods trend leads that of the Household Survey Emp and the SP500 by 6mos-12mos.

The relationship to the SP500 ($SPY) is shown in Chart 2. Equities have always been influenced over short periods by changes in market sentiment as investors anticipate effects of geopolitical and other highly visible events, i.e. Japan’s tsunami. One can see in the volatility of the SP500 vs. the steady Durable Goods trend. In the final analysis, what matters most, is the economic trend which dominates the SP500 over the business cycle. With 8.5% unemployment we are still early in the business cycle and have considerable improvement ahead in my estimation.

The economy continues to move forward and stocks have always followed historically.

The good economic news stream since March 2009 continues unabated and is in sharp contrast to the media’s overwhelming coverage of fearful global geopolitical events. The economic trends have a history of continuing to move ahead without any influence from geopolitical events and today’s economy appears to be no exception. Jim Carville’s Clinton campaign slogan “It’s the Economy Stupid!” is an apt response to today’s pessimists.

One reply on ““Davidson” on S&P, Durable Goods and Household Survey”

[…] The market is still catching up to the economy. (ValuePlays) […]