“Davidson” submits:

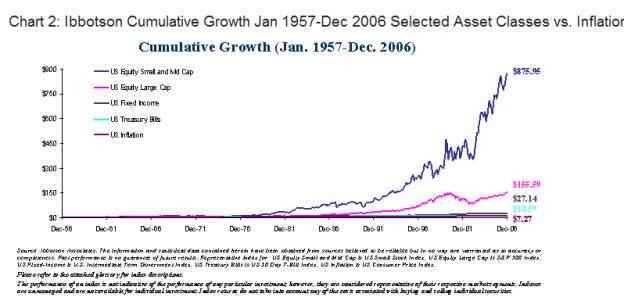

In my estimation based upon the historical relationships presented in the 2 charts below:

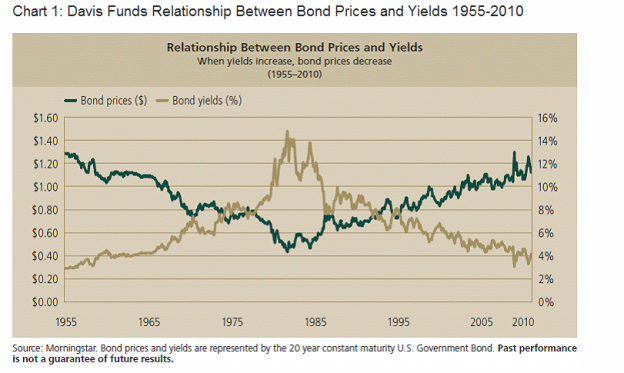

- Chart 1: Davis Funds* Relationship Between Bond Prices and Yields 1955-2010 and

- Chart 2: Ibbotson Cumulative Growth Jan 1957-Dec 2006 Selected Asset Classes vs. Inflation, bond yields are near historical lows (prices are historically high) and in a “Bubble”.

A “Bubble” occurs when a majority of investors develop the same market psychology and elect to place most of their capital in a single strategy or asset class to the exclusion of diversification. This type of behavior creates great risk to the holders of the favored asset class who often suffer severe capital losses when market psychology changes course. “Bubbles” occur reasonably often throughout history and cause selected asset prices to rise/fall to extreme levels of over/under valuation respectively. My observations lead me to view the marketplace as increasing driven by the impact of momentum traders since 1995. This has resulted in wider extremes from average prices since. We have witnessed multiple “Bubbles”, i.e. the “Internet Bubble”, the “Housing Bubble”, the “Commodity Bubble” or various “commodity Bubbles” and now we see “The Bond Market Bubble”.

That bond rates of return are near historically low levels (prices near historically high levels) can be seen in Chart 1. The 20yr Constant Maturity Treasury Bond has been hovering at 3% the past 2yrs which is close to the levels last seen in 1955. Most investors are comfortable with owning bonds today because of the risks they perceive in other investment options and this is why so many have selected to over-own this asset class vs. others.

BUT (and this is a big, big “BUT”), the historic relationship between asset classes and inflation and GDP is that asset classes have historically been priced to yield a return competitive to inflation as shown in Chart 2. This means that even the US Treasury Intermediate Term Index in Chart 2 has outperformed inflation the past 50yrs(1957-2006) by 6.16% annually on average(call or email me for the calculations). With rates at such low levels (and bond prices at such high levels) this means that bonds are grossly over-priced vs. historical returns. I think that it is fair to say that investors have created a “”Bond Market Bubble” of significant consequence because of their fears of other investment options.

The historical investment returns vs. inflation in LgCap and SmCap asset classes shown in chart 2 are 10.5% and 14.5% respectively.

Compare today’s yields on the 20yr Constant Maturity Treasury Index of 2.7% ( http://research.stlouisfed.org/fred2/series/GS20 ), current yields on the 10yr Treasury of 2% and the 30yr Treasury of 3% and my longer term GDP proxy, the “Prevailing Rate”, at 4.89%. Even T-Bills have out-performed inflation by more than 3%. Bond yields are well below today’s historically valid benchmark and when the relationship is normalized the losses are likely to be severe. One can easily see that investors in bonds are in a “crowded trade”.

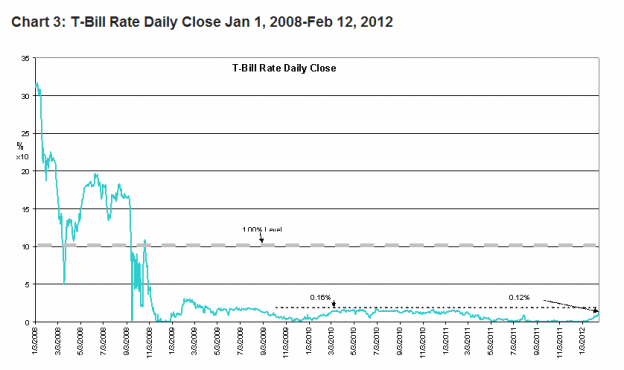

The evidence is that rates are beginning to rise! Chart 3: T-Bill Rate Daily Close Jan 1, 2008-Feb 12, 2012 of the daily close of T-Bill rates shows a rising trend the past few weeks. Historically T-Bill rates begin to rise 2yr-3yrs into a recovery as businesses and investment managers move cash into other areas seeking higher returns. For businesses this means expanding supply chains by hiring additional employees and building additional manufacturing capacity. It is quite evident that Ford, Caterpillar and Boeing are expanding capacity in the US and that 2nd and 3rd shifts have been added. For portfolio managers, the equity markets are rising even in the face of continued geopolitical events surrounding Greece, Iran and other global “Hot Spots”. In both instances capital is shifting from T-Bills at 0.005% in Nov 2011 causing rates to rise hitting 0.12% the past 2days. This is significant in my estimation.

A higher T-Bill rate at this stage of economic recovery is a sign of increasing economic health and represents an ebbing of business and investor pessimism.In my estimation stocks remain historically under-valued and bonds over-valued ($TLT) ! I continue to favor stocks over bonds and with bonds I recommend shorter maturities to reduce the risk of rapidly rising rates. It appears to me even at these ridiculously low yields that rates are beginning the traditional rate rise of an expanding economy.

Interestingly enough, our pal Wilbur Ross said the same thing this am (5:30 mark) . He calls shorting treasuries the “safest bet”