As long as banks continue to raise capital levels and M2 stays low, the hyperinflation people fear will not develop.

“Davidson” submits:

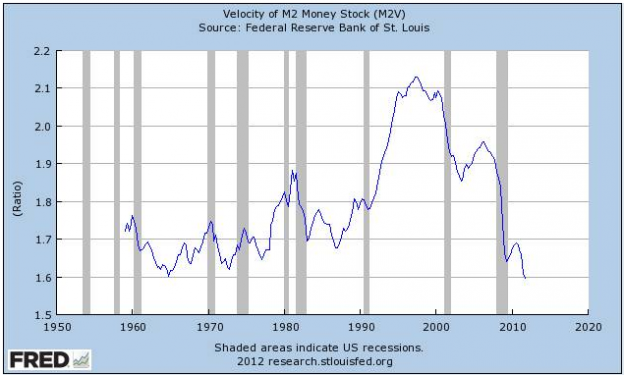

The velocity of M2 is back to mid-1960s levels. This is why the Fed has had to create so much liquidity as cash has been “king” due to the fears inspired by volatile markets and the residential real estate correction. This causes investors and corporations to hoard CASH and CASH turnover, i.e. Velocity, falls. But, fear of inflation is over-done if the Fed pulls liquidity from the system before or as velocity improves. The fact that inflation comes from too much money chasing too few goods is a psychologically driven environment and simply unpredictable. This is why too much liquidity today is holding back hard asset deflation can turn into additional hard asset inflation in the next 5yrs if the banks begin to lend willy-nilly.

The key to keeping bank lending in check is through raising required capital reserves to ~9% under Basel III. The rules as stated:

As on Sept 2010, Proposed Basel III norms ask for ratios as: 7-9.5%(4.5% +2.5%(conservation buffer) + 0-2.5%(seasonal buffer)) for Common equity and 8.5-11% for tier 1 cap and 10.5 to 13 for total capital.

What we have passed through is a period in which lending institutions were levered 40x and higher or less than 2.5% capital to debt. Inflation will not revive while banks are letting debt roll off and capital levels rise to that required by Basel III. At this point the Fed will have to re-evaluate how much liquidity it provides. It is a tricky issue and one that cannot be predicted as it depends on how good people feel about spending vs holding on to cash.

At the moment hyper-inflation is not an issue, but this does not mean it could not emerge if the Fed fails to reduce liquidity should consumers suddenly go on a spending boom and M2 Velocity rises sharply.