Let’s revisit two posts I did last September on this lawsuit:

Here is the conclusion of the piece (click here for whole article). Bold emphasis is mine

This case is on a relatively fast track, with an October 2012 trial date.

Given the $50 billion claim looming over it, Bank of America will most likely try to settle this litigation. The settlement value appears to be in the billions. Firing your main witness — Mr. Mayopoulos — and escorting him out the door no doubt only increases the cost.

The case shows how regulators’ actions can be supplemented by private actions. And if the plaintiffs win, this case may be the exceedingly rare event of directors and officers, particularly Mr. Lewis and Mr. Price, actually having to pay money personally to settle a securities fraud claim. If so, the two men would join the relatively few executives from the financial crisis who have been personally penalized.

Whatever the outcome of this case, it appears that Bank of America shareholders were sacrificed in December 2008 so that the Merrill deal could be completed. The bill may now be coming due for Bank of America.

“In the billions” is the settlement value. Now, given the suit is for $50B (BTW, I can sue my breakfast for that much so do not let the amount of the suit deter you from analytical thinking) a reader will naturally go to $5B? Maybe $10B? Without any guide and given the damning tone of the article, why not?

But, lets go and try to find what reality is. I tend to think that is of more importance.

Here is a report on all securities class action settlements from 2001-09 and 2010 Securities Class Action Settlements (click to open pdf). It has specific information of “credit crisis” lawsuits and we’ll assume this would be one. We’ll also do the data as if it isn’t a “credit crisis” claim so readers can make their own conclusions

For this exercise we will assume:

- $BAC is guilty

- $BAC will settle

- $BAC shareholders today are not benefiting from Merrill deal (they are)

- No other factors contributed to $BAC’s price fall during that time frame (can you spell Countrywide?) so the $50B in claims being 100% related to Merrill is 100% legit (it isn’t)

Now, if they will settle, we want to know “when” and for “how much”.

For settlements in 2010, the average time from filing to settlement was 4.1yrs (for all securities suits). The average amount of the settlement as a % of the amount claimed by those filing was between 2% and 3%. That means in this case $BAC, assuming everything above in 2015 or 2016 would be on the hook for anywhere between $1B to $1.5B. Considering during that time frame they will have generated over $120B in pre tax/provision earnings (assuming no improvements from now to then), this amount at the high end comes to a whopping 1.2% of earnings.

This assumes it settles withing the average. “Credit Crisis” suits are settling at a far slower rate:

Credit-crisis-related cases generally were filed between 2007 and 2009 and have settled at a slower rate than traditional cases…. Of the nearly 200 credit-crisis cases filed, only 15 have settled based on our review

Also:

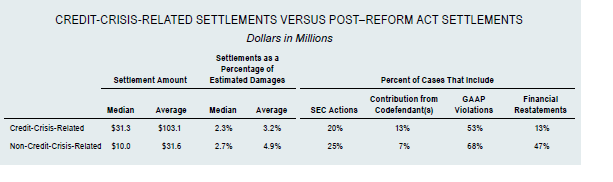

As shown, credit crisis cases have settled for higher amounts but lower percentages of estimated “plaintiff-style” damages compared with non-credit-crisis cases. While

This means it is realistic to assume $BAC may not be on the hook for anything on this until even after 2016. Here is the data:

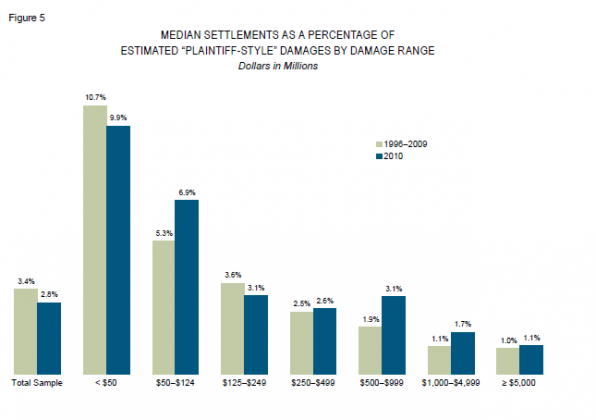

If we assume it isn’t a “credit crisis” claim, then one would expect it to settle faster but for a lower amount. For all securities claims, the larger the damages claim, the smaller the % of the settlement amount the final tally is. In 2010, the % ranged from 2.6% for $500M in claims to 1.1% for claims over $5B (figure 5 below). Because of this it is reasonable to expect the $BAC settlement will be at the lower end of the 1% to 3% range or less that $1B.

Here is the data for all securities litigation:

So, if we take the two classes of litigation we essentially have two outcomes, ~$1.5B at the higher end but not settling until 2016 or later or $500M- $1B settling before 2016. Either scenario, doesn’t do any real damage to $BAC given their reserves and current cash flows

Now, I am also fully aware that “Bank of America May be Exposed to $1B Settlement Later This Decade” is not NEARLY as eye catching a headline as “A $50 Billion Claim of Havoc Looms for Bank of America” ………. but it is REALLY more accurate…

Been doing more work on this after today’s earlier post. We have established a 1%-3% settlement rate on Securities Class Actions and an ~4 yr. time frame. But, why would plaintiff’s settle? Surely $BAC is guilty as hell and are responsible for the $50B in claimed losses, right?

What do claiments need to prove? That the Merrill deal, had investors known of the potential losses, they would have not voted for it and, solely because of the deal, they lost $50M in market cap.

Questions that need answers:

- Was the stock deterioration due to Merrill deal or market factors

- How much did Countrywide contribute to rapidly deteriorating results in 2008-09

- Was $BAC strong armed into completing the deal by Gov’t officials and therefor omissions were due to that?

So, lets look at the lost $$.

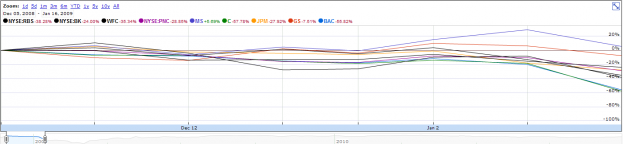

Here is a chart of the major banks during the same time frame:

I’m not the only one who sees the same thing, right? While $BAC chimes in at a 55% loss, $C matched that and the other major banks averaged a ~30% loss in value.

So, $BAC can now argue “Hey, Merrill may have lost us money, but it did not lose $WFC, $STT, $JPM, $PNC, $C and the others money. If their shares prices fell, that fall was market specific, not company specific. The argument can be made that only 1/2 of the market cap loss at the most can be attributed to the Merrill deal. So now we are down to $25B in damages.

In July 2008 $BAC completed the Countrywide acquisition (NOT part of this lawsuit). In the Jan 2009 earnings release, Countrywide was already having a material negative effect on $BAC credit quality:

Credit Quality

Provision expense increased $18.44 billion to $26.83 billion in 2008 because of higher net charge-offs and additions to the reserve. The majority of the reserve additions were in the consumer and small business portfolios as the housing markets weakened and the economy slowed. Reserves on commercial portfolios were increased as the homebuilder and commercial domestic portfolios within Global Corporate and Investment Banking deteriorated.

Total managed net losses were $22.90 billion during 2008, or 2.27 percent of total average managed loans and leases, compared with $11.25 billion or 1.29 percent during the prior year. Net charge-offs totaled $16.23 billion, or 1.79 percent of average loans and leases, compared with $6.48 billion, or 0.84 percent in 2007. Portfolios directly tied to housing, including home equity, residential mortgage and homebuilders drove a significant portion of the increase. The weaker economy also drove higher levels of net losses across the Card Services portfolios as well as the commercial portfolios.

Was $BAC forced into the deal?

The Bank, in its January 16, 2009 earnings release, revealed massive losses at Merrill Lynch in the fourth quarter, which necessitated an infusion of money that had previously been negotiated with the government as part of the government-persuaded deal for the Bank to acquire Merrill. Merrill recorded an operating loss of $21.5 billion in the quarter, mainly in its sales and trading operations, led by Tom Montag. The Bank also disclosed it tried to abandon the deal in December after the extent of Merrill’s trading losses surfaced, but was compelled to complete the merger by the U.S. government. The Bank’s stock price sank to $7.18, its lowest level in 17 years, after announcing earnings and the Merrill mishap. The market capitalization of Bank of America, including Merrill Lynch, was then $45 billion, less than the $50 billion it offered for Merrill just four months earlier, and down $108 billion from the merger announcement.

Bank of America CEO Kenneth Lewis testified before Congress that he had some misgivings about the acquisition of Merrill Lynch, and that federal officials pressured him to proceed with the deal or face losing his job and endangering the bank’s relationship with federal regulators.[60]

Lewis’ statement is backed up in internal emails subpoenaed by Republican lawmakers on the House Oversight Committee. In one of the emails, Richmond Federal Reserve President Jeffrey Lacker threatened that if the acquisition did not go through, and later Bank of America were forced to request federal assistance, the management of Bank of America would be “gone”. Other emails, read by Congressman Dennis Kucinich during the course of Lewis’ testimony, state that Mr. Lewis had foreseen the outrage from his shareholders that the purchase of Merrill would cause, and asked government regulators to issue a letter stating that the government had ordered him to complete the deal to acquire Merrill. Lewis, for his part, states he didn’t recall requesting such a letter.

[60] LOUISE STORY and JO BECKER (June 11, 2009). “Bank Chief Tells of U.S. Pressure to Buy Merrill Lynch”. New York Times. Retrieved June 13, 2009

.

$BAC could make the point that they had to hide fact because the Fed and Treasury were commanding them to do the deal. With Gov’t maybe as equally as unpopular as bankers, it won’t take jurors much to start pointing figures in different directions.

So, of that $25B remaining, how much of the loss was due to the Merrill deal and how much was due to investors realizing the huge pile of shit Countrywide was turning into? Maybe 50/50? 60/40? Who knows but if we are going to come up with damages, the court has to put a number on it. $BAC can also argue that Merrill is now one of the best units of the bank so while it initially hurt results, it is helping tremendously now.

For those seeking $50B, as these doubts arrive and the potential payout shrinks, we will begin to hear the calls for settlement to get anything soon rather than potential far less many many years down the road. Running some of these numbers, it looks increasingly less likely any settlement approaches $1B

These suits are brought to settle, not to litigate.

Here is the more recent news:

Lawyers leading a class-action lawsuit in federal court in Manhattan against the directors of Bank of America over its purchase of Merrill Lynch have agreed to settle the matter for $20 million even though damages in the case could reach $5 billion, according to plaintiffs in a parallel suit against the bank’s board in Delaware.

Calling the settlement grossly inadequate and the result of collusion, the lawyers in the Delaware case have asked P. Kevin Castel, the judge overseeing the New York matter, to order the parties agreeing to the deal to justify its terms.

If the settlement is approved by the Manhattan court, all damage claims made in the Delaware suit would be extinguished. That matter is scheduled to go to trial in October.

The settlement was struck privately on April 12 by lawyers representing two public employee pension funds that had sued the directors of Bank of America for breach of fiduciary duty. The funds are the Louisiana Municipal Police Employees’ Retirement System and the Hollywood (Florida) Police Officers’ Retirement System.

At issue in both the federal and state suits is whether Bank of America’s board breached its duty to shareholders in approving the 2008 acquisition of Merrill Lynch for $50 billion and whether it misled investors about the brokerage firm’s weakening financial condition leading up to the purchase.

So, YES, the settlement is being contested, just like the recent $25B Mortgage Settlement was (it was eventually approved). Maybe the Judge sends them back and they come up with another $20M for a $45M total….it is chump change. I like how they throw in the “even though damages could reach $5B”…….oh yeah, that is according the “plaintiff’s attorney’s” so it must be 100% accurate.

It goes to the larger problem of investors and the media consistently over stating $BAC’s legal liabilities. One does not need to be a lawyer to place a logical outcome on this types of litigation, there is more than enough precedent for one use. Every number is a absolute worst case scenario but it is treated as though it is the likely outcome. That is just wrong. The media headlines for these suits have overstated the likely outcome by 100x -200x on a consistent basis. Even I was was way over on the eventual amount. I do try to build in a large over shoot on my estimates of liability but even I was off by a huge #. ($500M to $20M).

I can live with that as it means that the bank is even stronger in its litigation position and reserves that I had estimated and that is a error I’d make every day of the week.

Eventually the rest of Wall St will catch on….