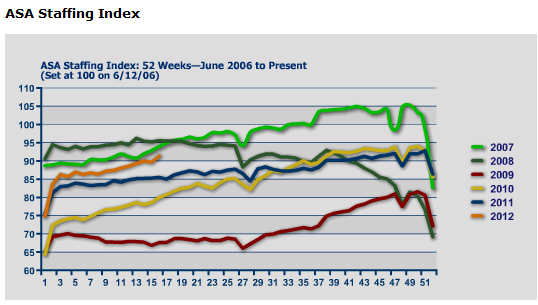

The Temp Employment Index hit 91 for the week of April 15th. It is up 6.9% YOY and a stunning 22% YTD. The index continues to surge indicatoring increasing employment strength from late spring and now, into summer.

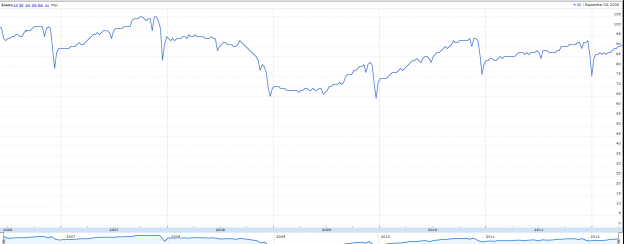

The “sell in May” crowd “may” be in store for a disappointment (sorry for that). The theory seems to be the US economy is weakening (this is based on a couple of week’s “not great” economic data) and we are in for a repeat of ’10-’11. Isn’t this the “recency bias”? For those not familiar with it, it is the tendency of investors to extrapolate recent events into the future indefinitely. So, because the late spring/summer of the last two years was bad, ’12 will be also.

But temporary employment tells us hiring is going to increase again May/June, rail data is telling us that an increasing amount of goods are being produced and shipped, auto sales continue to beat expectations and Q1 earnings numbers are thus far better than expected.

I don’t pretend to know what the market is going to do over the next 4 months (um, no one does so be wary of those who tell you they do) but I am becoming more confident of a stronger than expected spring/summer for the US (perhaps very much so). Those who are pessimistic in their expectations of the performance of the US economy over that time frame are not going to have those expectations met with reality.