“Davidson” submits:

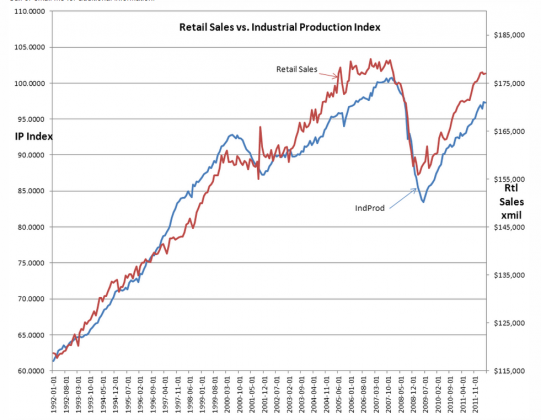

There has been much talk lately on the imminent slow down and potential recession looming in the US and globally. Many assert the recent reports on employment, retail sales, industrial production, housing sales and etc. are unusually weak. The problem with these forecasts is that the data just does not reflect economic weakness. The chart Retail Sales vs. Industrial Production Index shows the strong correlation between these two series and one can even see that Retail Sales trend shows a strong tendency to top and bottom before the trend in Industrial Production. The bottoms are relatively sharply defined but the tops are comparatively broad.

You can observe that Retail Sales flattens prior to a top in Industrial Production. This makes sense! Producers who experience many ebbs and flows during economic expansion do not react immediately to slower sales until they note a significant inventory build.

Reported data which many say reflects weakness in both of these data series are actually within the normal range of the statistical range. Before one can interpret these data as suggesting that a slowdown in Retail Sales had occurred one would need 6mos. of flat Retail Sales reports followed by and coupled with signs that Industrial Production is flattening coupled with indications that Job Openings and Help Wanted Online have begun to fall coupled with a deterioration in Auto & Lt Truck Sales coupled with Monthly Supply of New Home Sales rising above 7mos. and a few other criteria. Data series should always be interpreted within the context of its own historical patterns and also in light of complementary series when they are available. The US has many complementary economic data series.

I cannot agree with the recent spurt of pessimism as the data strongly suggests that it is “Full Steam Ahead” as Retail Sales and Ind. Prod remain in strong trends.

One reply on “Spurt of Pessimism Unwarranted”

[…] No signs of economic weakness here. (Value Plays) […]