“Davidson” submits:

Inflation in any society erodes the purchasing power of individual and corporate financial assets. Inflation is especially destructive when it comes to financial assets which are not placed in the appropriate asset classes and to those living on fixed incomes from pensions. One of the more definitive studies as to inflations causality comes from Alan Meltzer, “Origins of the Great Inflation” who states,

“The start of the Great Inflation—the sustained increase in the price level—was a monetary event.”

The Great Inflation is defined as the period of inflation experienced from 1965-1984 and is attributed to the US government’s issuance of excessive dollars to finance spending on The Great Society initiative, the Vietnam War and NASA’s goal of sending a man to the moon in the US’s space race with the USSR. Government became a serious competitor for goods and services in the economy, but it was not at all sensitive to price thus driving all prices higher. In short inflation is manmade!

Meltzer makes it clear that monetary policy should issue no more new dollars than the change in Real GDP (inflation adjusted growth of US production of goods and services). When we grow the amount of currency faster than the growth of the US Real GDP, inflation is the result.

Another way to think of this is to think of your own productivity. As you work at whatever you do and gain expertise, each year your experience translates into your performing your work more productively. Each year on average you are accomplishing your work faster, better and cheaper than the year before such that your work produces a good or service valuable to society at cheaper prices. This keeps your goods or services in high demand. But, if you are able to lower your costs and continue to produce goods at higher levels of value to society such that society’s demand remains high, then you will gain excess capital for your efforts and be able to raise your standard of living. With the US population rising at ~1% and Real GDP rising at ~3% there is an improvement of ~2% of real increase of value in society per individual. Meltzer’s assessment is that by keeping the rise in the amount of currency at the rate of Real GDP increase produces a non-inflationary economy.

A productive society by producing goods and services “Faster, Better, Cheaper” should in theory result in a natural rate of deflation. Personal Incomes could remain flat year to year yet goods and services prices fall such that income sustains a higher standard of living year over year.

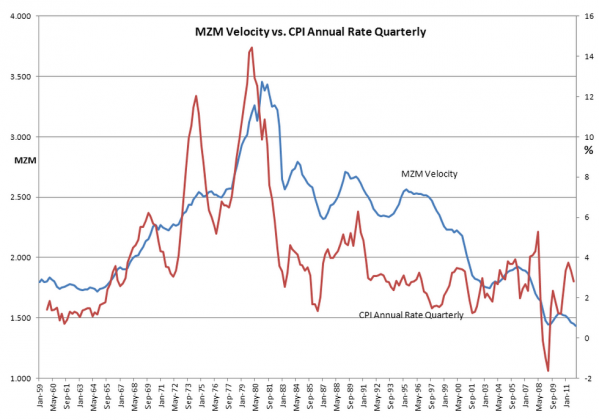

That we have inflation is entirely due to government issuance dollars at a rate in excess of Real GDP. When this occurred in the past individuals would spend the dollars as quickly as possible and even borrow funds to spend with the intent of paying back the borrowed funds with inflated, ‘cheaper”, dollars in the future. One can see this in the MZM Velocity vs. CPI Annual Rate Quarterly chart below. MZM (Money Zero Maturity) is the money we have in our pockets and checking accounts. No interest is paid by banks for this money as it remains in place for only a short period. One can see that as inflation rose (BROWN LINE) the speed at which we spent our available cash (BLUE LINE) also rose in response.

Today there is a serious debate about the direction of future inflation. Some are so concerned as to have bought heavily into commodities and farmland. This is the reason why we have seen such a rise in gold, copper, oil and etc even with the economy still at lower than normal levels. You can see this reflected in the CPI since 2009. Associated with this is a fear of currency debasement or the fear that the US may devalue its currency and commodities are believed to be a store of value should such an event occur. We have also have had fears during the past 5yrs of “Peak Oil”, of running out of food to meet needs of developing nations, running out of copper and etc. Commodities are said to have been “financialized” in the race to protect other financial assets.

Net/net we have had many fears lately which have resulted in higher raw materials prices.

That this time government issuance of dollars is different one can see from the chart. Even with the spikes in commodity prices, MZM Velocity remains at historic lows. Lowest in the 53yr history of the measurement of this data series! Individuals are fearful! We are keeping the extra dollars in our piggy banks at 0% rates rather than running out to spend them. Without the Fed providing extra dollars to meet our psychological needs and the needs of many worldwide (the US dollar is in high demand globally-some are calling for an additional $1Tril to be issued), we would not have enough currency to transact our daily needs and deflation similar to the 1930s would be the likely result.

Even with all these extra dollars in the system, history shows that after a recession individuals continue to hold on to dollars as can be seen by the drops in MZM following recessions in 1982, 1991 and 2002. One can also see that rises in MZM tend to coincide with periods of speculation, i.e. Junk Bond & Housing Bubble began 1987, Internet Bubble began 1995, Housing & Commodity Bubbles began in 2005. The difference this time is that excess dollars have not been spent directly on goods and services by government. The excess dollars issued have in large part been spent to maintain existing (and too many a bloated) national and state government employment. This type of spending prevented a wider deflation that might have occurred if government downsized at the same time as businesses. Today the size of government is being unwound at all levels while business employment is rising at an accelerating pace.

Today’s CPI is beginning to fall as fear subsides about currency debasement. The core inflation as measured by the Dallas Fed’s 12mo Trimmed Mean PCE is 1.8% and it appears to be falling as well. The panic which drove all commodity prices higher has not by this measure entered the general economy in a meaningful way precisely because individuals have been loath to spend the dollars they have in their pockets!!

At the moment inflation is not a serious issue. For the next couple of years, inflation is likely to be kept in check by subdued MZM Velocity as well as a result of the major energy discoveries which have caused natural gas prices to plummet and is likely responsible for the recent oil price declines. Continued discovery could result lowered energy costs for decades. This in turn can result in lowered consumer inflation expectations and correlated spending habits.

The dollars in the financial system are only a problem if MZM Velocity suddenly rises in speculative fever. At the moment it appears that there is significant motivation to reduce government. This should contribute to economic growth by lowering the burden of government on the economy.

Inflation as having pure monetary causality is not a given as we have just seen. It matters how the money is spent and utilized by society. The level of dollars in the system does not guarantee inflation by any means. If it were this predictable, then managing financial assets would be far simpler.

The relationship, Government Spending = Inflation, is not simple and it is definitely unpredictable.

I hope this discussion is helpful. The best we can do is to be watchful of economic conditions. Inflation is a manmade problem and we have reversed it with commonsense several times.

When and by how much we influence inflation is not easily predicted. For now we are OK!