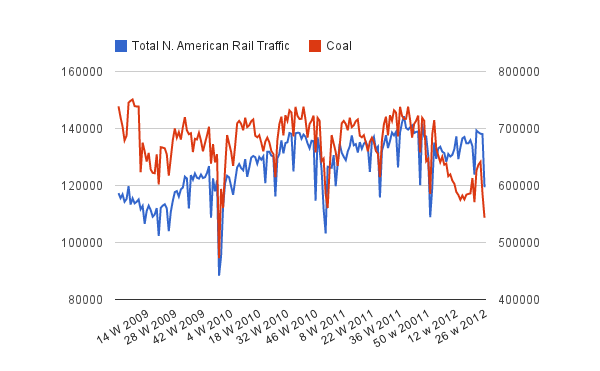

Total N.American rail traffic took the usual 4th of July week dip last week but still easily beat 2011 with a total of 597k cars vs 578k the year before. The numbers are even larger when you consider coal had the lowest levels since Dec. 2009 at 108k cars (vs 122k in ’11).

I know “recession is around the corner” talk is en vogue now (not sure it ever wasn’t the last 3 years) but rail traffic is not indicating any type of retraction in the US economy. Now, in the “all or nothing” times we seem to be in that does not correlate to 4% GDP. It means, like we have said here for a long time now that we are growing modestly….but we are growing.

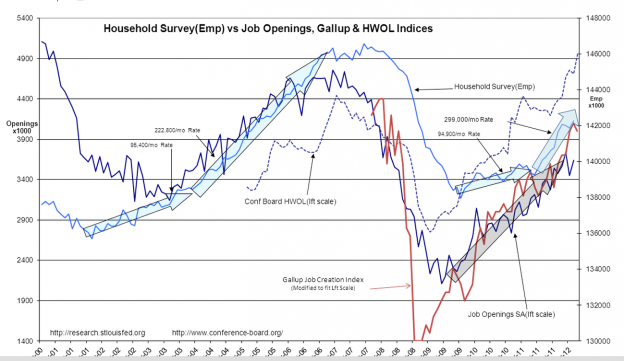

The “unexpected” drop in employment claims today is another buffer for growth. As a side note, notice how good news is always “unexpected” lately, it goes to sentiment. It would also be the time to note that the drop in claims is now at a 4 year low. It is far too early to know if this is a one off even or a new trend, but if we go back to some earlier posts, we did say that the temp employment numbers indicated improving employment conditions in “late spring/early summer”. The next few weeks will be the tell on that. The bears will say that the drop isn’t real because it was due to auto makers not closing plants to retool. Well, the next question that needs to be asked is, why? They aren’t closing because demand for vehicles is so strong. That is why we are seeing reports of $F and other makers adding third shifts to plants for the first time in years,

Now if we add some other data, we see that the household survey is way up and, most importantly, the HWOL number is really beginning to take off meaning more employers are looking to fill job opening. Both the HWOL and Temp data lead the gov’t employment data. You can see it in the larger turns and in the short term spikes and pauses in the household survey. The point is that no one data point is a panacea of perfection for looking down the road. But, when we have several and see the correlations to how they interact with each other, the monthly or weekly variances in either direction become less important than the underlying trends of all the data points.

This data just does not point to a recession in the near future. Yes, indeed we will have another one, they will always enter our lives. But for the folks like David Rosenberg who in the summer of 2010 said we were in a “depression” or ERCI who in Sept. ”11 said “if you thought the last recession was bad you ain’t seen nothing yet” and indicated that even then we were tipping into a recession it is time to own up the the errors (they have since “reset” the clock on this prediction a few times).

For the record, they isn’t anything with being wrong. Hell, we all are at different times.

There is a lot of talk how “numbers are slowing”. Well, didn’t they do that the last two summers also? Did we fall into recession? Monthly numbers have historically been volatile and have often dipped into negative territory for extended periods without recessions then taking place. If you are looking for more data here are 17 more reasons

Maybe we will enter a recession this time, it would be the first time in history we did so with increasing auto sales/production and increasing housing construction happening at the same time. Maybe this time is “different”. Maybe this time increasing temp employment and increasing job openings mean employment will decrease, not increase as it has historically done. Maybe for the first time increasing rail traffic does NOT mean the economy is growing, anything is possible I guess.

Maybe this time is really different…..I’m just not inclined to think it is….

One reply on “Rails, Employment, Recession…..Is This Time “Different”?”

[…] Rails, Employment, Recession…..Is This Time “Different”? by ValuePlays […]