Remember the last deal $CRM did?

They bought Buddy Media. The deal included $467 million in cash, $184 million in Salesforce stock and $38 million in vested options and restricted stock. Additional payments would be made if certain milestones were met, making the total amount as much as $745 million.

Here is what the folks at Buddy Media had to say when the deal was announced

Pretty powerful combination and ought to drive $CRM and its business and its stock ever higher…..right?

Well, $CRM filed an S-3 regarding those shares paid to Buddy Media folks…..

How much of the stock they received in this new combined entity are they selling? The answer: 99%

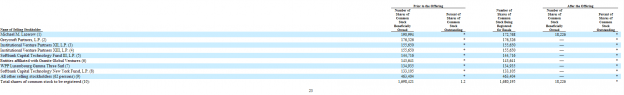

Here is the list:

Now, I get founders want to cash in on their hard work and monetize the asset. Really I do. But they did get $467M in cash, that is a bit of liquidity. This isn’t even a liquidity issue, this is a clean break.

When a company is hot to use its stock to acquire other companies, it means even they realize the value of that stock is overstated. When $1 of stock is worth much more than $1 of cash, you use it as a currency. Even those receiving it in this case realize that and are cashing in before that $1 of stock is in fact only worth $1.

So again, I ask the question. If insiders are selling the stock on a weekly basis, often exercising options years early and even companies they acquire dump the stock they get as soon as they are allowed to…..why is anyone else buying it?

One reply on “Even Buddy Media Folks Don’t Want CRM Stock”

[…] More insider selling at SalesForce.com ($CRM). (Value Plays) […]