“Davidson” submits:

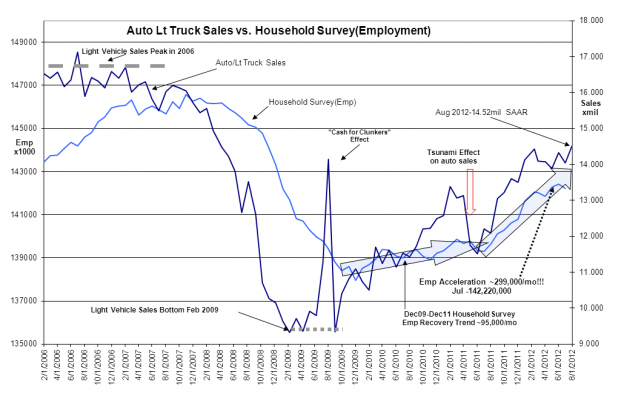

August 2012 Light Weight Vehicle Sales: Autos & Light Trucks were reported yesterday at 14.52Mil SAAR(Seasonally Adjusted Annual Rate)-DARK BLUE LINE in the chart below. The correlation between Light Weight Vehicle Sales and the Household Survey Employment trend is unmistakable-Light Weight Vehicle Sales trend leads the Household Survey Employment trend by 6mos-12mos. In addition, if one can imagine the trend in Light Weight Vehicle Sales through the choppiness of the data, one can see today a slower trend from Jan 2009-July 2011 which has now accelerated in line with employment gains since Jul 2011.

- Auto&Light Truck Sales trends lead employment trends by 6mos-12mos.

- Auto&Light Truck Sales provide one of the earliest indications to future economic trends and the all-important employment trend.

- Higher Auto&Light Truck Sales leads to Increased Employment which in turn historically translates into Higher Equity Prices. ($SPY)

Historically stock markets have always been priced higher during strong economies. Often they become over-priced as investors come to believe that good times will last forever. There are two types of pricing always present in the investment markets; 1) The current value of a business based on management’s historical ability to generate returns and 2) The value placed on the business by investors seeking to outperform the general market. The first can be calculated using past business returns and we project these into the future to estimate what investors should be willing to pay if management continues to generate the same returns. But, what investors are willing to pay for any security is a complex mix of market psychology which can change overnight with geopolitical events. One needs to be mindful of the role market psychology plays in securities pricing. One needs to be mindful what it takes to turn negative psychology which results in the underpricing of a security into positive psychology resulting in security overpricing. Light Vehicle Sales, when they just recover back to levels representative of what has been deemed a good economy, has typically been the point at which market psychology begins to turn from negative to positive.

Typical “Good Economy” Light Vehicle Sales levels have historically been 15mil SAAR. This has been the level which has caused historical market P/Es to rise as market psychology moves from negative to positive. This can be correlated with “The Recency Effect”-the psychological term referring to one’s current judgment being heavily colored by one’s most recent 2yrs-3yrs experience. Investors have had 3 ½yrs of continuously improving economic data and higher stock markets. Market psychology can be expected to turn more positive in the coming months as this comes to dominate “The Recency Effect” and stock valuations should expand (all things being equal).

- Great Light Vehicle Sales predict higher employment, better market psychology and higher stock prices.

Optimism is warranted! If you are not yet fully optimistic, I encourage you to be so. We have had 3 1/2yrs of up-trending economic data. The uptrend continues! This is the historical turning point for market psychology, negative turning to positive with higher stock valuations.