“Davidson” submits:

The belief that the Fed has induced the recent market rally is in the commentary of most analysts today. My view is that something else far more fundamental is taking place which has been in place since March 2009. It is an economic and stock market improvement which has continued against hundreds of calls for market collapses and additional recessions which have not occurred the past 3 ½ years.

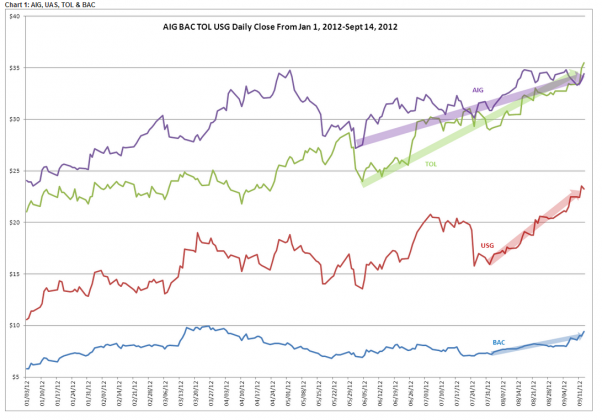

The market improvements the past 9mos have been prominent in financials and home building related issues. Below I show the price improvements in Chart 1: $AIG, $USG, $TOL & $BAC since Jan 1st 2012. These price improvements are a small sample of what has been occurring as the housing reports have continued to reflect increasing economic activity. This occurred not with the recent Fed activity, but has been building slowly since last summer as the Monthly Supply of New Homes for Sale fell below the 6mo Supply level. One could see this trend improving as I have been pointing out to you for some time.

Economic trends do not suddenly develop overnight, but gradually form as our needs and confidence dictate.

Investing requires looking for traces of economic activity well before the “Risk On!/Risk Off!” crowd has begun to take notice. It is all about positioning one’s investment portfolio to be in the way of the change in investor psychology before the majority become informed of something worthwhile for their interest. It requires careful detailed study of past economic cycles and how economic information translates into stock market behavior and individual stock prices. This is not about suddenly having to make an investment decision which is to last a few days or weeks, but a positioning of funds to be carried along by a major trend which is more likely than not to last 5yrs+ and perhaps as long as 8yrs-10yrs.

Being a longer term investor is where the better gains occur in my perspective. This is also where investors benefit from long term capital gains treatment. In doing this work one needs to understand the markets as intimately as possible and their relationship to economic fundamentals. The connections are not ever immediate nor do they even correlate over 1yr-2yrs. But, over longer periods they do have a high correlation and one can make reasonable forecasts about market direction even if one cannot predict with precision date and price targets.

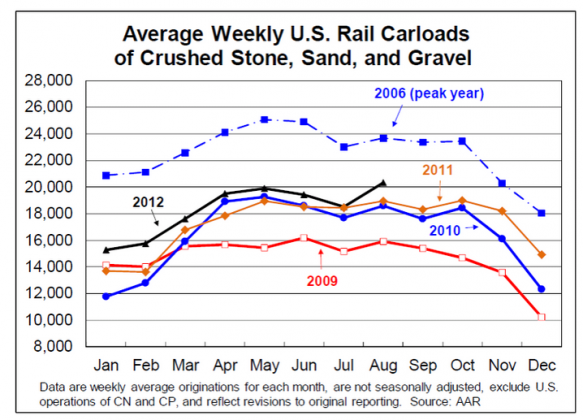

The markets could have responded to any number of reports the past 9mos which reflected improving trends in the final leg of our economy, the housing market. But, it did not do so till more recently. I think part of the cause is the Recency Effect which I have mentioned any number of times. New in the mix of information is the railcar loadings of crushed stone showing a sharp upward move from the past few years of static activity which is shown in Chart 2: Average Weekly Rail Carloads of Crushed Stone, Sand and Gravel. I think that it is this report which has finally broken the pessimism barrier.

2 replies on “Is It the Fed Causing The Rally?”

[…] Is the Fed really causing the stock market to rally? (ValuePlays) […]

[…] Is the Fed causing the rally? (ValuePlays) […]