“Davidson” submits:

I am always looking at the long term trends and this is reflected in my investment advice. The approach is to be invested in equities during economic recovery/expansion and then move towards 5yr Treasuries during the period of economic contraction. I do this using existing decades-long historical economic and market cycle data which is readily available. Underlying these cycles is a longer term inflation cycle and global development patterns of which China has been one of the most prominent the past 15yrs in its global impact. At the moment inflation is in a downtrend and China is beginning to transition due to the emergence of a middle class.

Reversal of the China Effect/Emergence of US as a Global Powerhouse Once Again

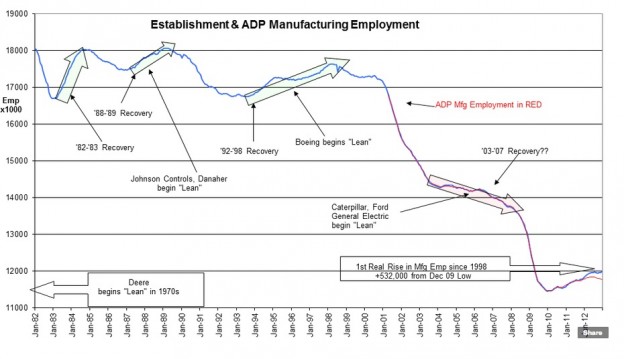

It has been ~15yrs since China became a favored low cost manufacturing location and end-customer target for many international firms. The end result was a shift of manufacturing performed elsewhere to China causing non-Chinese manufacturing to feel the brunt of this change. In the US the counter-response has been a visible shift to “Lean Manufacturing” first developed by the Japanese to regain global competitiveness. The effect can be seen in the chart below of US Manufacturing Employment which displays the first significant upturn since 1998. A 532,000 increase since December 2009! The chart also notes when key US businesses began to embrace “Lean” practices. The term “Re-Shoring” has been coined for this phenomena.The net/net of “Lean” manufacturing which takes different forms in different businesses is that management takes the position that employees are the most valuable resource they have in running a business efficiently and in generating new more productive business processes. There is a dramatic difference between a “Lean” business today and one of 50yrs ago in which management directed employees not only how to make needed products but also dictated with rigid mindset the numbers per minute for peak efficiency. Robert McNamara, known as one of the “Wiz Kids”, applied the fad of the day, Systems Analysis, to direct output at Ford and later did the same as Secretary of Defense during the Vietnam War. Employees responded by joining unions for protection from mind-numbing regulation and forcing businesses to be less productive. Unions have been much maligned by investors, but history supports unionization as a protective shield from the misperceived actions of management which at one time thought of human beings as easily replaceable cogs in the corporate machine. Today’s more enlightened CEOs have embraced “Lean” achieving wide ranging benefits to all concerned.

Today’s “Lean” approach, when it works well, empowers employees as the most important aspect in the production process. Employees can stop a production line if they believe that the quality of the product is impaired and they get rewarded for it. They get rewarded for their individual contributions to quality and productivity improvements suggested. As part of the incentive process, employees receive a base wage with which they and the corporation can survive during economic downturns with minimal layoffs, but then participate heavily in profit sharing during good times. The overall effect is that corporations keep their workforces and skillsets intact during difficult periods and employees do not suffer the wrenching trials of layoffs which often include loss of healthcare benefits, loss of one’s home when union benefits stop, loss of one’s work friends as those who kept their jobs suffer survivor guilt and avoid contact. “Lean” processes are a holistic approach towards employees across the entire business cycle and are designed to maximize business productivity and employee engagement while minimizing work related accidents, warranty costs and layoffs. A key feature is variable compensation which is high during profitable years and falls to a living wage during difficult years. It is “Lean” processes which have taken hold in the US and made many companies globally competitive in spite of very low competing wages in newly developing countries. This is why the US has begun to see a surprising net increase in manufacturing employment in my opinion.

While the US has been embracing “Lean”, China has been building its wealth and a middle class without the costs of environmental protection of water, air, food and other key societal needs. Not addressing the impact of pollution has permitted Chinese based manufacturing to underprice its true costs of production. There have been a series of articles the past several months which indicate that China will tract the US in its efforts to deal with the typical pollution as demanded by its growing middle class-see WSJ excerpt below. The wealth created from years of pollution has now begun to create its own backlash. The history of an emerging middle classes globally is always the same. Once one has wealth enough to afford a modest home, a car and other accoutrements of success, one turns to improve one’s environment, i.e. the air one breathes, the water one drinks and etc. One expects government to regulate so that one’s children will have a safer environment to grow-up in than their parents. Besides improved environmental and food regulations, the middle class expects a more even handed less corrupt legal system to insure all are treated with fairness. This is what is happening in China today and these costs are going to be borne by their society.

US productivity rising and costs falling do to “Lean”, at same time China’s costs of productivity are rising due rising demands by middle class for improved environment and legal system.

US can benefit vs. China and newly developing countries for years to come!

US began its efforts in 1975 with the introduction of the catalytic converter, Wikipedia.org-Catalytic Converter The US has already had 40yrs to incorporate efficient environmental controls in almost all areas which needed modifications. China, the global favorite manufacturer, is now being forced to address many issues demanded by an emerging middle class. China in my estimation is entering a period in which it will lose some of its manufacturing prowess to the US due to rising costs. China is not alone in ignoring its growing middle class needs while it captured a share of global manufacturing. All developing countries have similarly ignored these costs. The next decade or so should see a continued reversal of global manufacturing in favor of the US.

I think the US has already entered a sweet spot for manufacturing productivity with efficiently embedded environmental controls, societal legal protections and newly implemented “Lean”. In my estimation this will be an even more positive environment for equity investors than many perceive at the moment.

Optimism is warranted in my opinion! Equity prices should continue to rise as investors become more aware of US productivity.*

3 replies on “China Pollution Leading to End of Low Cost Manufacturing Advantage Over US”

[…] China is losing its edge as a low-cost manufacturer. (ValuePlays) […]

[…] China pollution leading to end of low cost manufacturing advantage over the U.S. (ValuePlays) […]

[…] an online post attributed to “Davidson” includes this interesting […]