“Davidson” submits:

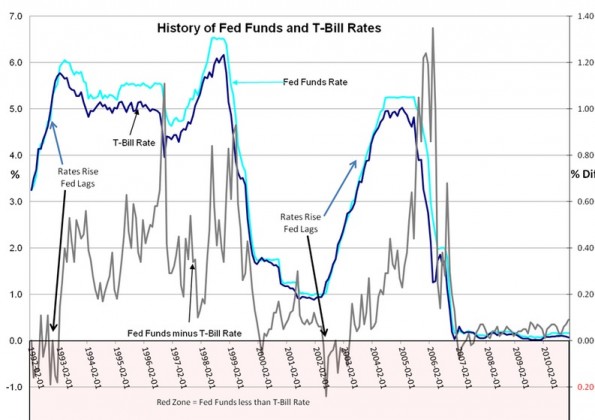

There is always great consternation that higher rates will hurt economic activity and the belief that the Fed controls rates is widespread. Looking at historical relationships provides great insight. The chart of the monthly History of Fed Funds and T-Bill Rates is below (Fed Funds in Turquoise, T-Bills in Dark Blue). The GRAY LINE is the difference between the Fed Funds and T-Bill rates.

· When T-Bills rise more quickly than Fed Funds month-over-month, then the GREY LINE falls below 0.0% into the RED ZONE.

· When T-Bills fall more quickly than Fed Funds month-over-month, then the GREY LINE spikes higher!

What this means is that the market controls rates!!

· When investors are comfortable seeking higher returns in either markets (equity prices rise) or business ventures they sell T-Bills for other opportunities driving T-Bill rates higher.

· When investors are less comfortable with risk then sell investments (equity prices fall) and buy T-Bills driving T-Bill rates lower.

In all instances it is the rise and fall market demands for capital which controls interest rates. The Fed has always been a follower! The single instance in which the Fed actually led T-Bills was when Paul Volker raised rates preemptively to quell the inflation spending mania of the early 1980s.

When trying the answer the question of when rates will rise history supports thinking that rates are most likely to rise when investors are comfortable about seeking higher returns outside of T-Bills. If we see this happen then we should take this as an economic positive!!

When T-Bill rates fall near the top of an economic cycle, it is because investors/businesses cannot find better returns and park funds in T-Bills causing rates to fall.

All the media chatter about the Fed controlling rates is not supported by history. The Fed can always surprise us and change its approach, but I truly doubt it will be different this time.

Let me repeat the truths of this study:

· Rising T-Bill rates is good for stock prices!

· Falling T-Bill rates is bad for stock prices!

Rates have been rising the past few weeks as investor confidence improves. This is good news.