“Davidson” submits:

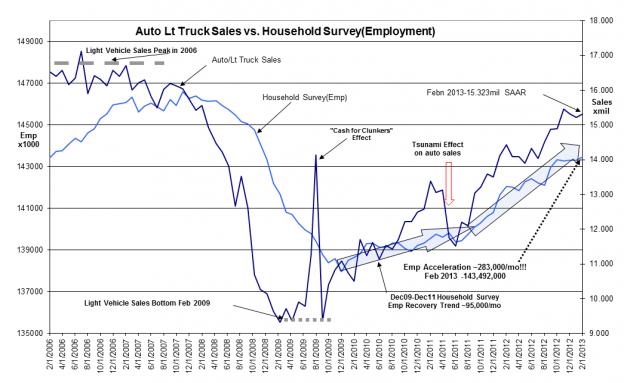

The Establishment Survey reported employment expanded by 236,000 and the unemployment rate fell to 7.7% and the market looks like it will pre-open by triple digits higher. The Household (Employment) Survey(HES) which is the series which covers all employment including the self-employed came in at 143,492,000 or 170,000 higher than Jan 2013. The HES has been tracking(LIGHT BLUE LINE) 283,000 monthly employment growth since July 2011 and this report continues to affirm.

Light Vehicle Sales: Autos & Lt Trucks was reported last week with the official figure of 15.323 SAAR (Seasonally Adjusted Annual Rate). You can see on the chart below that this is also tracking its trend(DARK BLUE LINE) since March 2009.

The history of markets reveals a strong correlation between Light Vehicle Sales, Employment and SP500 trends over the business cycle. The correlation is so tight that one can use Light Vehicle Sales trends to predict the future trend of employment and the SP500 as long as one does not strive for precision with values and timing.

The recent calls by some in the media that we are in a recession or about to enter a recession are without foundation. We are in a strong economic expansion with construction sectors lagging. Both Residential and Commercial Construction sectors have lagged most likely due to tight bank lending. In my opinion I attribute this to low interest rates which have kept bank lending more focused on Prime Borrowers and refinancing. In the realm of finance, lenders require wide enough lending spreads from cost of funds to counter any default risks they may face with the uncertainties of future events. With 15yr rates in the 3% range and borrowings ~1% and higher, banks do not have enough to run operations and take on risks with less than Prime Borrowers who have FICO scores in the 760 range. To lend to FICO 650 borrowers banks need wider spreads over the cost of funds, i.e. lending rates need to be in the 5%-6% range. For higher risk borrowers the rates need to be even higher. It is my opinion that when rates rise as investors favor stocks over bonds that bank lending will expand to the less than Prime Borrower population.

Today’s news is good and represents a continuation of the trends which have been in place since March 2009. I remain very positive on equities, especially LgCap Domestic and International asset classes.