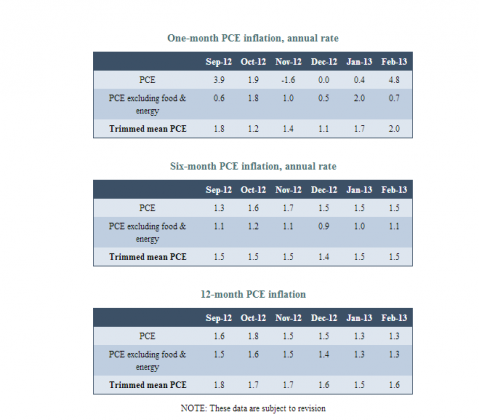

The Federal Reserve Bank of Dallas reported the 12mo Trimmed Mean Inflation Rate at 1.6%. One can see from the PCE Inflation Table below that the 12mo Trimmed Mean PCE appears to be in a slow downtrend but February’s gasoline rise caused a spike which is already being reversed as an artifact of the winter to spring blend change. The Dallas Fed comments:

“As regular readers of the Inflation Update know, our own rule-of-thumb forecast for headline PCE inflation over the coming 12 months is always the current 12-month trimmed mean rate. By that forecast, 12-month headline inflation—now 1.3 percent—should gradually rise toward 1.6 percent over the next 12 months.”

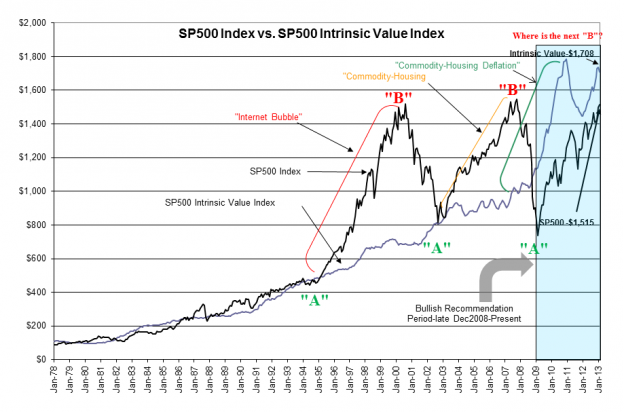

The effect on the “Prevailing Rate” used to calculate the SP500 Intrinsic Value Index is a slight decrease as the denominator rises. The SP500 ($SPY) Intrinsic Value Index now stands at $1,708 vs. last month’s $1,746.

The SP500 remains undervalued vs. the historical trend of the SP500 Intrinsic Value Index.