“Davidson” submits:

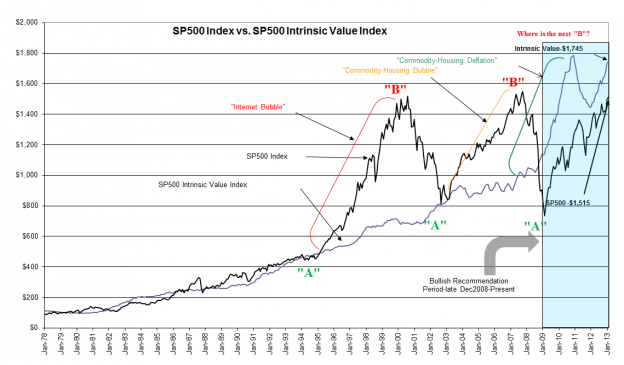

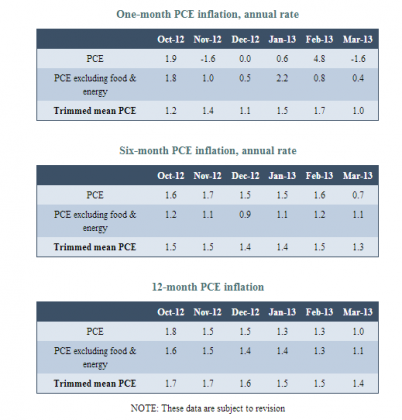

The Dallas Fed reported the 12mo Trimmed Mean PCE(Core Inflation) at 1.4%. Their table is reprinted below with some of their commentary. Below is the chart of the SP500 ($SPY) vs. the estimated SP500 Intrinsic Value with the end of March SP500 at $1,515 and SP500 Intrinsic Value at $1,745.

The market is historically priced higher with falling inflation. My research leads me to view inflation as dependent on market psychology. When we as a society are worried about the future, we tend to hoard cash, reduce our spending and inflation falls. Like today!! When we are more buoyant about the future and eager to accumulate goods or we feel that future dollars will not buy as much, we spend freely and even expand our use of credit thus we cause inflation. Like what government and society did during the 1970s!!! Historically, stock prices fall when inflation rises and rise when inflation falls.

Lower inflation results in higher equity prices all things being equal. In the PCE Table below, the trend is for lower inflation.

Since 1978 the SP500 Intrinsic Value Index calculated using the “Prevailing Rate”(Real GDP Rate + 12mo Trimmed Mean PCE Rate) as a capitalization rate for the mean earnings for the SP500 has been a helpful indicator in judging SP500 under/over valuation levels.

From the Dallas Fed:

“The trimmed mean PCE inflation rate for March was an annualized 1.0 percent. According to the BEA, the overall PCE inflation rate for March was -1.6 percent, annualized, while the inflation rate for PCE excluding food and energy was 0.4 percent.”

“The tables below present data on the trimmed mean PCE inflation rate and, for comparison, the overall PCE inflation and the inflation rate for PCE excluding food and energy. The tables give annualized one-month, six-month and 12-month inflation rates.”