“Davidson” submits:

Interest Rates are beginning to rise as investors make shifts in their thinking as to which asset classes are most likely to provide the better future returns. Rising rates have always been favorable to bank lending in the earlier stages of economic recovery. History supports this! Rising 10yr Treasury Yields provides greater rate spreads so that banks can lend to home buyers with FICO scores below the 760 level. Why this works this way is due to the fact that wider spreads in the longer dated yields provides enough of a return to offset the normal level of defaults banks have historically experienced with FICO scores in the 660-750 range. As yields rise early in an economic recovery, lending increases as banks become more comfortable with lower FICO score borrowers. It is only as short term yields rise to the level of intermediate and long term rates which occurs as the business cycle matures that bank yield spreads narrow and lending slows. This in turn results in both the economy and the equity markets correcting the excesses which accumulated during the previous up-cycle. All of this can be seen in the chart below.

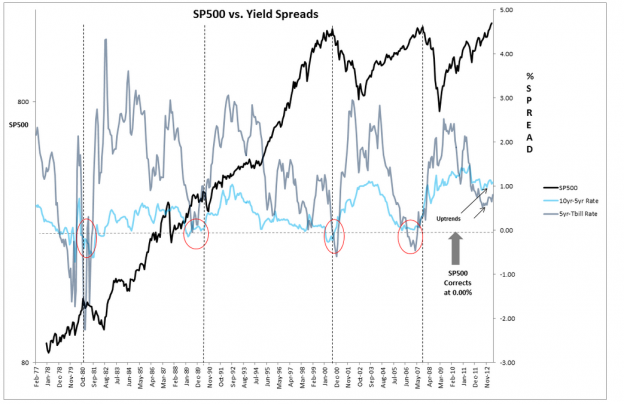

In the chart below I show the SP500 vs. Yield Spreads(10yr Treasury minus 5yr Treasury Yields & 5yr Treasury minus T-Bill Yields) from February 1977 to May 2013. The SP500 is the BLACK LINE with market peaks shown as DASHED VERTICAL BLACK LINES. The 10yr minus the 5yr Treasury yield spread is shown with by the LIGHT BLUE LINE and the 5yr Treasury minus the T-Bill yield spread is shown by the GRAY LINE. The RED CIRCLES show the periods when the spreads of the 10yr-5yr Treas and the 5yr Treas-T-Bill narrowed to 0.00% or less. Bank lending slows to a trickle when yield spreads fall to these levels and the economy slows sharply.

Rising rates have different effects depending on where we are in the economic cycle!

Investors always need to view markets as “works in progress”! The common view is that markets and the economy are both choked by rising rates, but the facts below show that this is not what we see historically. The effect of rising rates differ where we are in the economic cycle! At the end of the economic cycle, it is the narrowing of yield spreads, RED CIRCLES, which reduce bank profitability. This causes banks to pull in their lending which results in economic slowing. Economic slowing reveals all the mistakes which were made in previous lending decisions and a correction rapidly ensues. But, in the early stages of economic recovery, rising rates cause yield spreads to widen. Widening spreads improves bank profitability and banks can lend to a wider number of consumers with lower credit scores.

In today’s marketplace rising rates are actually resulting in widening yield spreads. One can see this in the chart where both the 10yr-5yr and the 5yr-T-Bill Rate differences are actually rising-see the ”Uptrend” arrows in the chart. This is actually very positive for continued economic expansion! This is very positive for the housing market! This is very positive for commercial construction!

Today’s Rate Increases are:

1. Very positive for housing market activity ($XHB)!

2. Very positive for commercial construction!

3. Very positive for increased employment!

4. Very positive for economic expansion!

5. Very positive for higher equity prices! ($SPY)