None of the employment news we heard this week should be a surprise to anyone. Auto sales, housing starts and HWOL levels have indicated nothing but higher employment readings for some time now.

“Davidson” submits:

he basis of my investment advice is the perspective of past business cycles, how the data develops “data point by data point” to form economic trends and finally how these trends become reflected in market prices. The fundamental concept is simple, but compiling the data and doing the analysis is the bulk of the work. The perspective is an investment history of hundreds of years, but the up-cycle can vary from a few years to longer than 10yrs. The goal is to capture a significant part of the investment up-cycles as long term capital gains and avoid the down-cycles. Importantly: Economic data develops over years. It creeps along! One cannot trade it, but I believe it to be very investible if one has patience and a time frame of 10yrs+.

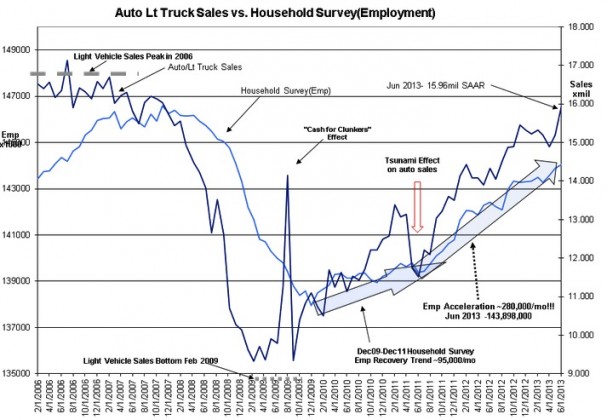

June 2013 employment statistics were released this morning with very positive results for the equity markets. The Establishment Survey was higher by 195,000 and the Household Survey was higher by 160,000. Lt Weight Vehicle Sales first estimated at 15.6mil SAAR(Seasonally Adjusted Annual Rate) earlier this week were adjusted higher to 15.96mil SAAR. The trends creep higher data point by data point. In the chart below I show the history of Light Vehicle Sales vs. the Household Survey. Light Vehicle Sales leads the employment statistics by 6mos-12mos. The data this week forecasts higher equity markets for the next 12mos or so. The housing/construction data released the last 2wks suggests the economy can continue to expand for the next 5yrs-6yrs.

It appears that “Sell in May and go away” crowd may have to adjust their thinking. Likewise, those betting on a collapse of the US$, high inflation in the US economy and a US economic collapse (there remain a considerable number of professional investors who believe these scenarios) must adjust or show poor performance to their investors. There continue to be many expressing negative views on this data in the media this morning. “Economic Malaise” this is not!

That the US was in recovery, had found solutions to self-imposed problems and was moving forward has been evident in the economic data, but many have either, not seen the data, seen it but not understood its significance or refused to acknowledge it. The equity markets have risen since early 2009 with the data. With a long history to draw upon we can expect to see a significant rise in equity prices ($SPY) in the years ahead.

Optimism continues to be warranted in my opinion

Also:

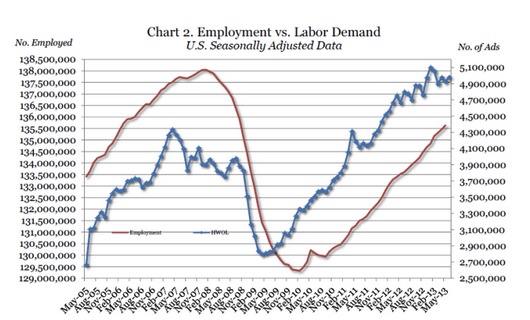

The Conference Board reported its Help Wanted Online for June 2013 at 4,980,300 or 59,300 than May 2013. Even though the advertising rate for new positions has slowed as can be seen in the chart, it remains in an uptrend.

The HWOL has been shown to be a 9mos-12mos+ leading indicator for employment. It is pretty simple to understand that higher HWOL, higher temp hiring, higher light vehicle sales all lead to higher employment levels in the months ahead. Higher employment reflects higher economic activity and this is reflected in higher stock prices.

Higher HWOL, Higher Temp Hiring, Higher Vehicle Sales = Higher Future Economic Activity = Higher Future Stock Market Prices

Stock market gains have always tracked economic activity across the business cycle regardless of the temporary scares which occur unpredictably. It is by following multiple economic data series that one can identify the important longer term trends which keep one from panicking over unexpected events. No single economic series can supply an adequate measure of something as broad and complicated as an economy. But, by taking a couple of dozen indicators together, one can determine if what appears to be a slowing or accelerating trend in one indicator carries useful investment information by comparison to the others.

The economic data has let one be positive on stocks since Dec 2008. The data continue generate trends which let one be optimistic. The better asset classes in my opinion continue to be LgCap Domestic and International Equities.

Economic trends do not let us predict with precision the jobs data which comes out this Friday. But, whatever the report, the trend should be in-line with the existing trend.

I continue to quite strongly recommend stocks over bonds